Cable Wireless Grows Up

Analysts, companies optimistic as subscriber rolls rise; no longer a drain on business

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Cable wireless service is growing into its own.

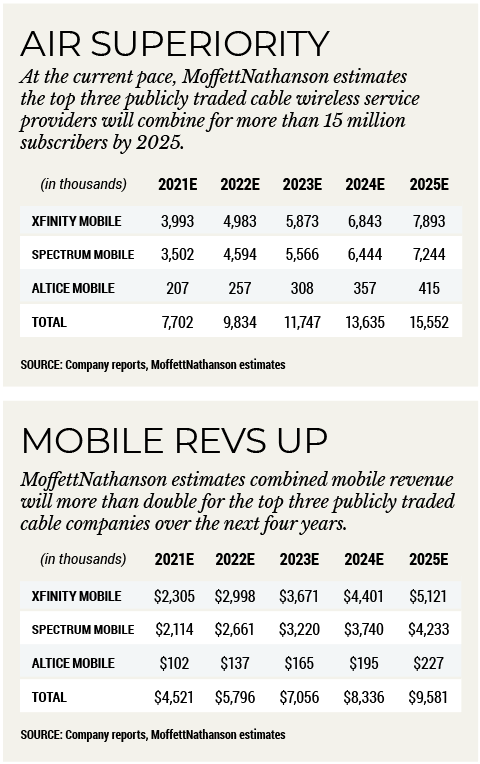

In the four years since Comcast pulled the trigger on what was to be the fourth attempt by a cable company to crack the wireless nut, Xfinity Mobile has been a growth engine, accumulating 3.9 million customers since April 2017. In the first quarter of this year, Xfinity Mobile achieved cash flow break-even, setting the wireless business on a course well beyond the early notion that it would be a backup to plans from more established carriers. Analysts and executives alike are taking notice, predicting that wireless could be a strong competitor in the market, especially if paired with broadband.

“Cable wireless is ready for its star turn,” MoffettNathanson principal and senior analyst Craig Moffett wrote in a research note. Moffett, whose earlier take was that cable wireless is more of a retention tool for other services, now sees the product as a potential profit center.

Comcast is currently the cable industry’s largest wireless provider and Moffett expects its lead to grow over the next four years. Moffett expects Xfinity Mobile to be close to breakeven in 2021, generating about $12 million in negative cash flow, and to turn profitable in 2022.

Aggressive Pricing a Plus

Moffett’s enthusiasm comes primarily from Comcast’s decision earlier this year to aggressively price wireless service. Comcast now substantially undercuts Verizon Communications and AT&T for unlimited mobile data across all plan sizes, according to Moffett, making the product competitive for a vastly larger portion of the market.

Charter Communications followed Comcast, launching Spectrum Mobile wireless service in June 2018. That offering also is flirting with profitability, but chief financial officer Christopher Winfrey said Charter is more concerned with adding subscribers.

“Our goal isn’t to drive short-term EBITDA profitability,” Winfrey said on Charter’s Q1 earnings call. “Our goal is to drive as much growth as we can, because we know what the underlying profitability is and what it does for the overall business.”

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Spectrum added about 300,000 wireless lines in Q1, raising the total to about 2.7 million subscribers.

Moffett estimated Charter’s mobile service would be profitable by 2024 as capital expenses decline.

Charter said its wireless business is finally hitting stride, fueled by competitive pricing, reliable service and the ability to bundle mobile with broadband.

According to researcher Parks Associates, about 19% of U.S. broadband households bundled high-speed data with wireless in Q1 2021. That’s up from about 15% in Q1 2020. With the number of broadband-only homes on the rise — Parks said 41% of households now take unbundled, standalone broadband service, up from 33% in 2018 -— the opportunity to sell mobile service to those households is increasing.

At the JP Morgan Media & Communications conference in late May, Winfrey suggested wireless customers could eventually number about half the level of broadband subscribers, currently at 29.2 million.

“I don’t think people took us seriously when we came into the voice market,” Winfrey said, adding that today, Comcast and Charter are the largest wireline phone service providers in the country. “And the way we did it is, because we weren’t the incumbent, we had the ability to save customers money, we had the ability to bundle it, and as a result we took down phone pricing dramatically across the entire industry and the entire U.S.

“Over 20 years, we became the largest operators,” Winfrey continued. “At its peak, you could almost count as clockwork that voice subscribers would be about half of broadband and if it hadn’t been for mobile substitution, those numbers were continuing to increase. I think our opportunity is at least that.”

Charter has been growing broadband at a 7% annual rate over the past three years and its wireless customers have doubled over the past two years. Continuing that pace, the wireless segment would reach about 15 million customers by mid-2023.

That might be a bit optimistic, as Moffett predicted Charter would reach 7.2 million wireless customers by 2025. But many analysts anticipate Charter will add about 1.1 million mobile customers annually over the next few years. That pace would lead to nearly 15 million wireless customers by 2030.

