5G Mobile: Everything You Need to Know About the New Wireless Network Standard as Apple Readies the First Enabled iPhones

With 5G devices now entering the market in abundance, we’ll finally be able to measure the hype for ourselves

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

In coming months, you’ll be hearing a chorus of boosters singing the praises of 5G mobile technology at an increasingly insistent and noisy level, as they bet many tens of billions of dollars and perhaps the nation’s industrial future. The new ultra-high-speed, high-capacity connections in 5G promise to transform everything from healthcare to TV production and distribution to farming, they say.

“5G offers tremendous possibilities for consumers across the country, but it’s also an issue of national competitiveness,” said FCC Chairman Ajit Pai in a recent Fox Business interview. “5G is going to transform entire industries. We want to make sure America leads in that transformation.”

We’ll have a better chance to evaluate what 5G means in a few months, when Apple is expected to launch its first 5G-enabled iPhones. Apple is likely to announce details of those new models at its World Wide Developers Conference, June 22-26.

Also read: 5G Is Here — And for Real This Time

Actual arrival of the 5G iPhones, probably somewhat delayed by COVID-19 impacts and economic uncertainties, is now more likely to come sometime between October and December, according to close observers of Cupertino smoke signals.

Whenever those 5G models arrive (5G-enabled Android phones from several companies have been available since last year), the carriers will have spent many months and billions of dollars to optimize their networks for an expected influx of new customers. Given that, expect heavy promotion of 5G’s potential as the carrier contenders try to surf Apple’s monstrous marketing wake.

Eighteen Times Faster Than 4G?

So what exactly will they be promoting? Most simply, 5G is the next generation, the fifth, in mobile phone technologies. Depending on a particular carrier and where you’re accessing it, 5G offers dramatically higher speeds, extremely low latency, and/or wide coverage for more sparsely populated areas.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

Just don’t confuse it with the 5-gigahertz band of on your home WiFi network. That’s a different beast, the 5G shorthand appended to your network’s name to connote which frequency, or slice of spectrum, is connecting the internet signal on the router in the corner the computer on your kitchen table.

To further clarify 5G’s technical complexities, we can actually use of that same WiFi router as illustration. Routers these days use a 2.4-gigahertz frequency band and one or two 5-gigahertz frequency bands as options to transmit the same WiFi channel. One frequency (5-Ghz) is faster, while the other is better at penetrating walls and carrying more data.

In much the same way, 5G mobile uses multiple swathes of spectrum, generally designated as high-, mid- and low-band. Which bands a given carrier’s network uses will vary from city to city, and urban to rural settings.

