Ad Impressions Decline for First Time at Canoe

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Canoe, the ad technology company owned by three of the largest cable operators, said the number of advertising impressions it delivered in the second quarter went down for the first time amid added competition from new streaming video-on-demand platforms.

Canoe, which dynamically inserts commercials into VOD programming for operators and programmers, said it delivered 6.7 billion impressions in the second quarter, down slightly from the 6.8 it delivered in the second quarter a year ago.

"After years of consistent growth, Canoe is starting to see the impact of other platforms for VOD viewing in the U.S., such as Hulu, YouTubeTV, Pluto TV and Roku," said Chris Pizzurro, VP, global sales at Canoe.

“Canoe views Q2 making sense as consumers try out other AVOD platforms, as we are continually improving our current product, while we expand with other U.S. and global MVPDs and programmers," Pizzurro said.

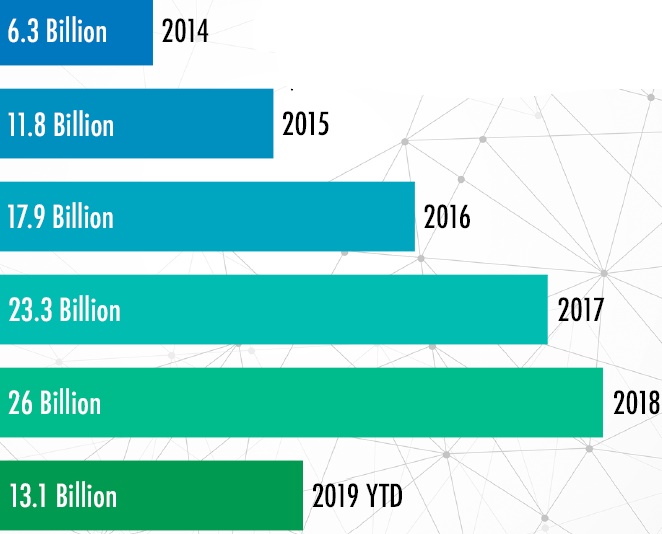

In the first half of 2019, Canoe has delivered 13.1 billion impressions, Pizzurro said Canoe is projecting that it will be flat or up in the single-digit range for the full year.

Last year, Canoe delivered 26 billion impressions, up from 23.3 billion in 2017 and 6.3 billion in 2014.

Canoe, owned by Comcast, Charter Communications and Cox, downplayed the role of cord-cutting, which is hitting other aspects of the cable business hard. Canoe said it can dynamically insert ads into 37 million households, up a million from a year ago.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

It is in talks with non-owner cable and telco distributors and virtual MVPDs, Pizzurro said, with some deals to be announced later this year. The company is also looking at opportunities to grow by getting into other markets, including Canada, Latin America and Europe.

Canoe said that 82.5% of its impressions are delivered via set-top-box VOD, up from 80% a year ago. The other 17.5% a seen on laptops, smartphones and tablets

On average, VOD viewers saw 3.9 ads during mid-roll breaks in the quarter, up from 3.87 in the second quarter a year ago. They get 1.5 pre-roll ads, up from 1.10 and 1.1 post-roll ads, up from 1.04.

With Canoe’s ad-capping capabilities, an advertiser can make sure viewers don’t see the same commercial over and over. The vast majority cap ad frequency at two per episode, Canoe said.

In the second quarter, viewers 60% of viewers saw individual spots just once per episode, up from 57% a year ago, with 26% seeing the same ad twice, down from 36% and 9% seeing an ad three times and 5% seeing a spot four or more times.

In a given day, 46% of viewers see an ad once, 26% see the same ad twice, 12% get it three times and 16% get four exposures to the same ad.

Over the course of a week 41% of viewers will see an ad once, with 24% receiving it 24%, 13% getting a triple place and 22% sitting through it four or more times.

Of the 3,876 campaigns managed by Canoe during the quarter 88% were from external advertisers, up from 83% a year ago. The other 12% are network tune in ads and promos. A year ago, Canoe handled 2,409 campaigns in the quarter.

The commercials were sold directly in 92.8% of cases, with 7.2% sold via private marketplaces.

The biggest day for dynamically inserted ads are Saturday and Sunday. On each day 1.1 billion impressions were delivered. The top weekdays were Fridays--929 million and Mondays--918 million.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.