Fox Reports Higher Second Quarter Net Income

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

21st Century Fox reported higher earnings for its fiscal second quarter as revenues rose at its cable and broadcast TV operations.

Net income rose to $856 million, or 46 cents a share, in the quarter ended Dec. 31, from $672 million, or 34 cents a share a year ago.

Revenues rose 4% to $7.68 billion.

The results were mixed compared to Wall Street expectations.

Related: New Fox VR Division Announces Content Partnership

At 21st Century Fox’s cable network programming segment, operating income rose 6% to $1.33 billion. Revenues were up 7% to $3.97 billion.

Domestic cable network operating income rose 12% driven by gains at Fox News and FX Networks.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Domestic advertising revenue was up 12% because of the elections and because of higher postseason baseball ratings on FS1. Affiliate revenue was up 7%.

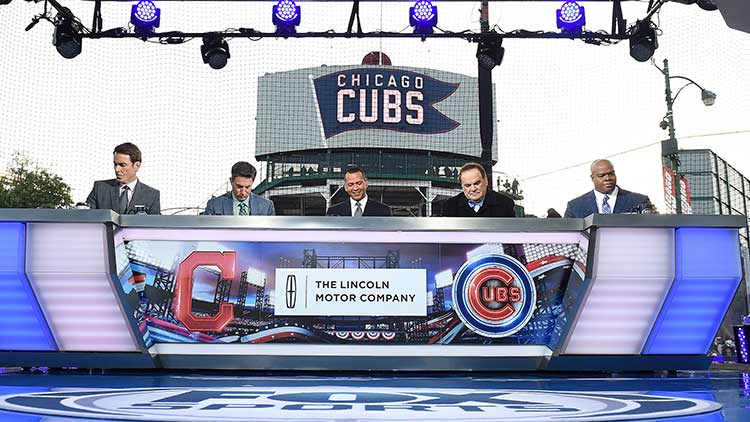

Operating income at Fox’s television unit were up 35% to $376 million. Revenues were up 12%, driven by higher sports ad revenues as the Chicago Cubs drew huge ratings winning the team's first championship in a seven-game World Series. Revenues were also helped by higher political spending at the Fox TV stations, higher retrans payments and higher content revenues.

“We delivered a second consecutive quarter of double-digit earnings growth, driven by solid increases in affiliate and advertising revenues across cable and television. Our record-breaking post-season baseball run underscores the immense value of our sports programming, as well as the broader competitive advantage we have built through our other leadership positions in entertainment and news," said Rupert and Lachlan Murdoch, the company’s executive chairmen.

“We also continue to excel creatively, with our television studio producing the number one series on six networks, FX Networks leading all networks in Golden Globe wins and our film studio recognized with 7 Academy Award nominations. Additionally, during the quarter we announced an offer to purchase the approximate 61% interest in Sky we do not already own. We expect the transaction will generate significant adjusted earnings per share and free cash flow accretion and it provides clarity on our near-term capital allocation priorities,” the Murdochs said.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.