National TV Revenue to Grow 4.6% in 2020

Magna Global forecast sees local TV ad revenue down 20.4%

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

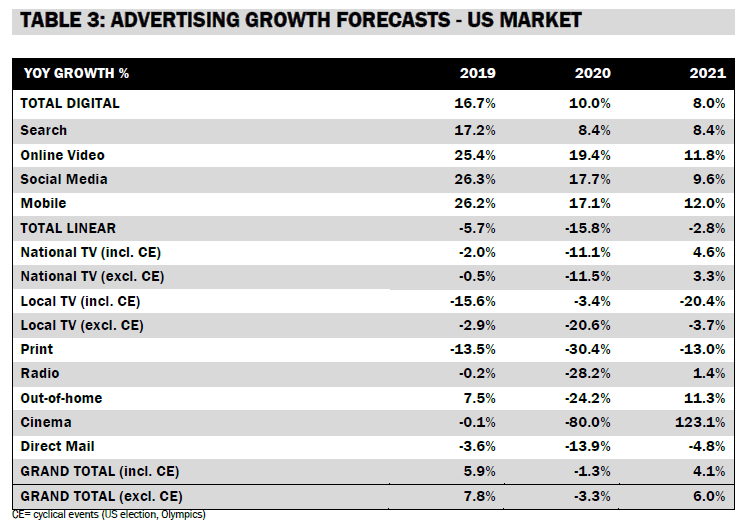

National TV ad revenue, thanks in part to the Tokyo Olympics, are expected to grow 4.6% in 2021, rebounding from a recession caused by COVID-19 that was more mild on the media than predicted, according to a new forecast from media buyer Magna Global.

Excluding the Olympics’ $800 million in incremental ad sales, national TV is expected to rise 3.3% in 2021.

With the Presidential elections in the rear view mirror, local TV revenue will be 20.4% lower (or up 3.7% if you exclude the record political spending in 2020).

Magna said that for 2020, national TV will finish down 11.1%, while local will close down 3.4%, or down 20.6% not counting political.

Magna estimates that the election generated $6.1 billion in net incremental advertising sales. Digital haul from the election was $1.5 billion, three times 2018, with $700 million spent on digital video. Local television took in about $3.6 billions political ads, up 30% and national television grew 32% to $300 million ads.

Traditional--or linear advertising is expected to be down 2.8% in 2021 after a 15.8% plunge in 2020.

The weakness in linear was offset by growth--slower but still significant--in digital media. Digital growth is expected to be 8% in 2021, down from 10% in 2020 and 16.7% in 2019.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Mobile will be the biggest gainer, up 12% in 2021, followed by online video, up 11.8%. Online video revenue jumped 19.4% in 2020 as the pandemic drew consumer to streaming.

Overall, U.S. advertising is expected to grow 4.1% in 2021 to a record $230 billion, compared to a 1.3% decline in 2020, including cyclical events.

Since its last report in June, Magna has increased the 2021 growth rate for North America to 4.2% from 4%.

Globally, Magna sees advertising growing 7.6% including cyclical events (Olympics), and 8.1% including cyclical events. That would follow a 4.2% drop including cyclical events in 2020 and a 5.1% decline excluding them.

“Back in the spring, Magna predicted that digital media organic growth factors would drive digital to grow despite the COVID recession (+1% globally, +3% in the US),” said Vincent Letang, executive VP, global market intelligence at Magna.

“It turns out digital media resilience was even stronger than expected (+8% globally, +10% in the US) and possibly because of the changes brought by COVID,” he said.

The pandemic triggered a tremendous acceleration in both supply (digital media usage and audiences, eCommerce) and demand, with small businesses embracing digital media to keep their business alive during lockdowns, big brands pivoting towards lower-funnel marketing channels as they typically do in recession times.

“Magna believes the return of consumer mobility, major events and economic recovery will prompt most industry verticals to grow their linear advertising budgets in 2021, but the long-term trajectory has shifted even further towards a digital-centric marketing environment for years to come,” Letang said.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.