At the JP Morgan conference, Winfrey said Charter does not view wireless as a standalone product but rather as an extension of broadband service. He said all Spectrum sales channels are required to sell wireless with other products.

While Charter won’t commit to a date when the wireless business will be profitable, Altice USA, which launched Altice Mobile service in September 2019 under a very aggressive pricing structure ($20 per, line per month for unlimited service for life), has since revamped that pricing. At the Credit Suisse conference, Altice USA chief financial officer Michael Grau said after a brief hiccup mainly around onboarding issues, the mobile product was beginning to hit stride in 2020 when the pandemic halted growth because retail stores shut down. The hiatus also forced Altice USA to take a hard look at the wireless business’s gross profit and churn metrics.

Altice Rethinks Pricing

“In the latter half of 2020, we offered 1 [Gigabyte] and 3 [GB] plans to supplement our unlimited plans, and we did right-size some of our pricing,” Grau said. “We’re starting to solve the gross profit problem; we’re no longer taking on customers that are generating negative gross profits.”

Altice USA now offers 1 GB data plans for $14 per month, 3GB data plans for $22 per month and unlimited data plans for $45 per month.

Grau said take rates on the 1 GB and 3 GB products are between 60% and 70%, an encouraging sign. The new pricing also has helped dramatically reduce churn, he said.

According to MoffettNathanson, Altice Mobile improved churn by 20% to 30% as it moved traffic to T-Mobile’s network in Q4.

“At the same time a lot of our stores are reopening,” Grau said. “I think we’re very close to getting to the point where we’re saying, ‘I’m comfortable with the gross profit, I think we’ve solved for that; I’m comfortable with churn, I think we’ve solved for that.’ And that’s when we’ll turn up the sales and marketing machine again. I think you’ll see that somewhere in the back half of 2021.”

Because of a late start, Grau said the mobile unit probably won’t see break-even this year.

“We’d like to see it break-even on a run-rate basis as we exit 2022,” Grau said. “I think that’s more realistic.”

While cable wireless continues to hum along, one potential competitor — Dish Network’s Dish Wireless — lurks in the wings. With plans to launch the first market, Las Vegas, in the third quarter, Dish appears to be moving forward with plans for the state-of-the-art 5G wireless network, despite Wall Street skepticism.

Dish appears to be branding the wireless offering under the “Project Gene5is” name, launching a website under that moniker in June that appears mostly to be a vehicle to gauge interest beyond Las Vegas. The website, which Dish confirmed as its own, promises to notify those who leave an email address and ZIP code when service will be available in their area. A Dish spokesperson confirmed Project Gene5is is from the company but declined further comment.

“We’ll be communicating to customers as options are available in their area, with Vegas being our first market,” a Dish spokesperson said.

Dish has until June 2023 to make the service available to about 70% of its footprint under a federal mandate. Over the years, pundits have criticized the offering, which Dish has said it can build for about $10 billion, on everything from time to market (too late) to expected cost (too little).

Dish Plans Draw Skeptics

JP Morgan media analyst Philip Cusick was the latest analyst to cast aspersions on Dish wireless plans, downgrading the stock to “underweight” from “neutral” while raising his 12 month price target to $45 per share from $38.

“We can’t find a way but to be skeptical on the Dish story,” Cusick wrote. He said while he has the highest respect for Dish chairman Charlie Ergen and the company, he remains stymied by three major issues: the inherent difficulty in launching a brand new wireless service, Dish’s spectrum disadvantage and the perception the company is too late to the 5G game.

Cusick noted the history of service and quality issues that have plagued wireless newcomers including Sprint, Leap Wireless and MetroPCS.

“Many times these were not issues of money to spend or desire, but simply that getting on the right cell sites can be very hard in areas and take years, if they are even possible,” Cusick wrote. While he noted that Dish has a leg up on previous new carriers by owning low-band spectrum and having a MVNO deal with T-Mobile, those aspects only reduce the challenge.

Dish, according to Cusick, has about 114 Megahertz of spectrum, far less than its competition. While Dish could buy more licenses in future federal spectrum auctions, Cusick doesn’t believe the company has the money now. Finally, Cusick stated that he worries that Dish missed the boat on 5G, adding that other larger carriers that have already rolled out the technology will accelerate those plans and erase any differentiation Dish would have had by coming to market sooner. λ

Mike Farrell is senior content producer, finance for Multichannel News/B+C, covering finance, operations and M&A at cable operators and networks across the industry. He joined Multichannel News in September 1998 and has written about major deals and top players in the business ever since. He also writes the On The Money blog, offering deeper dives into a wide variety of topics including, retransmission consent, regional sports networks,and streaming video. In 2015 he won the Jesse H. Neal Award for Best Profile, an in-depth look at the Syfy Network’s Sharknado franchise and its impact on the industry.