Cable Knocks on Wireless Giants’ Door

CBRS spectrum could help make mobile service cheaper; 5G could vault ops into contention

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Cable operators may not be an imminent threat to the Big Three wireless carriers, Verizon, AT&T and T-Mobile. After four years of tapping on the front door, though, they may be closer than ever to knocking it down, with help from Citizens Band Radio Service (CBRS) and 5G mobile spectrum.

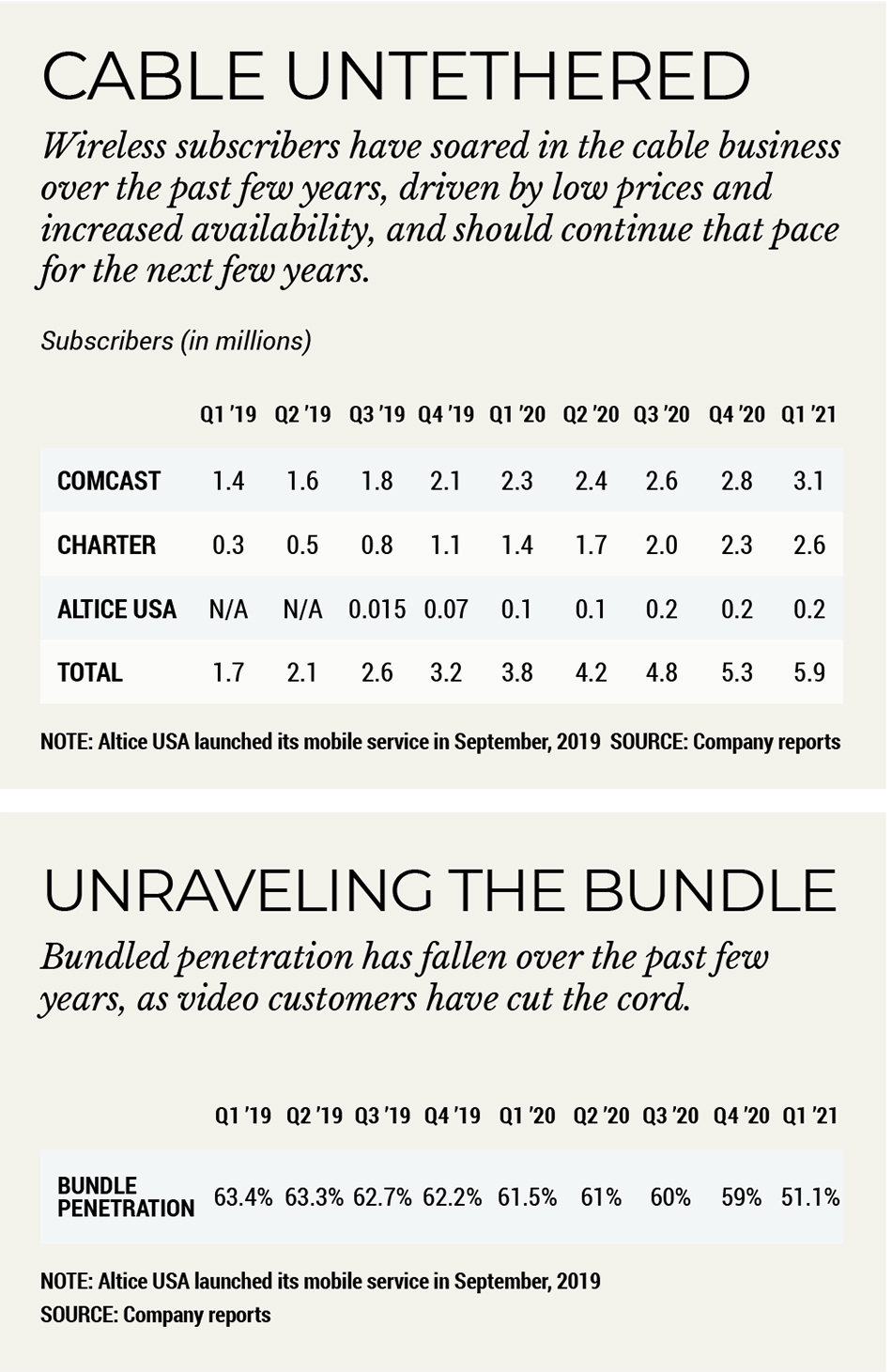

Since Comcast launched its Xfinity Mobile service in 2017, via a mobile virtual network operator (MVNO) agreement with Verizon Communications, cable wireless amassed nearly 6 million subscribers, making it the industry’s fastest growth product in terms of percentages. Cable’s biggest wireless rise was in 2020, when top cable operators Comcast, Charter and Altice USA, fueled in part by pandemic-

