Nielsen Alters Release of Total Content Ratings to Buyers

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

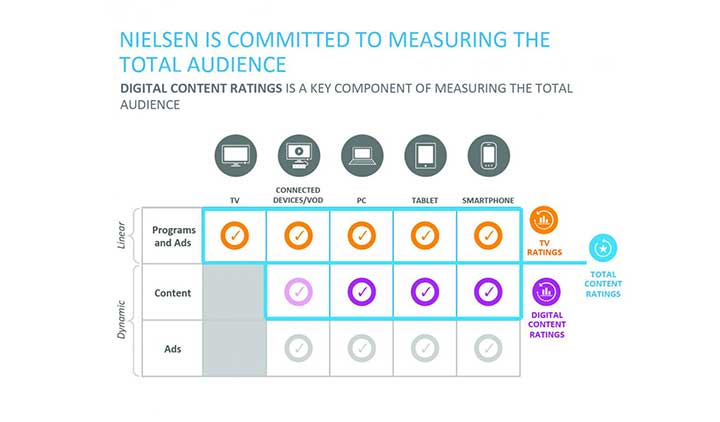

Nielsen is changing the way its new Total Content Ratings will be shared with ad agencies, and will be meeting with clients at the end of the month to decide whether or not to continue on a timetable that will make the data available for use in the upfront.

NBCUniversal and other networks have called the new Nielsen measurement — designed to include viewing of programming on all platforms — not ready to use. Some media agencies have complained that the data has not been shared with them to evaluate.

Some major buyers say they see flaws in the Nielsen data they’ve been able to obtain, and are looking for ways to do their own analyses.

Related: Nielsen: Smaller Drop in Live Viewing in 3Q

Nielsen had planned to release a syndicated version of its ratings in March. That timetable has not changed, pending a meeting of Nielsen’s Senior Research Council at the end of January.

“We will be discussing with our media and agency clients the best mechanisms to make additional content ratings data available over the course of 2017,” Nielsen said in a statement.

Nielsen said that it will be sending Total Content Ratings data this month to agency clients in an offline format, rather than an online format.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Related: Tribune Sells Gracenote to Nielsen for $560M

“We will be making certain reports available to agencies based on our clients and where they are in terms of implementation. These reports will evolve as more clients come online,” Nielsen’s statement said. “This will allow media clients to customize the data they wish to share, whether it be to focus on particular platforms, programs or demographics. This decision is not based on any methodological issues, but rather, client readiness and their need to further evaluate data.”

Some media companies and distributors have been more aggressive in getting the software needed for their programming to be measured installed. Some distributors have not implemented the technology. That means viewing done on some cable company apps will not be counted.

“Any attempt to more comprehensively measure the increasingly complex video viewing landscape must by definition reflect that same complexity. Methodologically that is extremely challenging but in this case things are made more difficult by the fact that it is outside the control of Nielsen to manage consistent implementation of the methods it is seeking to adopt. That's a problem,” said Mike Bloxham, senior VP of Frank N. Magid Associates, a research company that consults with the TV business.

“While nothing is wholly perfect it has to be fit for purpose and critical to any measurement system is the ability to compare all things measured in a systematic way, using the same metrics. But as networks themselves decide where and even if they install the necessary software to make total viewer measurement viable, it's going to take time and a lot of work by all involved to get to the kind of level of consistent implementation necessary for success. Everybody wants this kind of system, but no-one likes the risk of doing things differently,” Bloxham said.

He added: “But let's not forget that while - if successful - the new approach stands to offer a joined up view of how content is consumed across platforms (with some caveats), it still only measures numbers of viewers. Measurement needs to evolve to include an accounting for the fact that viewers have different relationships with different shows and what that means for ad effectiveness. That's where we need to go next."

Nielsen, in its statement said, “It is important to note that other aspects of the Total Audience framework including Digital Content Ratings, Total Ad Ratings, Out of Home, C35 data and OTT data are already in active use by our clients.”

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.