NFL Advertising Revenue Down So Far This Season

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Despite rebounding ratings, television networks are bringing in less ad revenue during NFL games in the first two months of the football season, according to Standard Media Index.

Overall, national TV advertising revenue is flat in October.

SMI says that for September and October, NFL revenue fell 19%. Some of that was because they sold 6% fewer 30-second commercials in those 51 games. But it also reflects two seasons of falling ratings for NFL games, which affected how much advertisers would pay for spots.

“The effects of the lower audiences last year are spilling into this season, as NFL revenue is down,” said SMI CEO James Fennessy. “Nevertheless, as the market reports improving viewership, we will see how these trends change over the remaining months of the season.”

The 2018 World Series was a big hit for Fox and advertisers despite its low ratings. Commercial prices were up 15% from last year and Fox raked in $121.6 million in ad revenue despite having only five games this year, compared to seven games in 201, Average revenue per games was up 27%, SMI said.

For October, broadcast ad revenue was down 7%, offsetting a 5% increase in cable, SMI said.

While Fox and NBC have introduced initiative to reduce commercial clutter in some shows and on some nights, SMI said that in October, the amount of 30 second spots was up 5% from a year ago. On cable networks, the number of spots was flat.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Revenue from spots sold in the upfront was up 2% in October. Scatter revenue was down 4%, indicating that marketers moved dollars to the upfront to avoid scatter premiums, SMI said.

“The linear television season has started sluggishly as expectations of robust demand haven't yet materialized in the market,” said Fennessy. Demand from marketers continues to outpace audience erosion even if that is due to more limited digital video advertising options due to ad-free delivery.”

Revenue from primetime original programming was up 3%. Dramas went up 7%, getting a boost from some new shows including ABC’s A Million Little Things and NBC’s Manifest and New Amsterdam.

Advertisers paid 158% more to be in the season premiere of shows. They paid 1% less than last year to be in those premiers while prices for spots in regular season episodes were up 6%.

Comcast had the largest share of revenue from entertainment programming, excluding kids, at 18%. That was followed by Discovery at 14%, Viacom at 11%, The Walt Disney Co. at 10%, CBS at 8% Time Warner at 8%, 21st Century Fox at 6%, A+E Networks at 5% and AMC Networks at 4%.

In cable news revenue for the six big networks grew 14%. MSNBC jumped 30%.

Broadcast news revenue was up 2%, with ABC showing the biggest gain, up 13%.

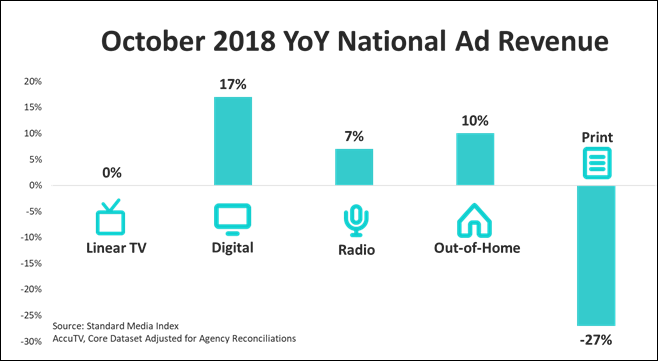

Overall, October national ad spending as measured by SMI was up 7% in October, with digital showing a 17% gain. Out of home was up 10%, radio gained 7% and print fell 27%.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.