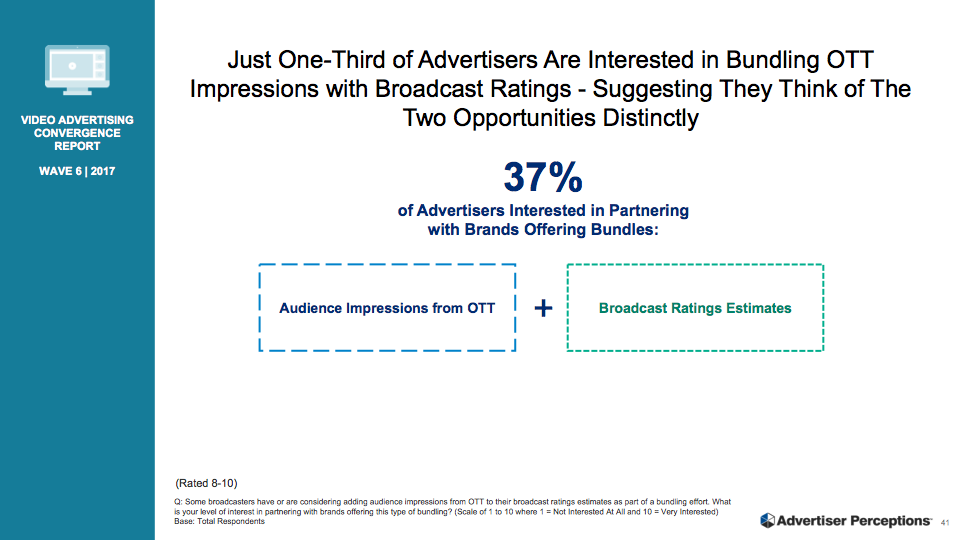

Few Marketers Ready to Bundle OTT with Broadcast

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Even as marketers increase their use of advanced forms of advertising, at this point only a third of them are interested in bundling the growing amount of over-the-top impressions with traditional broadcast ratings, according to a survey by research and business intelligence company Advertiser Perceptions.

Advertiser Perceptions found that, usage of advanced TV has reached critical mass.

A survey it conducted earlier this year found that 56% of the advertisers surveyed are making a significant investment in OTT/connected TV. It also found that 44% of advertisers have made significant investments in programmatic linear TV, 30% in addressable TV, 35% in data-enabled linear TV and 32% in set-top-box video on demand.

Despite the attractiveness of advertising in programming delivered on over-the-top platforms, measurement issues make them reluctant to simply buy it in a bundle with their traditional TV, said Justin Fromm, VP of business intelligence at Advertiser Perceptions. Only 37% of advertisers said they were interested in partnering with media companies selling a bundle based on broadcast ratings estimates and audience impressions from OTT.

“They want to be able to seamlessly buy across platforms, but they need the right measurement and I think this argues that C3 is not the right measurement,” Fromm said.

OTT offers helps advertisers reach consumers who have cut the cable cord and additional data about who is watching and how they’re reacting to ad campaign.

“The idea of being able to better target, and then also being able to get better and more interesting metrics on the back end, I think that’s really driving alternatives to these measures,” he said “Plus with the continued growth on the consumer side of SVOD services, they understand that there’s a need to find folks wherever they are.”

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Most of the clients involved in TV—76%- thought that the tracking of over-the top was at least somewhat reliable.

And they were looking forward to having networks or other ad platforms providing a multiplatform solution that includes both traditional TV and digital TV in a single buy.

Fromm said a cross-platform system that helps advertisers understand unduplicated reach and frequency so that they put the value of the audiences they’re getting from advanced advertising in context is still needed.

"Everyone’s working towards thatand no ones quite gotten it," he said.

That hasn't stopped some networks from selling their TV and online inventory together. The CW has done it for year with its convergence package. And this year, NBCUniversal introduced CFlight, a metric is said combines broadcast and non-broadcast impressions.

Advertisers also advanced advertising on digital TV platforms because of the data they get.

“You see folks like Hulu at the upfront making a big splash about partnering with lots of different folks who will help understand consumer behavior after exposure. So that’s another example of the digitalization of television,” Fromm said.

“There are expectations that marketers have from what they get on digital, especially from Facebook and Google, and they look to have that wherever they can have that. And so I think you’ll see more of that and again you even see that with A+E with their Data Plus Math partnership,” he said.

A+E is using attribution data to guarantee some advertisers they’ll see gains in web visits or store traffic after running campaign on its networks.

Advertiser Perceptions conducted its survey in December 2017 and January 2018.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.