More Viewers Satisfied With Pay-TV Value

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Pay-TV customers are a bit happier with their subscriptions, but a large number remain poised to drop or change their provider.

According to Digitalsmiths’ fourth-quarter online video and pay-TV trends report, the big issues are being stuck with channels they don’t want to watch and difficulty in finding good shows.

The share of people who said they were satisfied or very satisfied with their pay-TV service was up slightly, with 21.8% saying they were very satisfied, up from 21.1% in the third quarter and the same number a year ago. Those saying they were satisfied were up to 55.6%, compared to 54.9% in the third quarter, but down from 55.9% a year ago.

That left the number of people saying they were unsatisfied at 22.6%, down from 24% last quarter and 23% a year ago, according to Digitalsmiths, a division of TiVo.

Among those saying they were dissatisfied, the reasons they cited were increasing fees, poor customer service and bad channel selection.

Fewer people said they cut their cable or satellite service during the past few months. In the fourth quarter, cord cutters represented 17.5% of those surveyed, compared to 19.3% of those surveyed in the third quarter.

That lines up with the numbers pay-TV companies shared during earnings season that indicated a slowdown of pay-TV subscriber erosion.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

The number of people who said they never had cable rose to 41.2% from 38.8%.

More people who don’t have cable said they were using an antenna to watch broadcast channels. Antenna users rose to 44.5% in the fourth quarter from 45.1% in the third quarter.

A chunk of those who do have a cable subscription said they planned to make some sort of a change, with 5.6% saying they plan to cut off their service, 6.6 saying they plan to switch to another pay-TV provider and 2.4% plan to switch to an online app. Another 30.1% said maybe they would make a switch.

Of those who said they might make a change, 45.5% said they would stay put if their provider made it easier for them to discover content.

“While 30.0% of respondents are disappointed with their channel selection, the majority of channels selected by respondents in the à la carte channel section of the survey () are offered in most cable/satellite packages today,” the report said. “This disconnect should make Pay-TV providers ask themselves: are these respondents simply unable to find their desired content?"

The study found that 33.8% of viewers felt overwhelmed by the number of changes available and listed in guides. That was up from 31.6% a year ago. More than 80% said they watch the same channels over and over again, and watch 10 or fewer channels.

Not surprisingly 42.2% answered “no” when asked if its easy to find something you want to watch on TV. That was up from 41.8% in the third quarter and 36.4% a year ago.

While 37.6% of respondents said they’d like to retain the traditional channel guide, 19% said they’d like something different. Most said they’d like their provider to have what the report described as a carosel type guide that offers recommendations like “what is on now” or “because you watched” another show, you might want to view this one now.

“With more than half of respondents with cable/satellite service open to trying a more content discovery-focused, personalized carousel experience, Pay-TV providers should act quickly on these trends,” the report said.

The study looked at Voice Remotes, which it said were in about 10.9% of respondents homes. Of those, 74% said they used it on a weekly basis. A significant number of those people use their voice remote to search for programming 4-7 times a month, up 36% from the third quarter.

To determine if skinny bundles might be more satisfying, Digitalsmith asked if people wanted to make their own package of channels, and 73.6% said yes. That’s actually down from the third quarter and has been falling all year. The average price they want to pay is $40.56 a month.

The networks they said they wanted in their bundles were headed by Discovery Chanel, ABC, CBS, History and NBC. If a skinny bundle were to include 20 channels, the others scoring highest would be A&E, National Geographic, Fox, HBO, PBS, Comedy Central, AMC, Food Network, The Weather Channel, CNN, Animal Planet, TBS, FX, TLC and TNT.

In the survey, 59.6% of the respondents said they paid more than $101 a month to their pay-TV provider. About 40% said their bill was higher than a year ago, down slightly from the prior quarter and a year ago.

“While fewer respondents indicated that their bill is more than a year ago, Digitalsmiths predicts this trend to change in 2016, due to rate increase announcements from three of the top four U.S. Pay-TV providers in January 2016,” the report said.

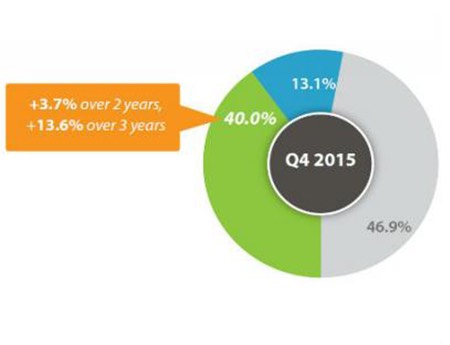

Awareness of pay-TV providers' TV Everywhere offerings rose to 40% from 36.3% in the third quarter and 25.4% a year ago. However fewer respondents have their pay-TV providers app on their tablet or smart phone. Just 21.5 said there’s an app for that, down from 21.9% in Q3 and 25.2% a year ago.

Among those who do have the app on their mobile devices, 45.4% said they use it on a weekly basis.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.