2Q TV Ad Spending Down As Price of Spots Slides

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Television ad spending dipped 1% in the second quarter—factoring out the World Cup--as advertisers paid less for the average 30-second commercial.

According to figures from research company Standard Media Index, the cost of an average paid commercial fell 3.4%. That was offset by a 2.5% increase in the number of paid ads.

Revenue from sports fell 6.6% from a year ago excluding the World Cup. The NBA Finals lasted only four games compared to five last year, costing ESPN and ABC 12% of last year’s revenue.

Average revenue per NBA Finals game was up 10% to $45.7 million.

The NCAA’s March Madness also earned less money because games played in April a year ago were played in March this year,

As for the World Cup, revenue for the Fox networks in June was $58.2 million, down 31% from four years ago when the soccer tournament was on ABC and ESPN.

Telemundo’s World Cup coverage generated $90.3 million in June, compared to $135.5 million for Univision in 2014. There were four more games in June four years ago than this year.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

“The growth in average revenue per-game for the NBA Finals highlights the opportunity for highly-anticipated sports events to drive revenue,” says SMI CEO James Fennessy. “By the same token, the declines for the World Cup, without the US in the tournament, illustrates the risk that TV networks take when it comes to punting on expensive sports rights.”

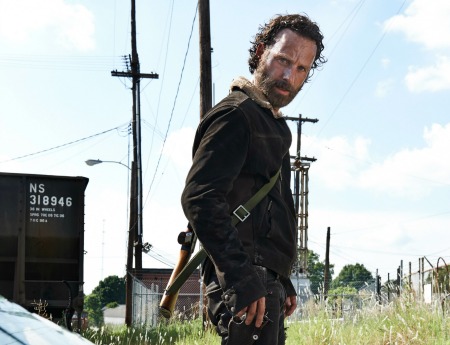

The highest priced 30-secondads in entertainment programming were $331,691 for AMC’s The Walking Dead; Fox’s Empire, $22,659 and CBS’s Big Bang Theory at $295,138.

That increase came at a time when many TV networks are talking about reducing ad loads in order to retain viewers who are increasingly turning to ad-free video services like Netflix.

The networks gave away 4% fewer free make-good spots to cover ratings shortfalls in the quarter.

Revenue from last year’s upfront was down 4%, while scatter revenue were up 11%. Direct response was unchanged.

Revenue from entertainment programming was down 0.4%, but primetime original programming was up. Revenue generated by dramas was up 0.9%. Reality shows rose 2.5% and comedies were up 19.5%.

All of the Big 4 major broadcast networks had higher revenue from primetime original programming in the second quarter, with CBS gaining 22%, ABC rising 7%, and NBC and Fox edging up 2%.

The networks’ big summer competition shows—America’s Got Talent and World of Dance and Fox’s The Four in June garnered a total of $76.9 million.

Cable news continued to benefit from the Trump era, with Fox News, CNN, MSNBC, CNBC and HLN up 16% in the quarter. MSNBC was up 70% from a year ago.

Overall ad spending was up 5% in the second quarter, according to SMI.

Digital advertising was up 12% and out of home rose 9%.

Radio was down 1% and print fell 22%.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.