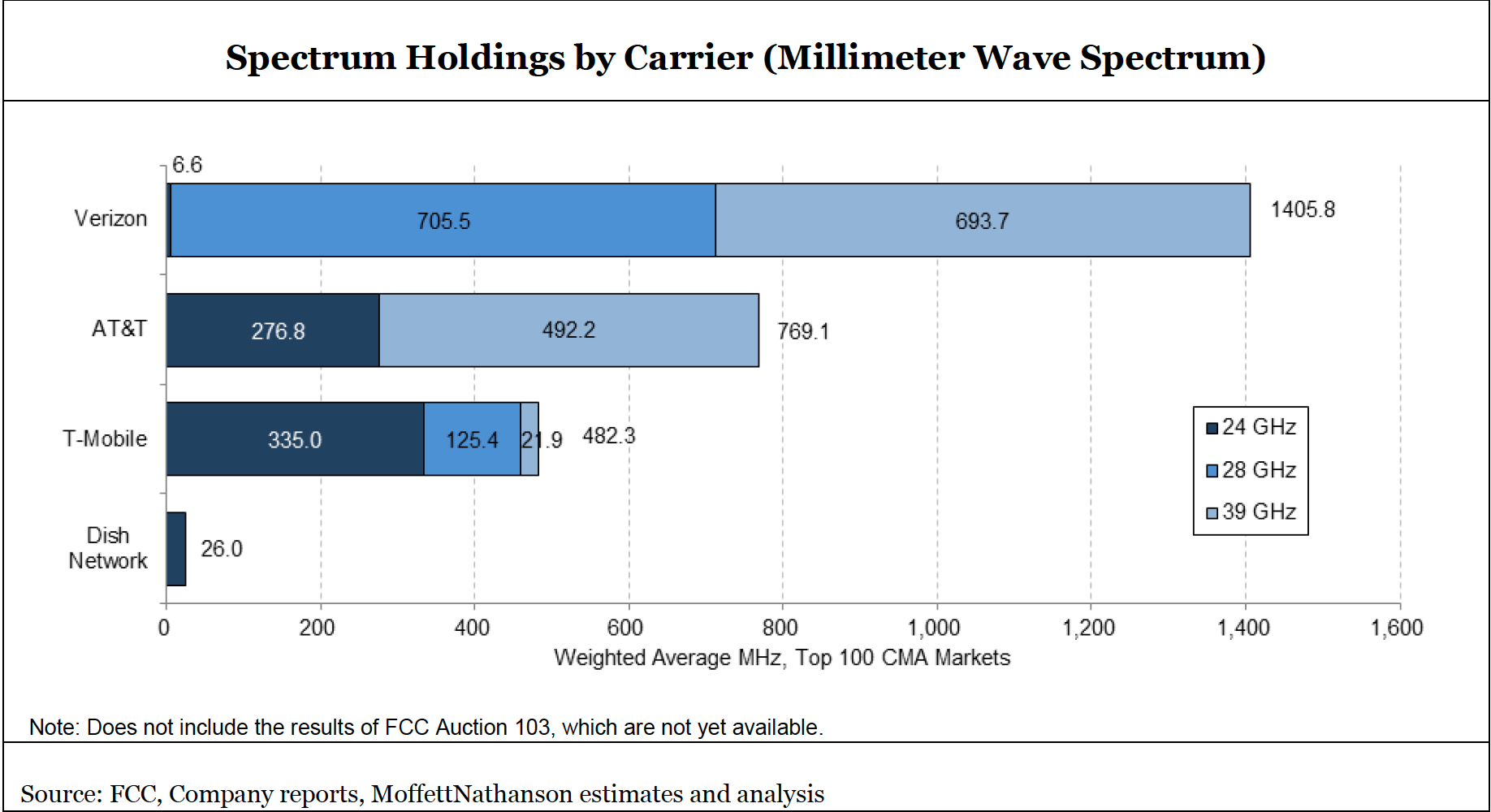

The fastest band is so-called millimeter-wave, great for densely populated urban areas but requiring an equally dense array of refrigerator-sized cell transmitters because its signal doesn’t go very far, and often is stymied by walls and solid objects. Low-band, as with the 2.4Ghz WiFi signal, does a better job reaching much further, and through more obstacles. Mid-band strikes a balance, and is useful for more suburban settings.

The speed and capacity you might access on a 5G network, especially here in the early days, can vary widely. All the big carriers and their would-be challengers have been spending vast sums to install the neighborhood transmitters and other equipment in cities across the country.

Already, the fastest installed 5G networks are as much as 18 times faster than the 4G equivalents provided by the same carriers, according to recent studies.

Those multiples are only possible where users have access to the millimeter band services that Verizon is emphasizing. They can hit 2 gigabit-per-second speeds (compared to 4G speeds that typically max out around 14 to 18 Mbps) but have very short reach and don’t penetrate building walls and other obstacles very well.

And as 5G becomes more universally available, and networks more fully built out, it should be transformative.

For its part, Pai’s FCC has focused on three key initiatives under its so-called FAST plan: a) make more spectrum available; b) speed up approvals to build more transmitters and other local architecture; and c) make it easier to lay the back-end fiber-optic cables that will connect all that traffic to the internet.

The agency also set aside $9 billion to finance 5G build-outs in rural areas that “never would have a business case for laying wireless,” Pai said. Depending on the topography and other factors, 5G could bring broadband to long-neglected rural areas, not only improving consumer access there, but boosting the productivity of farms and ranches trying to manage their far-flung crops, crews and machinery.

