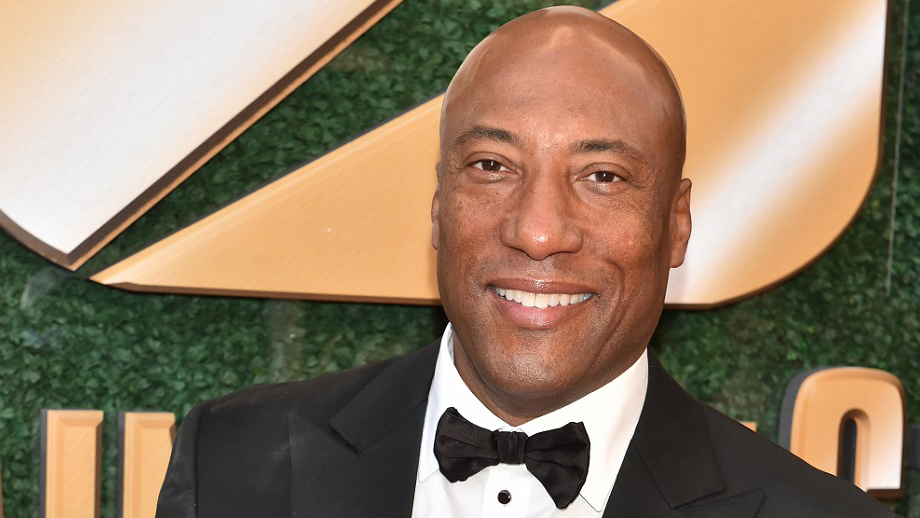

Byron Allen Sues Nielsen Claiming Billion-Dollar Fraud

Suit alleges measurement firms panels are ‘unreliable’ for measuring his company’s networks

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Byron Allen’s media companies have sued Nielsen, seeking billions of dollars in damages for what they called the measurement company“s “fraudulent misrepresentation” and “fraud by concealment.”

Allen, whose Allen Media Group properties include 27 broadcast stations, cable networks including The Weather Channel and numerous online and streaming video outlets, claims that Nielsen’s panel system for estimating viewership is unreliable for some of its networks.

The lawsuit, filed Wednesday in Circuit Court in Cook County, Illinois, further alleges that Nielsen concealed these facts and thereby caused AMG units Entertainment Studios and The Weather Group to pay millions in fees. The lawsuit identifies several other networks that similarly received fundamentally unreliable services from Nielsen.

Also: Busy Byron Allen Wants To Be Big, but Doesn’t Want To Be a Unicorn

Allen claims Nielsen’s actions resulted in damages including millions of dollars paid to Nielsen for “shoddy and unreliable” services, million of dollars in lost ad revenue and profits, and lost business value and other “consequential harms estimated to be in the billions of dollars.”

The suit says Allen is seeking compensatory, special and consequential damages to be determined at trial.

Also: Networks Ask Nielsen to Halt Release of 'Big Data' Numbers Until After Upfronts

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Nielsen declined to comment on the suit.

“The industry has suffered billions of dollars in losses, and we can no longer afford these damages. Nielsen needs to quickly address these issues,” Allen said. “If not, I highly expect that Nielsen will soon face a $10 billion-plus class-action lawsuit.”

Nielsen has been under heavy criticism from its network clients lately. It is also reportedly in talks to be acquired by private equity groups for $15 billion.

Allen has been more than willing to take on big opponents in court. Last year he filed a $10 billion suit against McDonald’s Corp., claiming the burger chain discriminates against minority-owned media companies. The suit was dismissed, then reinstated by a federal court judge in January.

Allen also sued Charter Communications for $10 billion in a discrimination lawsuit when the cable company wouldn’t carry his cable channels. The suit was “resolved and withdrawn” in February and the networks are currently being carried by Charter.

In June of 2020, Allen resolved a suit against Comcast that reached the U.S. Supreme Court. Comcast wound up carrying The Weather Channel, other Entertainment Studios Channels, including Comedy.TV and JusticeCentral.tv, and 14 broadcast television stations owned by Allen.

Allen previously sued Nielsen in 2020, claiming Nielsen’s “predatory pricing” resulted in the Weather Channel being overcharged by $425,000 per month. That suit is still pending.

In the new Nielsen lawsuit, Allen’s companies said they first engaged with Nielsen in 2007 to measure syndicated programming created by Allen’s Entertainment Studios unit.

Entertainment Studios launched several cable networks in 2009, and Nielsen aggressively sought to have those measured by Nielsen as well. According to the suit, Nielsen officials in 2016 told Allen and his colleagues that the Entertainment Studio networks “had attained sufficient distribution and viewership for Nielsen to reliably rate them.”

But, the suit alleges: “Nielsen did not tell Entertainment Studios the truth — that, in reality, its ratings services were not reliable for networks like those owned by Entertainment Studios. At the time, Entertainment Studios did not have access to information that would show that Nielsen’s data was unfounded and false.”

The suit said Nielsen, in internal reviews, knew that “when distribution for a network is limited in the number of subscribers, the sample errors in Nielsen’s reports increase dramatically making the service fundamentally unreliable.”

Numbers for Allen’s The Weather Channel were also unreliable, according to the suit. “By 2021, the sample error was over 50% for most of the timeslots reported by Nielsen for The Weather Channel. In other words, more often than not, Nielsen could not report data for the Weather Channel that had a minimum degree of reliability,” the suit said.

Allen said Nielsen’s issues led to its “dramatically underreporting” viewership of The Weather Channel.

In the lawsuit, Allen refers to criticism that Nielsen’s numbers have received by others in the industry.

It noted that the VAB, which represents networks and distributors, accused Nielsen of underreporting viewing during the pandemic because of problems Nielsen had maintaining the quality of its panel. The Media Rating Council confirmed that Nielsen’s viewer numbers were low.

The MRC subsequently removed its accreditation for Neilsen’s national measurement system.

More recently Nielsen has admitted that it had not included all out-of home viewing in its ratings numbers.

Nielsen has been working on Nielsen One, a new system that will add big data to its panel of about 40,000 households as the basis for its audience estimates.

The new system was made necessary as the media landscape has become more complicated, as Allen Media Group noted in its lawsuit.

“Nielsen’s panel system may have worked decades ago when there were a handful of networks that could be viewed only over the air on a television set,“ the suit said. ”With changes in the television industry, viewers now have hundreds of channels to choose from. They can watch video by subscribing with distributors, such as satellite or cable providers, or stream over the Internet through services and apps that can be viewed on Smart TVs, computers, cellphones and tablets. This fragmentation of viewership has eroded the reliability of Nielsen’s panel system. Nielsen has known about the problems for years but has not invested to make its ratings system reliable and up to date. “ ■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.