Indies Enjoy More Moments in the Sun

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

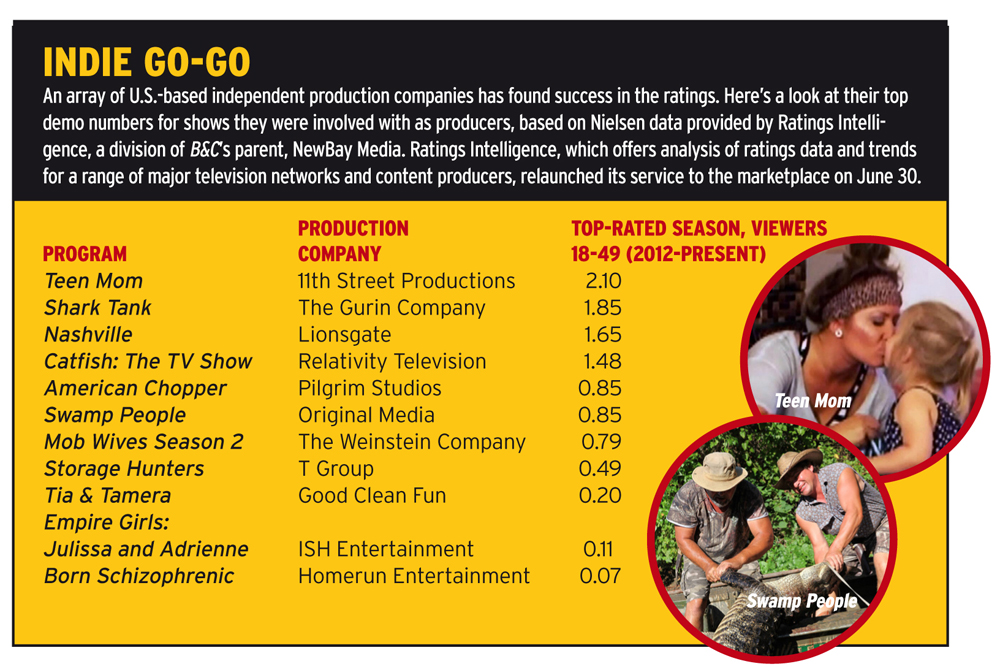

These are busy, heady and increasingly lucrative times for many U.S. independent TV production companies, thanks in large part to the reality TV boom and growing global demand for content. Now, as part of the inevitable business cycle, a period of consolidation has set in, as the success of some indie U.S. studios has made them attractive to larger media companies, primarily from abroad.

Defining an indie remains tricky, but most would agree these are companies unaffiliated with major media companies that have broadcast or cable networks. Shine, for example, was acquired by 21st Century Fox; while it has expanded into the U.S. and continued minting hits like MasterChef Junior, it isn’t in the same indie bucket as before.

Speaking of stateside expansion, Eyeworks, eOne and All- 3Media have also stepped up their U.S. presence—eOne has forged a strong tie with AMC, which airs three of its scripted series in The Walking Dead, Turn and Halt and Catch Fire. British media giant ITV claims to be the largest indie TV production company in the U.S. after buying a controlling interest in Leftfield Entertainment (Pawn Stars) in May. ITV has acquired four other U.S. indies in the past year and a half: Gurney Productions (Duck Dynasty), High Noon (Cake Boss), ThinkFactory Media (Gene Simmons Family Jewels), and DiGa Vision (Teen Wolf).

British-based FremantleMedia recently added 495 Productions (Jersey Shore) to its U.S. portfolio, while Wales’ Tinopolis Group acquired Magical Elves (Top Chef) in February. Germany’s Red Arrow Entertainment also has been busy, recently adding Half Yard Productions (Say Yes to the Dress) to its U.S. stable.

11TH STREET PRODUCTIONS

Goldcrest Post, 799 Washington St., Suite 207, New York, NY 10014 11thstreetproductions.com.

KEY EXECS: Founders Morgan J. Freeman and Dia Sokol Savage

The smarter way to stay on top of broadcasting and cable industry. Sign up below

KEY CREDITS:Teen Mom, 16 & Pregnant, Being specials, Baby High, Maui Fever

GOOD CLEAN FUN

3415 S. Sepulveda Blvd., Suite 1200, Los Angeles CA 90034 goodcleanfunllc.com.

KEY EXECS: CEO, founder and executive producer Jason Carbone, executive producer and head of development Nick Lee, head of production Meredith Marshall

KEY CREDITS:Run’s House; Daddy’s Girls; Life of Ryan; Tia & Tamera; Mountain Movers; Rev Run’s Sunday Suppers

THE GURIN COMPANY

11846 Ventura Blvd., Studio City, CA 91604 gurinoco.com.

KEY EXECS: President and CEO Phil Gurin

KEY CREDITS:Shark Tank, The Singing Bee, Lingo, Weakest Link, Test the Nation, Wanna Bet?

