Fall Elections May Help Cable Shake News Blues

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

The TV news business had a tough year in 2013. Revenue was down 7% at the cable news networks in a post-election year, according to Nielsen and the perception that the news audience is older than the demos marketers prefer to target didn’t help.

“It was always old and it just keeps getting older,” says Marianne Gambelli, chief investment officer at Horizon Media. Younger consumers increasingly are getting news online and on mobile devices.

When Gambelli was in sales at NBC, she recalls that it was hard to get some clients to buy news. “One of the turnoffs was the type of clients that run in it,” she says, pointing to pharmaceutical companies looking to reach older consumers. And at a time when clients are taking a bigger hand in creating content, the unsettling images newscasts often feature can also be an issue. “They don’t want to be in that environment.”

While mainly acknowledging a post-election slowdown, the executives who sell TV news see things picking up as this year’s upfronts approach.

“This quarter is looking pretty good. I’m pretty pumped about this year. Election years are always good for us,” says Paul Rittenberg, executive VP for ad sales at top-rated Fox News.

Rittenberg says that while youth-oriented Pepsi and McDonald’s buy news rarely, for Fox News’ three biggest categories—automobiles, specifically luxury cars, pharmaceuticals and financial services—59 is the new 49. “We have one deal for a luxury auto where we’re guaranteeing 35-64 [year-old viewers] with $100,000-plus household income,” he says. “Truthfully, not a lot of people under 35 are going to spend 85 grand on a car.”

NBCUniversal is taking on the age issue more directly. “There are a lot of antiquated, stereotypical perceptions of the news viewer that we need to correct,” says Seth Winter, executive VP of sales for NBCU’s News and Sports Group. “It’s not as if the 18-34 people who inhabit this world aren’t interested in what’s around them.”

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Winter says news viewers are decision-makers and influencers, intelligent and leaders. “We think advertisers want that audience,” he says. “We believe in live programming as a company and the company has invested a lot of money in both sports and news” and in digital news sources such as technology site Re/code.

Spreading to More Screens

At CNN, Greg D’Alba, president for ad sales, says marketers are looking to be on more screens. “TV’s going to be the best viewing experience,” D’Alba says, “but we’ve managed to build out more real estate by providing more, and that’s where digital technology has helped our brand.” CNN has also created new TV franchises such as Anthony Bourdain: Parts Unknown and CNN Films that are attracting new advertisers with content they can count on.

As they make their upfront presentations, each news organization has different points to emphasize. CNN will be introducing the new CNN Money, with a new emphasis on digital video, to attract financial advertisers.

At NBC News’ presentation, “we’ll let people know that the NBC News of yesterday is not the NBC News of today or tomorrow and we have been building our digital assets,” says Winter. “That perception of the 55-to-65-year-old news viewer is not where NBC is mired. We are looking to the next generation of news user and news viewer.”

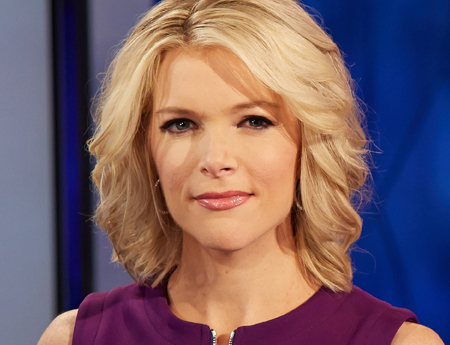

With Greta Van Susteren, Megyn Kelly and Elisabeth Hasselbeck in new time slots on Fox News, Rittenberg is happy to have something different to present. “It was great to talk about consistency, and we’ve been No. 1 for 13 years, but now I have a new schedule, which is generally what people do like to talk about.”

UPTICK, TICK, TICK, TICK AT CBS NEWS

CBS, the most-watched network, remains in third place in news, but execs say business is improving. “Over the past year or so, we’ve seen a resurgence in news and news advertising. Our money was up a tick in the post-election year, and that’s a good sign,” says Chris Simon, CBS executive VP, sales.

“We’ve seen growth in the movie studios, financial, autos and tech. There’s a wide variety of clients that have value in the evening news daypart,” says Joe Mina, VP, news and late-night sales.

On Sundays, where 60 Minutes ratings remain strong, CBS airs special packages including MoneyWatch, sponsored by Spiriva and Lincoln Financial, and Sports Desk, sponsored by Pfizer, Citibank and Pacific Life. And CBS News has 60 Minutes Overtime online, backed by Pfizer

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.