Ad Buyers See 20% Spending Drop: IAB

59% in survey said they plan to increase spending on CTV

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Ad buyers said they expect their 2020 spending to decline 20% from last year because of the COVID-19 pandemic, according to a new survey by the Internet Ad Bureau.

The IAB has been polling media buyers and sellers since the pandemic began.

Digital ad spending is expected to be up 13% in the second half of the year, despite the business disruptions caused by the coronavirus.

Buyers said they expect linear TV ad spend to be flat for the third quarter but be lower for the fourth quarter. At the same time, they see investment in connected TV and over-the-top video to increase significantly. Agency execs saw a 46% increase and brands saw a 32% rise.

When asked which media they would increase spending in, 59% said CTV/OTT, tops among digital media. Only 22% said they would increase spending on linear TV, compared to 54% planning to pull back.

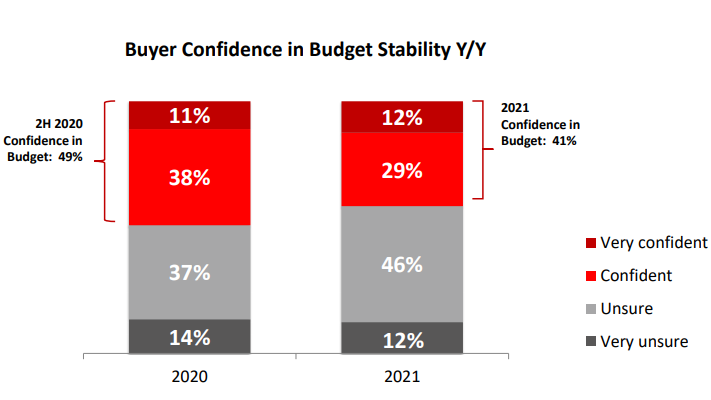

Almost half of the buyers surveyed said they were confident in their budget plans for the rest of 2020, but there was more uncertainty about 2021 spending plans.

With the virtual NewFronts scheduled to start on June 22, 72% of buyers said those presentations are more important than ever before, but most want the TV upfronts and the NewFronts to merge.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

While there has been a lot of talk about how the pandemic has disrupted the upfront market, the buyers still expect to spend about 41% of their budget in the upfront, down from 44% a year ago and they still expect to allocate about 33% on a broadcast-year basis, unchanged from its historical share.

The IAB’s latest survey was conducted May 29-June 8. It interviewed 148 media planners, media buyers and brand executives.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.