HOMERUN ENTERTAINMENT

112 Arena St., El Segundo, CA 90245 homerunent.com.

KEY EXECS: CEO and founder Barry Gribbon, chief creative officer Tony Reece

KEY CREDITS:Food for Thought, Food Finds, Blueprint of Home Building, Be Your Own Contractor, Born Schizophrenic

ISH ENTERTAINMENT

104 W. 27th St., New York, N.Y. 10001 ish.tv.

KEY EXECS: President and CEO Michael Hirschorn, executive VP of production and development Wendy Roth

KEY CREDITS:Kosher Soul, The Approval Matrix, Trans Teen: The Documentary, Empire Girls, Paris Hilton’s My New BFF

LIONSGATE

2700 Colorado Ave., Santa Monica, CA 90404 lionsgate.com.

KEY EXECS: CEO Jon Feltheimer, vice chairman Michael Burns, TV Group chairman Kevin Beggs, TV Group COO Sandra Stern

KEY CREDITS:Mad Men, Nashville, Weeds, Nurse Jackie, Anger Management, Orange Is the New Black

ORIGINAL MEDIA

175 Varick St., New York, NY 10014 originalmedia.com.

KEY EXECS: CEO Daniel Laikind, COO/executive VP production and development Michael Saffran, senior VP production and development Patrick Moses

KEY CREDITS:Swamp People, Miami Ink, The Rachel Zoe Project, Storm Chasers, BBQ Pitmasters, The Philanthropist, Comic Book Men

PILGRIM STUDIOS

12020 Chandler Blvd., North Hollywood, CA 91607 pilgrimstudios.com .

KEY EXECS: President and CEO Craig Piligian, COO and general counsel Gretchen Stockdale, executive VP/development & original programming Johnny Gould, executive VP/production and current programming Nicholas Caprio

KEY CREDITS:American Chopper, Dirty Jobs, The Ultimate Fighter, Fast N’ Loud, Ghost Hunters, Welcome to Sweetie Pie’s, Bring It!

RELATIVITY TELEVISION

1040 N. Las Palmas Ave., Building 40, Los Angeles, CA 90038 relativitymedia.com/relativitytv.aspx .

KEY EXECS: CEO Tom Forman

KEY CREDITS:Catfish: The TV Show, The Great Food Truck Race, The American Bible Challenge, Coming Home, Wilson Phillips: Still Holding On, Picker Sisters

T GROUP

2121 Cloverfield Blvd., Santa Monica, CA 90404 tgroupproductions.com .

KEY EXECS: President Jennifer Daly, executive VP production and operations David Kelleher, executive VP development and current productions Rob Lobl

KEY CREDITS:Storage Hunters, Invention USA, Mystery Diners, Private Chefs of Beverly Hills, House of Food

THE WEINSTEIN COMPANY

345 Hudson St., New York, NY 10014 weinsteinco.com.

KEY EXECS: Cochairman Harvey Weinstein, cochairman Bob Weinstein, president of television Meryl Poster

KEY CREDITS:Project Runway, Project Accessory, Project Runway: All Stars, Mob Wives, The No. 1 Ladies’ Detective Agency

CAUTION: STEEP GROWTH CURVE AHEAD

Recent deal valuations show the increasing value for formerly independent production shops. A brief chronology:

FEBRUARY 2008: U.K.-based Shine Group buys L.A. indie Reveille Productions (The Office, Ugly Betty, The Biggest Loser) for $125 million; final price could go as high as $200 million depending on performance of Reveille shows

FEBRUARY 2009: FremantleMedia (also U.K.) pays a reported $50 million for a 75% stake in U.S. reality show pioneer Thom Beers’ Burbank, Calif.-based Original Productions (Deadliest Catch, Ice Road Truckers).

JUNE 2011: Wales-based Tinopolis pays a reported $100 million for L.A. indie A. Smith & Co. (Kitchen Nightmares).

DECEMBER 2012: ITV (also U.K.) pays $40 million for a 61.5% stake in L.A.-based Gurney Productions (Duck Dynasty) with an option to buy the rest of the company; final price may go as high as $111 million, depending on Gurney’s bottom-line performance.

MAY 2014: ITV pays $360 million for 80% of N.Y.-based indie Leftfield Entertainment (Pawn Stars); price may go as high as $800 million if ITV exercises option to buy remaining 20% and Leftfield meets performance benchmarks.