NFL Game Ad Revenue Grew 10%, Says SMI

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

The National Football League continued to be a strong draw for advertisers in addition to viewers, according to new figures from research company Standard Media Index.

SMI said that revenue for commercials aired during NFL regular season games was up 10% from September through November.

The price per commercial was up 8.6% and the networks managed to increase the number of paid unit during games by 2%.

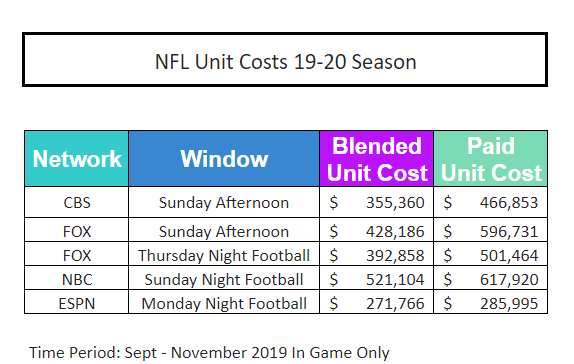

NBC’s Sunday Night Football commanded the highest ad rates, at $617.920, up 4.7% from last year. The other networks also showed strong price gains for their NFL game inventory, with Fox up 13.6%, CBS up 7.4% and ESPN registering a 6% hike.

NFL ratings were up for the regular season, bucking the erosion seen in most other TV programming. On Monday, CBS announced that its coverage of the AFC Championship game was the highest-rated program on any network since Super Bowl LIII last year. With 19,404 viewers, the AFC Championship was up 3% from a year ago.

Football wasn’t the only sport performing. Fox’s World Series revenues in October were up, largely because it required the Washington Nationals a full seven games to beat the Houston Astros.

The average cost per spot dipped slightly in 2019 to $329,700 from $336,500 in 2018, but was up from 2017’s average of $289,900, SMI said.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Despite the dip, total ad revenue for the seven-game series was $149 million, up from $119 million in 2018, when the Series went five games. The seven game 2017 series generated $134 million in ad revenue.

“The NFL and World Series results are a testament to the growing importance of live sports,” said James Fennessy, CEO of SMI. “The NFL telecasts account for 17% of season-to-date revenue across all programming on major linear channels, and 70% of FOX’s ad revenue during the current broadcast year.”

SMI’s data comes from the actual invoices from large media buying groups accounting for about 70% of all spending.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.