All Quiet as Deadline Passes on Fox Dispute with Altice

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Fox Networks Group and Altice USA apparently continued their negotiations as their distribution agreement expired at the end of September.

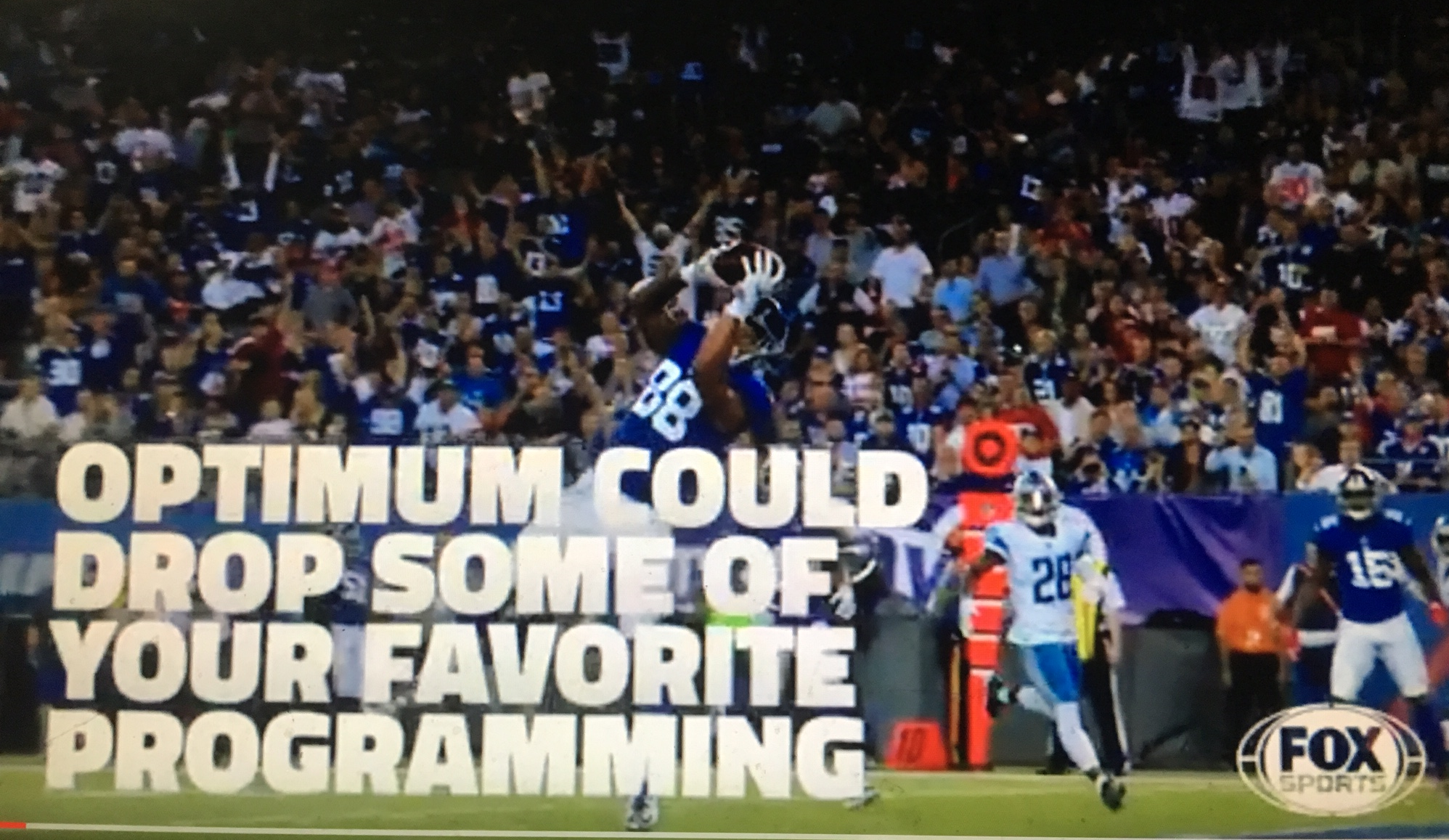

A week ago, Fox began running ads during college football games warning Altice's Optimum cable subscribers that they could lose programming including NFL football, Major League Baseball playoffs and prime time shows including Empire and 9-1-1 unless an agreement was reached.

The deadline came and went at midnight Sunday night and there was no word from either party early Monday morning and no sign that the channels had been blacked out.

Related: Fox Warns Viewers Blackout Nears on Altice's Optimum

The carriage fee dispute involves Fox’s broadcast station in New York, WNYW-TV, FS1 and FS2, which will remain part of the new Fox after assets are sold to the Walt Disney Co. The dispute also covers cable networks FX and National Geographic Channel, which will become part of Disney went the transaction closes.

Fox News Channel and regional sports networks including the Yankees’ YES Network are not affected.

The new Fox will be focused on live sports and news, and analyst Richard Greenfield said that this negotiation will be the first test of how much clout it will have with traditional distributors like cable operators.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Fox recently paid big bucks for Thursday Night Football and for WWE’s Friday Night Smackdown. To pay for those it will need a big hike in retransmission payments it gets from operators.

“While we do not know the terms of what Fox is asking for, we have to believe they are seeking upwards of $1/sub/month in incremental fees given the cost of new content and the headwinds facing non-sports/live programming,” Greenfield said in a recent research note.

“Given Altice’s relative small size, they are in a difficult position, particularly with new Fox trying to set the tone for its future negotiations, not to mention proving out the investment thesis for new Fox investors,” Greenfield said.

Fox had begun running ads warning Altice USA subscribers that a blackout was possible on Sept. 22 during college football games.

The commercials, which began airing Saturday during afternoon college football broadcasts, employ Fox TV personalities to say that popular programming including NFL football, the baseball playoffs and a new season of primetime series such as 9-1-1 won’t be available unless an agreement is struck.

“We are disappointed that despite our repeated efforts to reach a deal over the past several months, Altice refused to engage in any substantive discussion until just last week and is now asking for preferential treatment that’s totally out of step with the marketplace,” a Fox spokesman said in a statement.

“We feel it’s our responsibility to inform Altice’s customers that as a result, they may lose access to Fox, FX, FS1, National Geographic and more, including NFL games on Fox, MLB postseason action on Fox and FS1, Empire, 9-1-1, American Horror Story and Mayans M.C, as well as their local news from Fox and some of their local Fox Sports networks,” the Fox spokesman said.

Altice acquired Cablevision Systems in New York in 2015. Its Optimum brand service carries popular Jets and Giants football games as well as New York Yankees baseball. It also owns the Suddenlink systems.

Altice confirmed it was negotiating with Fox and said it is "disappointed that they have started threatening to black out certain channels in an effort to extract hundreds of millions of dollars in new fees from us and our customers."

"Programming costs are the greatest contributor to rising cable costs, and we urge Fox to stop its threats and instead focus on negotiating an agreement that is fair for consumers," Altice said.

In 2010, Fox networks were blacked out on Cablevision for two weeks. When an agreement was reached, just before the first pitch of Game 3 of the World Series, Cablevision complained that it had been pressured into a bad deal. “Cablevision has agreed to pay Fox an unfair price for multiple channels of its programming including many in which our customers have little or no interest,” the cable company said at the time.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.