Cord Cutting Now: 7 of the Top 8 Publicly Traded U.S. Pay TV Operators Lost Ground in Q2 (Chart of the Day)

The better news: Only three of these companies lost more customers than they did in the second quarter of 2022

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

With subsystems like regional sports networks now in outright collapse, fixation on quarterly cord-cutting metrics is hardly passé.

A lot of pivotal decisions about just how long linear businesses can be sustained are being made right now by companies including Disney, which reported a 7% revenue decline for traditional channels for the second quarter and is now publicly discussing its plan to take ESPN over-the-top.

With that in mind, we laid out what we know about the just completed Q2 earnings season for U.S. pay TV operators (at least, the publicly traded ones) below.

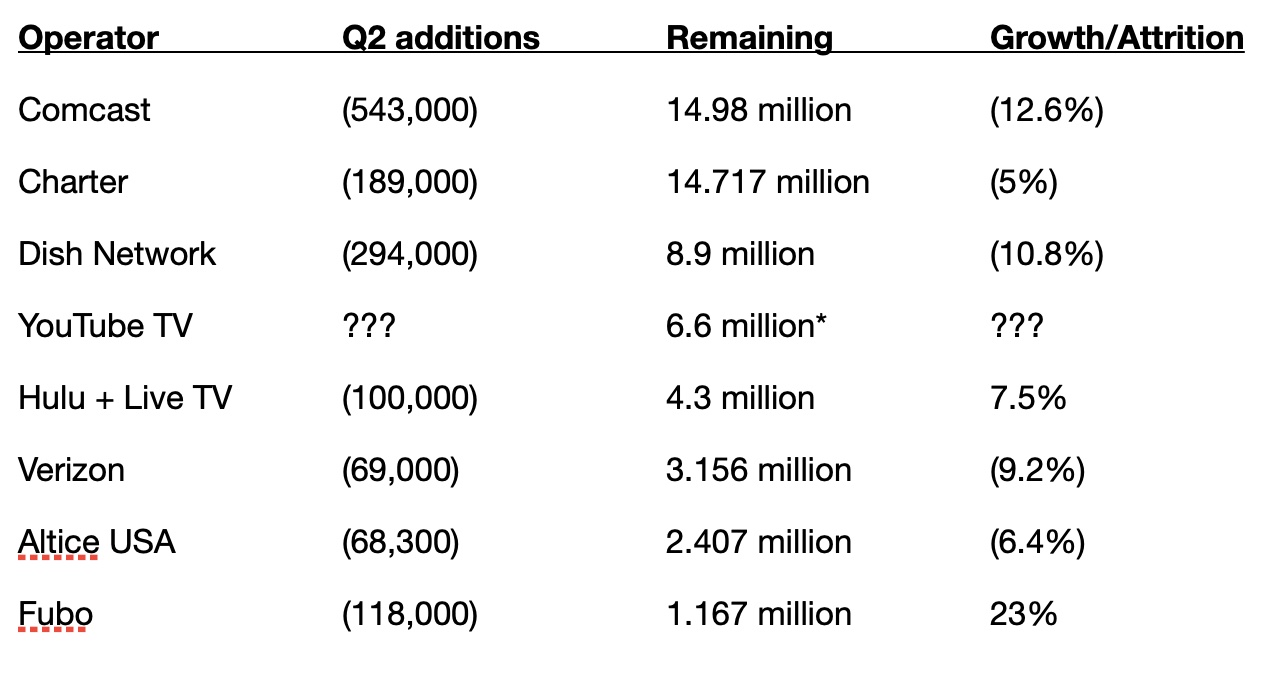

The bad news is that losses for leading operator (still for now) Comcast keep on quickening, now up to a whopping 12.6% year over year. Same for Dish Network, which is seeing erosion not just on linear satellite TV (now up to 11.4% year over year), but on vMVPD Sling TV, as well.

The better news: Only three of the eight operators featured on our chart lost more subscribers from April to June than they did in the second quarter of 2022.

And Google's entry into the bundled channels business, YouTube TV, seems to be growing fast. With the infusion of the NFL Sunday Ticket out-of-market games package, equity research firm Lightshed Partners believes the platform is up to 6.6 million paid users.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!