driven increases in broadband, grew their wireless customers at a 68% clip. That momentum continued into Q1 2021, with those three operators growing their total wireless lines to 5.9 million, a 9% increase.

Comcast broke records in the wireless business in Q1, adding 278,000 lines — its most ever in a quarter — while the Xfinity Mobile unit reached cash flow breakeven (it didn’t lose money) for the first time since its launch. Wireless revenue rose nearly 50% in the quarter to $513 million, further solidifying the company’s wireless commitment.

The news was just as good for Charter, which added 300,000 wireless customers in Q1. Altice USA added about 5,000 wireless customers in Q1.

Comcast still leads the pack with 3.1 million mobile subscribers, followed by Charter — which also has a MVNO agreement with Verizon — with 2.6 million and Altice USA with 174,000. Altice USA was the last to launch a mobile service (Altice Mobile) through an MVNO pact with T-Mobile, in September 2019.

Those cable companies are still a long way from being an immediate threat to wireless’ Big Three: AT&T leads with 164 million postpaid wireless customers, followed by Verizon with 117 million and T-Mobile, which completed its $26 billion purchase of Sprint in 2019, has 67 million. But as pricing continues to be one of the biggest deciding factors in selecting a mobile service, and many cable wireless customers are also hardwire broadband subscribers, the gap is poised to close rapidly. Add in the potential of 5G mobile service — which depends greatly on fiber interconnections between towers, a cable strong suit — and the notion that cable wireless could become a major player isn’t that much of a stretch.

Skeptics need look no further than the dominant position cable has carved out in broadband service. In the beginning, telcos ruled the day with copper wire digital subscriber line service, offering 1.5 Mbps speeds that in the 1990s were a major upgrade from dial-up. But as cable continued to deploy fiber deep into its network, and speed requirements vaulted into the hundreds of megabits per second, cable broadband quickly overtook its DSL competition. Today, cable accounts for about 70% of the U.S. broadband market, a number expected to grow as operators push fiber out to the edges of their footprints.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Broadband Sets Precedent

Cable operators have been edging out their footprints at an accelerated pace over the past few years. In 2020, Comcast added about 1 million homes passed to its footprint, with Charter adding about 1.1 million homes. Even at 30% penetration rates, that could translate into about 300,000 more broadband customers. And increasingly, cable operators seem anxious to add wireless to that bundle, which could drive those numbers as well.

As many as 90% of cable wireless customers are also cable broadband customers, said Evercore ISI media analyst Vijay Jayant. Extending that broadband reach can only help the cause for wireless.

In its Q4 conference call with analysts, Comcast chief financial officer Mike Cavanagh said mobile is a “strategic priority” for the company and has been “fully integrated” into the core business. Xfinity Mobile added 774,000 wireless customers in 2020, slightly behind the 816,000 added in 2019, all during a period where most of its retail stores were closed because of the pandemic. Those outlets were fully open this year and as a result expected to have a positive impact on sales.

Did they ever. Xfinity Mobile reported its best quarterly subscriber additions yet in Q1: 278,000 versus 216,000 adds in Q1 2020.

Many analysts are beginning to see wireless as a replacement for video in the overall cable bundle. As video subscribers continue to cut the cord for streaming services but keep their cable broadband connection, adding wireless service could keep the price of broadband more manageable. According to Bernstein, penetration for the video/broadband double-play has fallen from about 63% in 2018 to 51% in 2020.

On its Q1 earnings conference call April 28, Comcast Cable president and CEO Dave Watson said that bundling broadband and wireless is something the company has done in the past and will continue to do.

