Merger Speculation Takes Focus Off Q2 Earnings

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Media company second-quarter earnings are likely to be overshadowed by merger speculation. One analyst, Todd Juenger of Sanford C. Bernstein went so far as to call the earnings reports “essentially irrelevant” in the wake of 21st Century Fox’s takeover bid for Time Warner.

Media stocks had been rising steadily as a group for the past three years, but worries about consumers going over the top and signs the ad market may be weakening were making picking winners and losers in the industry trickier based on fundamentals. Now, however, it’s all about figuring out which companies will be bought and which ones sold.

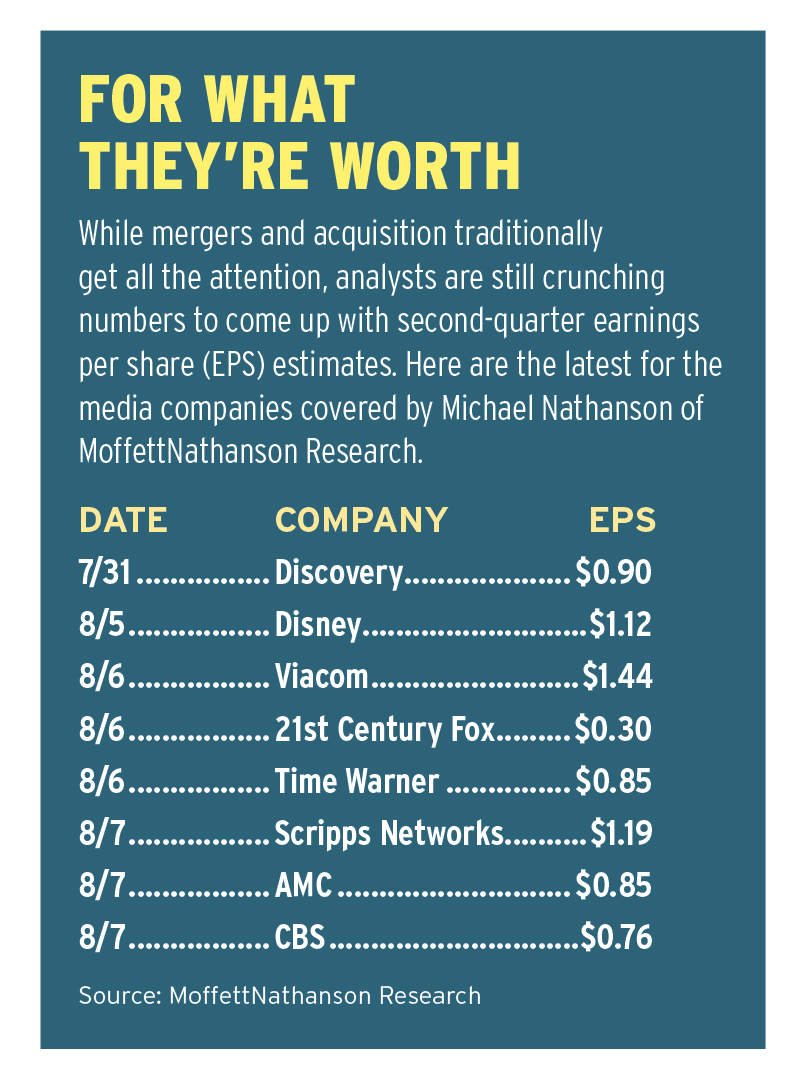

“This was not supposed to be a great quarter,” said Michael Nathanson of MoffettNathanson Research. “Ratings for the group are not great. Scatter in June was kind of soft. We can tell advertising growth this quarter won’t be impressive. And then all of a sudden, the deal happens, and it all takes a back seat to M&A speculation.”

Nathanson noted that there was a similar pattern when cable and satellite companies started consolidating last year. To some degree, the consolidation of distributors is contributing to the merger speculation about programmers.

During this year’s earnings conference calls, Nathanson expects his analyst colleagues to pepper executives with questions about whether they feel they are big enough to compete in an increasingly competitive landscape— “Without a doubt,” he says. And he expects most will say they’re happy with the size they’re at now.

“We had our investors’ conference in May and we asked all the CEOs out there [about consolidation] and they said they were fine,” Nathanson said. “But those denials aren’t going to change the speculation, right?”

In fact, last week, the third question asked during Comcast’s second-quarter earnings call was about whether or not the company felt it needed to increase its content assets. “We certainly don’t think we need to bulk up in content,” Steve Burke, CEO of Comcast’s NBCU unit replied. Comcast helped kick off speculation about programmers merging when it agreed to acquire Time Warner Cable. And NBCU won’t have to worry as much as other programmers about having to face off against the combined might of Comcast and Time Warner Cable because they’ll be corporate siblings.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Nathanson and Juenger noted that bad earnings could be good news during a merger frenzy because it makes companies easier to buy. “[Time Warner] is in the perverse situation where the worse their quarterly results, the better the stock will react [because it increases likelihood of a deal],” Juenger said in his report. “To a lesser degree, the same could be true for any of the companies considered ‘in play,’” which includes Scripps Networks Interactive, AMC Networks, Discovery Communications or, really, the entire sector. “Weakness across the board would strengthen the urgency for companies to combine and become stronger.”

And with distributor consolidation likely to slow sub fee growth, and ad revenue declining, floating merger deals is a way to change what investors are thinking about, Nathanson said.

Time Warner and 21st Century Fox both report earnings on August 6. Nathanson expects that during those calls, Time Warner execs will say the Fox bid undervalues the company’s growth potential, while Fox execs will say the deal will take them to a new level. “Time Warner’s going to talk about how the timing is just wrong, and Fox will talk about why the time is right,” Nathanson said.

Nathanson added that he believes Fox will eventually acquire Time Warner, and he doesn’t expect another media company to swoop in with a better deal. As for a non-traditional buyer, such as Google, he’s skeptical: “That’s the great white hope. At this point, I’ve not seen it yet.”

Nor does Nathanson expect another megadeal to happen. “At the end of the day, I don’t know who is available to do deals,” he said. Not that that will stop the speculation. “Both you and I will have a lot more to write about.”

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.