CBS Is Cashing In With 'Under the Dome'

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

With Under the Dome last year, CBS showed that a scripted series could make money for a broadcast network over the summer. This year, with season 2 a sure thing, the network is looking to cash in again.

Media buyers expect season 2 to generate ratings similar to last year and have paid nearly 60% more for spots.

For CBS, the supernatural Stephen King show was set up to have its production costs covered before it even aired last year, thanks to international distribution deals and an exclusive streaming agreement with Amazon.com. Once the ratings rolled in, the ad revenue was pure gravy.

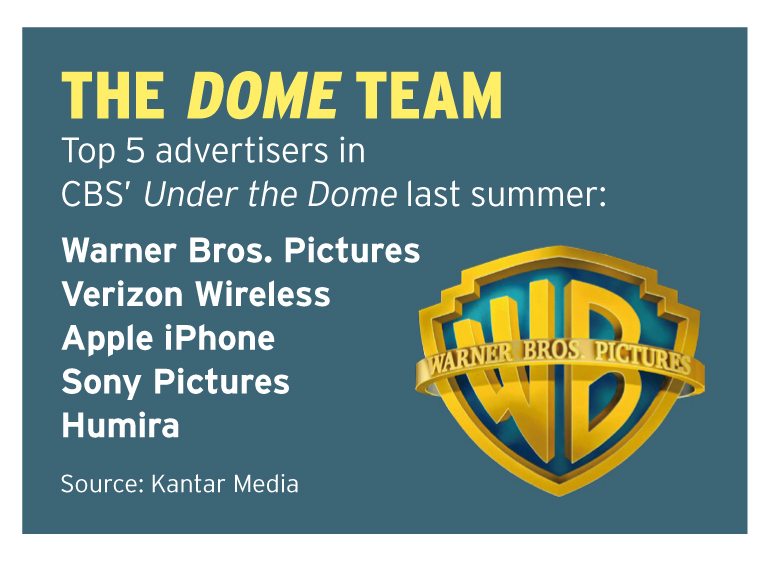

According to Kantar Media, the 13 episodes of Under the Dome in season 1 generated nearly $39 million in ad revenue. That contributed to a 13% increase in ad revenue at the network during the third quarter.

CBS was able to sell 30-second spots in the first season of Under the Dome for an average of $108,000, according to SQAD’s NetCosts service. That rate breaks down to a $56 cost-per-thousand-viewers in the adults 18-49 demo, a premium to the $48 CPM CBS generated for all of its third-quarter ad sales.

This year, media buyers say commercials are selling for about $170,000.

“The money follows the eyeballs and so the more eyeballs you bring to the set, the more money you get,” says Linda Rene, executive VP, primetime sales and innovation, at the CBS television network. She declined to address specific numbers, but said season 2 is well-sold.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

“Everybody was very excited about it last year, so there was a lot of interest in it,” she says. “Now it’s a proven entity so everyone wants to run in it. It clearly is very important to be on the schedule for movie studios, but it’s a strong demographic, so it will work for every category. You always want to be in a show that has buzz and is talked about and is social, so it’s that kind of a show.”

Summer Heats Up

This year, CBS is adding another highly anticipated scripted show to its summer schedule with Extant, starring Halle Berry. “There isn’t a client that’s coming in and spending money that doesn’t want those shows in their mix. Those are the hot shows,” Rene says.

The summer programming opens a new window for broadcasters such as CBS to sell ads against premium scripted programming. “We’re thrilled that there are no rules anymore. In the days 100 years ago, you had your season and you were in repeats over the summer and that was your model. And now we’re scheduling year-round and we’re selling against scheduling year-round successfully, so I think for us that’s very exciting,” she adds.

Buyers like the year-round programming opportunity as well.

“I think it’s great what networks are doing during the summer. Cable nets have had a lot of success with summer shows and I think it’s important for the networks to get back in that game,” says Dave Campanelli, senior VP, director of national broadcast at Horizon Media.

“The broadcasters don’t go dark in the summer and neither do our clients’ businesses,” says Sam Armando, senior VP and director of strategic intelligence at Starcom MediaVest Group’s SMGx unit.

“If there’s anything that Under the Dome has done it has shown that you can do summer and it doesn’t have to be reality,” Armando says, pointing to series such as Wipeout, America’s Got Talent and Big Brother that have been summer staples for the broadcasters.

Armando expects Under the Dome’s ratings to be slightly lower than last year. He says the main question going into season 2 is that broadcast shows sometimes don’t maintain their audiences after long absences the way cable series do.

“You can keep shows like Sons of Anarchy and Mad Men off the air for 12 to 18 months, and when they come back they do the exact same ratings, or potentially even better,” he says. “But broadcast, when they have their hiatuses, sometimes it doesn’t come back as strong. In the past, Heroes, The Following, they just lose a little something when there’s a hiatus.”

This year, there will also be a fair amount more summertime competition from the other broadcasters, he adds.

“I think that combination will bring it down just a touch. But I do not see it becoming a shell of its former self. I still think it will be one of the summer’s top-rated shows,” Armando says.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.