Snapchat Gets in the ‘Not Social Media’ Game

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Snapchat Discover is a mobile platform built to deliver shortform videos via a selection of content channels within Snapchat’s mobile messaging app. A Jan. 27 announcement on the company’s blog was even more obfuscating and jargon-y in describing what Discover is. But it was pretty blunt about what the new feature is not.

“This is not social media,” the post read. “Social media companies tell us what to read based on what’s most recent or most popular. We see it differently. We count on editors and artists, not clicks and shares, to determine what’s important.”

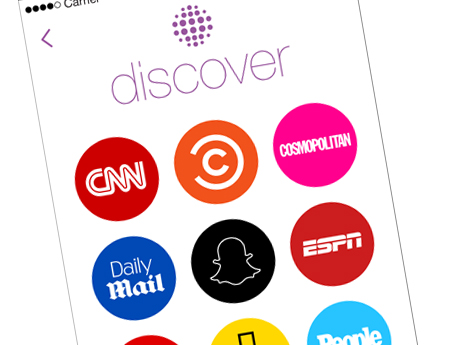

Many of those “editors and artists” hail from brands that have been curating content since before content was something people talked about curating. Among the initial Discover channel partners are TV brands such as ESPN, CNN, Comedy Central, Fusion and print legacy operations such as People and Cosmopolitan. The partnership between old media and not-social-media unlocks new revenue streams and new growth potential for both, and does so with relatively little investment.

According to the Interactive Advertising Bureau’s Internet Advertising Revenue Report, U.S. digital video advertising revenue in the first half of 2014 was up 13% from the first half of 2013 at $1.5 billion. Discover gives Snapchat—best known as a service that allows users to send images and messages that disappear after receipt—a shot at seizing a slice of that growing pie.

“The incentive for Snapchat to do this is it monetizes,” said Brian Solis, principal analyst for Altimeter Group. In 2013, Snapchat rebuffed a $3 billion acquisition offer from Facebook. “Now there’s tremendous pressure for the company to generate revenue, substantial revenue.”

Discover allows Snapchat, through ad sales, to monetize content that it is essentially aggregating. In exchange for uploading a handful of videos to Discover—videos that will only be available to view for 24 hours before being replaced by new ones—brand partners get a cut of the ad money. They also get access to Snapchat’s base of young, mobile-friendly, appointment-viewing-averse audience members. (A Snapchat representative declined to comment on how many users the app has or its demographic information, but Comscore in November measured its penetration among smartphone-using adults 18- 34 at 32.9%—behind only Facebook and Instagram.)

“If, from a marketing perspective, there’s a sustainable ability to talk to a different audience than we speak to on our other platforms, that’s extremely valuable,” said Tamara Franklin, executive VP, digital, Scripps Networks Interactive. Scripps brand Food Network is one of Dis- Discover’s launch partners. Content for Food Network’s channel is generated, edited and uploaded by the Scripps in-house editorial team.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Discover has “tons of potential” as an advertising platform, Franklin said. In that sense, it stands out in the broader scheme of Scripps’ social-media strategy. “We’ve used social media for the traditional marketing opportunities that it represents for lots of great brands and premium-content publishers. This is different in that it’s a product on a social media platform.”

As for whether Discover holds more value as a marketing vehicle or a product from which to glean advertising revenue, “I think the jury’s still out,” she said.

Regardless of how effective Discover proves to be in either role, Scripps and other partners are able to explore the possibilities for low table stakes. The content they post can be culled from what they already produce for linear television and other platforms.

But if the same content can be found on platforms such as Hulu and YouTube or owned-and-operated apps and websites, why should users go to Snapchat to find it?

“At this point it does seem kind of redundant to me, and a little bit limited,” said Seth Shafer, research analyst at SNL Kagan. “But I’m not sure if what we’re looking at now is what the future of it will be.” A well-designed platform offering small-batch content may be a good way for Snapchat to find whether its users are interested in an expanded experience—and for TV and media companies to explore whether such a platform is worth mounting.