Many other sectors are headed to a 5G-fueled reboot, too.

Pai points to telemedicine, vital amid the COVID-19 lockdown, but potentially transformative even in more normal times, with services like remote monitoring of diabetics’ blood-sugar levels, stroke-symptom tracking and long-distance robotic surgery.

5G will bring the speed, capacity and latency needed to build out important, but nascent sectors such as autonomous vehicles and the so-called Internet of Things, which promises fleets of net-connected smart devices in every home and workplace, communicating wirelessly with each other, with you, and with the rest of the internet.

Various corners of entertainment and media are ripe for 5G, too, beginning with mobile gaming and virtual and augmented reality. 5G will give mobile users access to richer, higher-resolution and more complicated experiences wherever they are.

It even has huge implications for more traditional entertainment.

For one thing, 5G promises to further upend already struggling traditional pay-TV, which pipes high-quality video into the home by way of co-axial cable attached to a headend or satellite dish. So-called fixed-wireless will bring 5G mobile to all the devices in a consumer household without WiFi’s bandwidth limits or cable TV’s wires and restrictions.

Satellite TV provider Dish Network is trying to avoid that disintermediation, remaking itself into a fourth wireless carrier. That process is very much still in transition, however. Two pending deals with T-Mobile remain unsettled, awaiting Department of Justice decisions. But expect, eventually, that Dish will acquire Boost Mobile for around $1.4 billion, launch an initially slow 5G network virtually on other companies’ backbone services, and then build out its own 5G network within three years.

Cable giants Comcast and Charter Communications are among those trying to create their own attractive alternative to 5G, bundling virtual mobile (MVNO) services on top of their pay-TV and broadband offerings, while enhancing their hardwired networks to become what they’re marketing as “10G,” as in twice as fast as 5G. Whether consumers will bite on the marketing speak will be another big question to resolve in coming months.

Also read: Cable Industry Set to Plug ’10G’ at CES

Broadcasters around the world also see 5G as a significant addition to their production toolkit, including replacing some satellite video transport, handling live or remote video production, and as cost-effective backup for contribution links, according to a new Nevlon survey of broadcasters in North America and three other continents.

Some 92% of the 225 broadcasters said they plan to adopt 5G within two years, a remarkable uptake plan that suggests its huge potential.

Most survey participants also said they believe their country’s 5G infrastructure will be able to handle the demands of video production. About two-thirds expect to use the technology for remote production.

“It’s positive that broadcasters are expecting to move forward at pace with 5G,” said Nevlon chief technologist Andy Rayner. ”However, there is still a lot of work to be done before it can be implemented into live environments, and given the current climate worldwide, testing and developments may have slowed down. Over the next year or so, it will be a case of broadcasters looking in earnest at the potential of 5G in the value chain and testing the technology’s capabilities within their organizations.”

As for the Big Three wireless carriers, 5G promises to shove them ever more centrally into everything we do.

They’re going about it with differing strategies, and all three have had other distractions and initiatives. But make no mistake, all are counting heavily on 5G as the foundation of their future.

AT&T

As for distractions, AT&T has had an expensive one: buying Time Warner Media for $85 billion in 2018, restructuring it into WarnerMedia, and then launching the priciest subscription streaming-video service yet, the confusingly named HBO Max.

But HBO Max arrived in May at a propitious time for the company. AT&T’s legacy pay TV systems—DirecTV and U-verse—have been hemorrhaging subscribers. And the IP-based platform intended to replace them, AT&T TV, has so far been coolly received.

AT&T still has some work to do on HBO Max, including cutting distribution deals with device platforms Roku and Amazon Fire TV, which together reach 80 million U.S. households, and launching a promised free, ad-supported tier.

But now it has an attractive chip to throw in when trying to sign up and keep 5G customers. As more consumers understand the advantages of 5G and the many offerings on HBO Max, that could pay off handsomely.

