Magna Forecasts 13.2% Drop in 2020 National TV Revenue

Local seen down 2.4% in election year

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

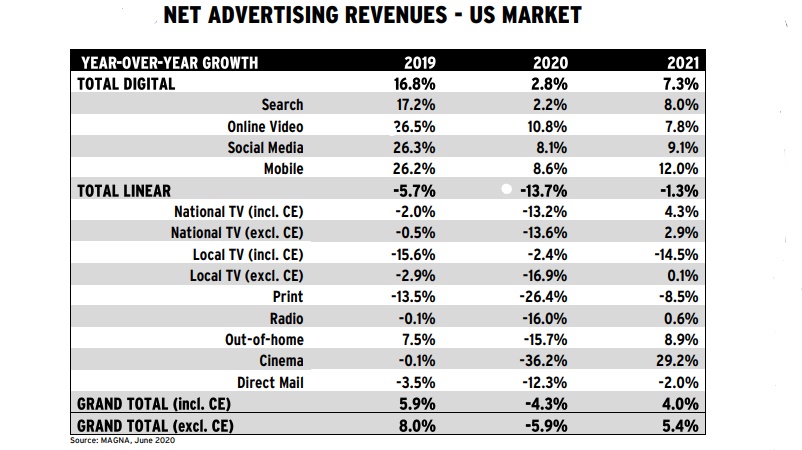

In the throes of a pandemic, national television advertising revenue is expected to drop 13.2% in 2020 and recover by 4.3% in 2021 according to a new forecast from major media buyer Magna Global.

Even with heavy political spending in a presidential year, local TV is expected to be down 2.4% for 2020. After the election, a 14.5% drop in 2021 is expected. Core revenue for local TV is seen edging up 0.1% in 2021.

Digital advertising continues to grow, even with COVID-19. Total digital is forecast to grow 2.8% in 2020--way downfrom the 16.8% growth seen in 2019. Magna sees total digital up 7.3% in 2021.

Online video is poised to increase 10.8% in 2020 and 7.8% in 2021.

“In contrast with most linear media, digital advertising formats benefit from increased consumption, and will remain more resilient to the drop in advertisers demand. MAGNA anticipates ad spend on digital formats (search, video, social, banners, digital audio) to stabilize in the summer and recover in the second half,” Magna said in its report.

Total U.S. ad spending is expected to shrink 4.3% in 2020 and grow 4% in 2021.

“Many industries face significant economic headwinds and have been forced to cut considerable amounts of spend as a result. The travel, entertainment, automotive and restaurant industries will be among the most affected, and Magna expects each of these industries to reduce linear advertising spend by 25% or more on a full year basis,’ the agency said.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

On the other hand categories like pharmaceuticals and food & beverage industries aren’t as affected and their ad spending may be reduced only by single digits. Some tech companies in hardware, software and e-commerce might increase spending.

“Magna expects advertising spending to start to stabilize in 3Q (-5% vs 3Q19) and recover in 4Q (flat vs 4Q19) as some businesses that started reopening in May-June will need to rebuild market shares, traffic and sales in the coming months,” the agency said.

Global ad revenue will drop 7.2% in 2020, according to Magna’s forecast, but rise 6.1% in 2021.

“Beyond the short-term V-shaped recession/recovery impact on the economy and the advertising market, the COVID crisis will have global and long-term effects on society, business models, consumption habits, mobility and media usage, all factors pointing to a more subdued economic growth and advertising spend than previously forecast for the 2022-2024 period,” said Vincent Letang, Magna’s executive VP, global market intelligence.

“Magna thus reduces its global advertising growth forecast for these three years, from 4.5% per year to 3.5% per year. The global ad market will reach $647 billion by 2021 compared to $745 billion in our previous long-term scenario (a 14% decrease),” he said.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.