Crown Rises While AwaitingNew Greeting From Hallmark

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

jlafayette@nbmedia.com | @jlafayette

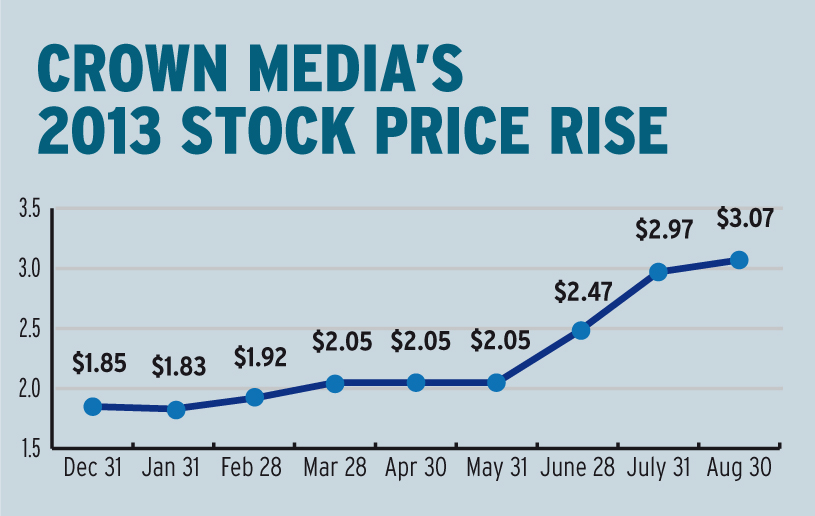

Shares of Crown Media , which runs the Hallmark channels, have been going up, partly because they might be going away.

The stock had been underperforming compared to other cable networks, foundering below the $2 mark since mid-2011 despite improving earnings. Then in June, Hallmark Cards, which owns a 90% stake in Crown Media, said in an SEC filing that when a standstill agreement expires at the end of the year, it will consider options that include going private and disposing of its investment.

The day after the filing, Crown Media shares rose 19% to close at $2.49 a share. Since Aug. 29, the shares have been trading above $3, with the day of reckoning drawing nearer.

Michael Pace, managing director for credit research at J.P. Morgan, said in a report: “We believe Hallmark still finds brand value in both Hallmark cable networks and think it is more interested in taking the company private than selling its stake.” Previous attempts to sell the channels failed.

A Hallmark Cards representative said the company had nothing more to say about Crown Media. And Crown said its largest shareholder has not discussed its intentions with them. During Crown Media’s second-quarter earnings call on July 31, several analysts and investors asked about what the filing meant and were frustrated by management’s lack of answers.

During the call, CEO Bill Abbott did not respond to questions about Hallmark. “We unfortunately have no information other than what they have disclosed in the filing,” CFO Andrew Rooke said in response to one question. “Hallmark as an investor has no obligation to make the disclosures beyond what they’ve made in [their filing].”

“We don’t necessarily know what the intentions of our investors are,” said general counsel Charles Stanford in response to another investor.

One interested questioner was Salvatore Muoio of SM Investors, who sued the company over its 2010 recapitalization, charging the deal was too favorable to Hallmark. Crown won the suit in 2011.

Your Share of Shares

If Hallmark decides to buy out the public shareholders, Muoio said there are a couple of ways of valuing the shares. He notes that there have been two recent sales of cable nets. One was Current TV, sold to Al Jazeera. The other was Outdoor Channel, bought by Koneke Sports. Those sales valued the channels with a cash flow multiple in the teens, Muoio said. Using that as a guide, one could figure a price of about $5 per share. A somewhat more reasonable method yields a price closer to $4 per share, based on Crown’s current earnings. “I feel like that’s the range that would feel fair to us,” Muoio said.

Muoio said the price could be higher if Hallmark opted to sell Crown Media to another programmer that could take advantage of synergies in corporate overhead, ad sales and affiliate sales that could save $40 million to $50 million.

Under Abbott, Crown Media has turned profitable. In the second quarter, net income rose 22% as ad revenue increased 3% and subscriber revenue advanced 4%. Hallmark Channel has begun to push into original scripted programming and Hallmark Movie Channel has increased distribution and ad sales, contributing to Crown’s earnings.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.