Magna Plugs in System To Make TV Programmatic

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

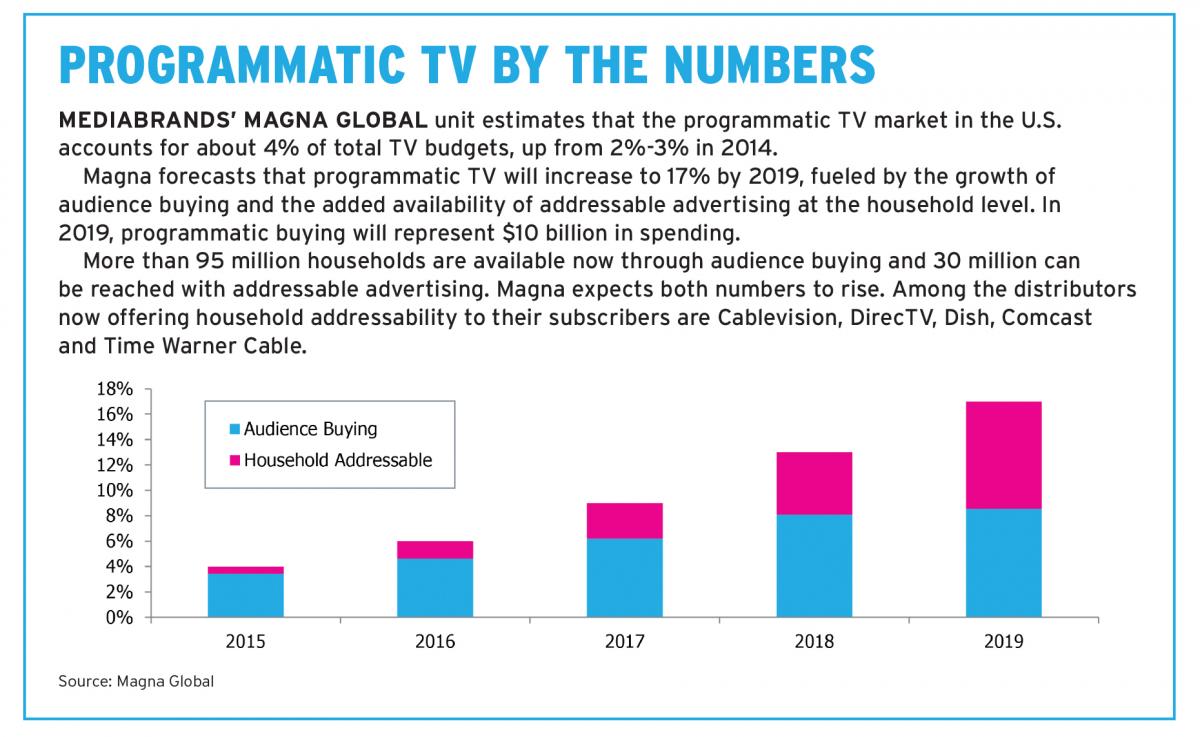

Programmatic advertising has been slow to come to television. But media buying group IPG Mediabrands, which has been aggressive about bringing automation to its operation, recently brought in a new computer system that it said will bring programmatic principals to TV on a larger scale.

In the current upfront, Mediabrands is negotiating with agencies to make available inventory it will be able to buy on an automated, programmatic basis, executives at the agency said.

“Automation gets categorized as just a way to convert from paper to pushing a button. And yes, that’s a part of it, but it’s also about the programmatic principals,” said Erica Schmidt, U.S. managing director of Cadreon, Mediabrands’ digital marketing services unit.

“There was a huge need in the marketplace to deliver automation in television and more important than automation is buying audiences and buying strategic targets instead of broad demographics,” added Matt Bayer, senior VP, advanced TV, at Magna Global, the buying and marketplace intelligence unit at Mediabrands.

“We’ve lived in a world where adults 25-54 was OK, but I think we need to look at TV in a different way to make it more valuable to clients and more meaningful to their business,” Bayer said. “This definitely is a way to buy more of the strategic audiences and the consumers that matter most to our clients, that are going to drive our clients’ business. And we can leverage automation for the first time to buy audiences at scale.”

Cadreon worked with TubeMogul to develop its demand-side system, but Bayer said the system is very different from TubeMogul’s off-the-shelf software. “This one is Cadreon-built, built by our product managers and our product team in San Francisco and our engineers in collaboration with TubeMogul’s best engineering talent as well,” he said. “It’s kind of a collaboration of two powerhouses. TubeMogul is really good at building enterprise software. We are good at understanding advertising technology, understanding the television marketplace, audience data and how to reach audiences. I think the power of those two together is very special.”

Programmatic buying has been a force in the digital advertising arena. For better or worse, it is credited with driving down the price of banner ads—a development that has made television networks wary of exposing their premium inventory to automation.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

The Timing Is Right

But automation seems inevitable. Media companies are installing their own commercial inventory management systems that allow them to include data and analytics and identify shows that reach the particular consumers marketers want to reach. And if agencies and their clients have money they want to spend in a programmatic fashion, TV networks are unlikely to pass it up in an otherwise slow market.

When it comes to programmatic buying, “TV is going to be a little bit different than digital in that it’s going to be a lot of private marketplaces and minimal open exchanges and more direct access to inventory between an agency and a publisher,” said Bayer. “And why that matters with this platform is this platform was built and developed to tie in our own proprietary data and our clients’ data with a plethora of private marketplace supply-side inventory that would otherwise not be able to be transacted or accessed. We think the future of programmatic TV will be private marketplace and audience buying and this platform lets us do both.”

Some audience buying is going on now, but it’s not really an automated process so it is difficult to scale.

“People will talk programmatic and they’re really picking up the phone to cobble together the inventory they want based on whatever data they’re using,” said Schmidt. “We really believe in the power of this platform and what it enables us to do. We’re talking [to programmers] about how we could be using the applications and the data we have to access their premium inventory in a programmatic fashion. That we believe is pioneering and exciting. And it’s a compelling proposition to clients.”

Bayer said some test campaigns are already running, and that the use of the programmatic platform is being discussed in upfront negotiations.

“We’re going out there and asking them to transact in an automated way through our private marketplaces, through our own platforms,” he said.

But Bayer said prices won’t be determined machine to machine. “There’s no real-time bidding; it’s not a real-time biddable platform. We’re negotiating rates with premium publishers directly and those rates are then being transferred to the platforms that we want access to,” he said.

He added that while establishing a price for programmatic buying, Mediabrands isn’t committing to spending a set amount via technology. Instead, they’re setting up a rate card at which networks are willing to sell spots programmatically when the data indicates a good buy for clients.

“This is really an evolution of the industry and where the industry is going,” Bayer said. “And we do think an audience and data-driven, customer-centric approach to buying is going to be critically important in the way our clients go to market for TV. This is where the industry is evolving and we want to be very much ahead of it and that’s why we’re taking this leadership position in delivering audiences and automation at scale on TV.”

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.