“We think it’s good for broadband, it’s helping broadband, we’ve seen the results in terms of churn, and it’s just a growth engine for us, period,” Watson said of the wireless product. “We’re focusing on every sales channel. We’re going to be consistent with our approach. You’ll probably see a bit more packaging with broadband and mobile, but that’s not really different than anything that we’ve been doing.”

Lose Some, Win More

In a research note, Bernstein media analyst Peter Supino called the practice of shedding low-margin video service for higher-margin broadband the industry’s “losing to win” strategy.

“The downside is the potential loss of ‘stickiness’ as a result of moving to a single offering,” he wrote. “Mobile is the potential cure.”

Supino added in other client notes that wireless is “far stickier” than video because the decision to switch internet/video providers is about a single item. It’s much harder to try to persuade every household member to change cellphone providers at the same time.

Wells Fargo Securities media analyst Steven Cahall estimated Comcast would add about 225,000 wireless customers in Q1 and 935,000 for the full year. That compares to his estimates of an increase of about 400,000 broadband subscribers in Q1 and 1.3 million for the full year.

Earlier this year, Comcast revised its Verizon MVNO agreement. It said in April it would drastically reduce pricing for its Xfinity Mobile service, offering four lines with unlimited data for $120 per month. That price lines up with T-Mobile’s flagship Magenta service ($140 per month with Netflix and taxes included) and severely undercuts comparable offerings from Verizon and AT&T that are priced above $160 per month. Charter, which has an identical MVNO arrangement with Verizon, is expected to follow suit.

While the price reductions are likely to attract some additional customer interest, Bernstein’s Supino wrote, they don’t include phone discounts so they’re unlikely to have a huge impact on subscribers. But once Comcast achieves scale in phone equipment — which Supino predicted will occur in 2023 — and achieves even greater economies by shifting the bulk of traffic onto its CBRS spectrum, all bets are off.

“We expect Comcast (and Charter) to continue to reinvest wireless economies of scale in subscribers in order to drive total cable customer lifetime value,” Supino wrote. “By 2023, when we forecast that Comcast and Charter will have deployed enough phones and small cells to make use of their recently acquired CBRS spectrum, we expect operating cost savings to fund more competitive phone promotions. ”

Betting on CBRS

The cable companies have invested heavily in CBRS spectrum: Charter spent about $465 million for 210 CBRS priority access licenses in the recent federal auction, while Comcast spent about $459 million for 830 licenses, Supino said.

“CBRS spectrum and low-cost, strand-mounted small cells allow cable operators to build out their own facilities in dense areas,” Moffett wrote. “As much as 70% of all wireless traffic is handled by just 10% of cell sites. Cable will attempt to build out these dense areas (high ROI) with CBRS, leaving the less dense areas to the Verizon MVNO agreement, effectively arbitraging the wireless industry.

“Everything hinges on how much traffic can be offloaded onto CBRS,” Moffett said.

During the Q1 conference call, Comcast chairman and CEO Brian Roberts acknowledged the spectrum will be used to offload some traffic from the MVNO, adding that the ability to do so requires a strong wireless partner.

“Yes, we bought some spectrum and we’ll be doing some trials to see how we can offload, and that really will prove to be a cost savings if we get it right in dense areas,” Roberts said on the call. “That whole relationship requires a healthy partnership with a wireless [mobile network operator]. And in the case of Verizon, we were really pleased with the partnership.”

For 5G, Moffett wrote as networks get more dense, key to their success will be the fiber connections between towers, which are spaced much closer together in 5G architectures.

“As wireless networks densify, underlying wires will become the single most important part of the cost structure,” Moffett added. “As wires begin to dominate the cost structure, he who has the densest wired network will win. Cable has the densest network. Therefore, cable infrastructure will ultimately win in wireless. Just as it has already won in broadband.”

Mike Farrell is senior content producer, finance for Multichannel News/B+C, covering finance, operations and M&A at cable operators and networks across the industry. He joined Multichannel News in September 1998 and has written about major deals and top players in the business ever since. He also writes the On The Money blog, offering deeper dives into a wide variety of topics including, retransmission consent, regional sports networks,and streaming video. In 2015 he won the Jesse H. Neal Award for Best Profile, an in-depth look at the Syfy Network’s Sharknado franchise and its impact on the industry.