2020-21 Upfront Volume Down 15%: Media Dynamics

$3 billion in 2019-20 upfront buys cancelled because of COVID

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

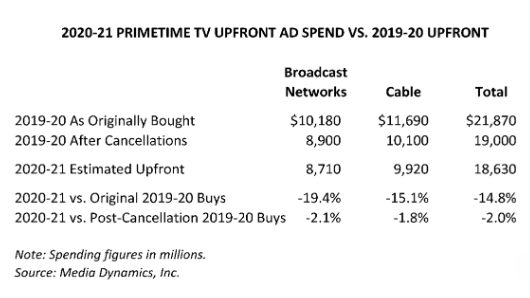

National television networks sold 15% less primetime advertising in the COVID-impacted 2020-21 upfront, according to preliminary estimates from Media Dynamics.

The upfront, completed just weeks before the start of the TV season, totaled $18.6 billion, Media Dynamics said, with $8.71 billion going to broadcast and $9.92 billion going to cable.

Media Dynamics estimates that of the $21.87 billion in upfront commitments made for the 2019-20 season, $3 billion was cancelled as businesses closed down and the economy went into recession during the second and third quarters of 2020.

“Once we adjusted our upfront ad spend figures to account for these cancellations, the sellers did quite well,” commented Ed Papazian, president of Media Dynamics, Inc. “2020-21 upfront ad revenues for the broadcast networks and cable channels were down by only 2% compared to the amounts that advertisers actually spent—less cancellations—for the 2019-20 upfront.”

Media Dynamics notes that because many buyers negotiated more favorable cancellation clauses as part of their new upfront deals, if a second wave of COVID-19 disruption hits during the fall and winter, major portions of flannel upfront spending may again be cancelled.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.