Fox Sees Improvement in Local Ad Market

National prices in scatter remain above upfront, Nallen said

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Fox said it is seeing improvements in advertising sales at its local station group as more businesses re-open after closing to slow the spread of the Coronavirus.

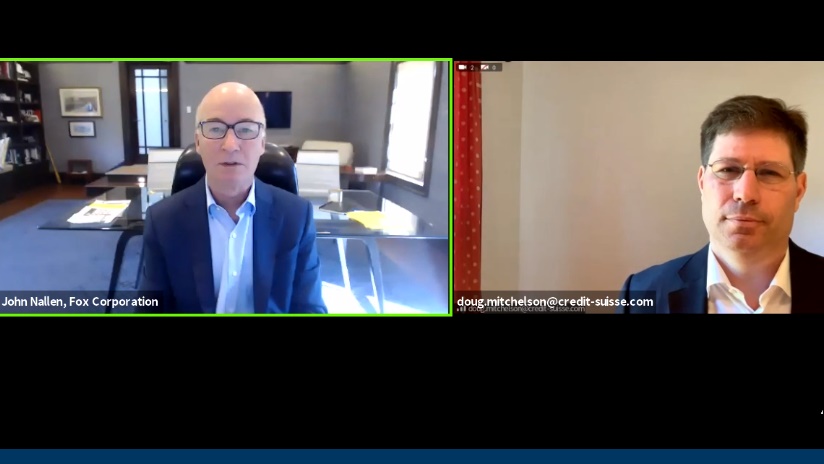

Speaking Tuesday at the Credit Suisse 22nd Annual Virtual Communications Conference, Fox COO John Nallen said he expected lost revenue to be on the low-end of the $200 million to $240 million range the company forecast when it reported earnings in May.

“We’ve seen some key categories in local markets return,” he said. In May, Fox estimated that local ad sales pacing was down 50% for its fiscal fourth quarter. Nallen said the company now sees local ad revenue down in the “low 40% range, with June itself basically down 30, so the trend is in the right direction.

Looking toward the first quarter, Nallen said Fox couldn’t seem much beyond July, when the trend still appears to be continuing.

In the national ad marketplace, Nallen noted that while more clients canceled third-quarter upfront buy than normal because of COVID-19, those cancellations were “manageable.”

Now he said demand is returning for scatter. Prices for commercials is softer than it had been, but remain above scatter, he said.

As far as the upfront is concerned, Nallen said the market “looks very different than the prior years. We've got some clients not all but some making some minimum long-term commitments. I think you see that in areas where they're looking [to secure inventory that they're sure they're going to need.”

The smarter way to stay on top of broadcasting and cable industry. Sign up below

The advertisers making those commitments are in the retail and technology categories,” he said.

“Other clients are just going to shift the scatter and buy on an as-needed basis when the economic picture becomes becomes known,” he said.

Nallen said for is taking a flexible approach with ad clients.

“We're ready to transact when they're when they feel good about ready to lean in and make some commitments,” he said, adding that many clients are waiting for the sports calendar to shake out before making advertising plans--particularly when it comes to Fox, which has a big sports slate from October through December.

Nallen also discussed Fox streaming strategy, noting that while it bought Tubi, it does not plan to compete with the Netflix' and the Hulus, or build an HBO Max or Peacock.

Even in terms of going after cord-cutters with a OTT offering of Fox programming is a non-starter for now.

“I don't think we're at that moment,” he said. I don't see it in the near term for us to be offering a fox bundle a la carte outside it’s current distributors. “I mean, we've got a massive business in the pay-TV world. We have fantastic partners in there. We're not about to go compete with them on different terms.”

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.