The Elephants in the Room Are (Credit) Card-Carriers

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Related: Stations Gearing Up For ‘Political Storm’ of Spending in 2016

The race for the Republican presidential nomination has taken on a new sense of urgency. The Nov. 10 primary debate in Milwaukee offered fewer candidates onstage (eight) and more intense exchanges about policy as opposed to scuffles over debate rules or university transcripts.

The amount of dollars flowing into political ads for candidates is also getting to be pretty formidable. And might we remind you that there is still a year to go before the actual election?

As the machine revs up ahead of Iowa and New Hampshire, the special report over the pages that follow takes the pulse of Madison Avenue and the TV station sector. In our Next TV section on pages 12-13, we also swipe through the latest election-season apps designed to further engage viewers and integrate their social and TV experiences. An informed electorate is good for democracy (or so we heard it said by some pundit), so read early and read often.

Primary Ad Spend May Go ‘On and On’

The forecasthas called for a downpour of campaign ad spending and those who track the election jockeying down to the dollar are sticking by their predictions.

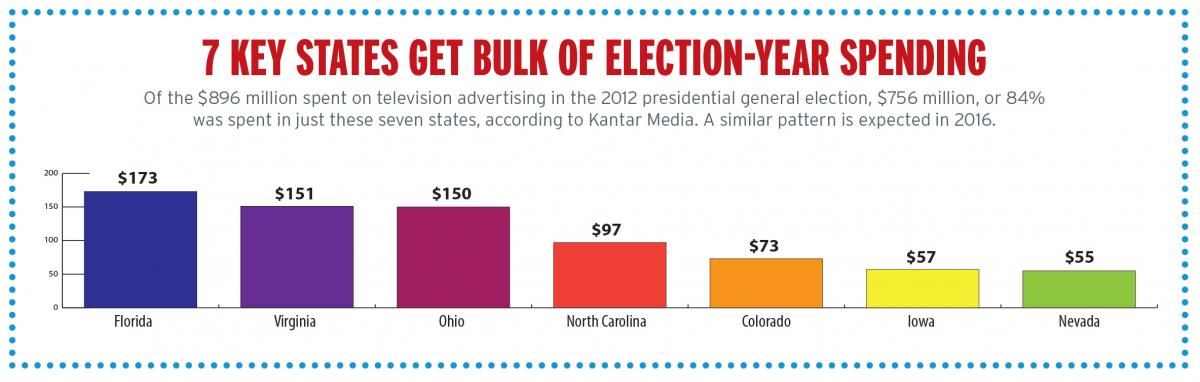

The Campaign Media Analysis Group, part of Kantar Media, estimated in July that political ad spending in the 2016 races would reach $4.4 billion. Of the $4.4 billion, $3.3 billion is expected to go to local broadcast TV and $800 million to local cable TV. Like 2012, more than 80% of that TV ad spending is expected to takle place in seven states.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Elizabeth Wilner, senior VP at Kantar who oversees the CMAG, sees no reason to second-guess her rosy estimates.

“There’s no contested Democratic primary,” she notes, with VP Joe Biden electing to stay out of the race. By the time the New Hampshire primary rolls around, Democratic front-runner Hillary Clinton will have spent about $15 million.

“On the Republican side, you have a primary that may go on and on,” she adds, “but the candidates that are doing the best are doing almost no advertising to speak of.”

A prolonged campaign season would be bad for TV spending, according to Wilner. “The longer a Trump or a Carson or a Fiorina stays in the race, the greater the chance that other candidates who are doing paid media might have to drop out,” she says. “And the greater the odds that the Republican primaries will end and whoever comes out of it will have no money to spend.”

After the Obama campaign emphasized data to buy targeted viewers on a broad array of cable networks, NCC, which sells local cable to national advertisers, believes cable’s share of political spending is on track to top 30% or $800 million. “That’s directly driven by the data-infused ability to try to find persuadable voters across multiple networks,” says Tim Kay, political director at NCC.

“NCC has the Clinton campaign on the air, as well as Jeb Bush’s Right to Rise PAC. Those campaigns are using the 2012 playbook of going broad and deep when it comes to cable networks,” says Kay. A low-end campaign employs 20 to 25 networks, while a high-end one goes up to 40.

“A campaign uses different networks in Iowa than in New Hampshire,” Kay says. “You’re really seeing this targeted on a DMA or even lower level.”

Campaigns have voter information plus set-top information they mostly get from Rentrak to target their buys.

Kay says campaigns are starting to take advantage of cable’s dynamic advertising insertion capabilities on video-on-demand programming. That allows campaigns to single out individual homes and deliver an appropriate message.

“This community for years has been adding for addressability,” Kay says. It is available in a smattering of markets, and it will be in demand as it rolls out further, he says.

But Wilner says she has been staggered by the impact earned media has been having on the race. “If Trump decides he wants to do Saturday Night Live, he does Saturday Night Live. He really knows how to work this,” she says.

And if two years ago, the emphasis was on data and people who know how to work with data and sophisticated targets, this year, it’s communications people who are the “cool kids” right now,” Wilner says. “They’ve got to find ways for their candidates to get the message out without spending tons of money on television,” she says. “Eventually all of the number crunching will kick in.”

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.