In late June, AT&T announced the addition of 28 5G city deployments, including Dallas, Miami and Salt Lake City, bringing its total U.S. deployment to 355 cities.

The Anti-AT&T

Verizon’s approach, by contrast, is the anti-AT&T, choosing to focus almost exclusively on building out the fastest network available right now.

Verizon shifted focus in 2019, when it named former Nokia chief executive Hans Vestberg as its CEO. He has de-emphasized previous CEO Lowell McAdam’s numerous content initiatives and acquisitions (Yahoo, AOL, Tumblr, Go90/Vessel, Huffington Post) in favor of more network buildouts.

Verizon, which for years marketed its 4G network’s strong reputation, may be positioned to do the same thing here in 5G’s early days. It will leverage two Qualcomm technologies that optimize networks—Carrier Aggregation and Digital Spectrum Spreading (DSS)—to grab the speed lead just as the iPhone 5G arrives.

A report in late May from mobile analytics company OpenSignal looked at 5G networks from 10 companies in four countries, and tabbed Verizon as the fastest, by a lot. A company spokesman said “speed and performance…become even more important as many consumer and industries will have to rethink how they operate post-COVID.”

The company already has 5G networks in 35 U.S. cities as of late May, Vestberg told CNBC’s Jim Cramer, and it accelerated capital spending when the pandemic sent telecom demand skyrocketing.

“We’re building 5G right,” Vestberg said. “We want to have a superior experience on 5G, and it’s not only the consumer who gets this experience. Industry and government are going to have to have it to transform their businesses. It’s 10, 15, 20 times faster than we have on 4G.”

In the middle of the lockdown, Verizon also snapped up video-conferencing company Blue Jeans for $500 million. The acquisition dovetailed nicely into its broader 5G strategy around services such as telemedicine and online learning, which could be huge opportunities, even if COVID-19 concerns ease.

“You’re going to see improvements over time, then dramatic improvements,” Vestberg said. “We are accelerating our investment levels right now because it’s even more important to have these connections now.”

Layer Cake

T-Mobile grabbed industry bragging rights earlier this month when a deal with an Alaskan provider allowed it to say it was the first U.S. carrier to have 5G networks in all 50 states.

More broadly, T-Mobile is taking what it’s calling a “layer cake” approach that matches its basket of owned or controlled spectrum with the needs of different regions.

Deutsche Telekom’s U.S. subsidiary has been ramping up its 5G capabilities amid its own remarkable corporate makeover.

Also read: Bigger ‘Uncarrier’ Looks to Become a Force in Streaming

Earlier this year, T-Mobile finally completed most of its long-sought Sprint merger to become the second-largest carrier. That brought it a trove of high-band 5G spectrum but also a lot of work to integrate it into its own systems. It’s also still in mid-deal with Dish, which when consummated will give it access to the latter’s portfolio of 600-Mhz bandwidth, while unloading pre-paid provider Boost Mobile. T-Mobile also just signed a spectrum lease with Columbia Capital for another swathe of 600-Mhz spectrum.

Walter Piecyk, an analyst for LightShed Partners, calls the lower-frequency bandwidth a “bridge” to T-Mobile’s even faster 5G future, allowing it to moderately speed up its network now while it cleans up that Sprint 2.5-Ghz high-band.

“It will take a few years to clean up and deploy the more dramatic 5G capabilities that 2.5 GHz spectrum enables,” Pieczyk wrote. By then, T-Mobile could be the speed leader among the big carriers.

In the meantime, T-Mobile and its competitors are doing what they can to roll out fast, widely available 5G networks now, before the iPhone 5G arrives.

David Bloom of Words & Deeds Media is a Santa Monica, Calif.-based writer, podcaster, and consultant focused on the transformative collision of technology, media and entertainment. Bloom is a senior contributor to numerous publications, and producer/host of the Bloom in Tech podcast. He has taught digital media at USC School of Cinematic Arts, and guest lectures regularly at numerous other universities. Bloom formerly worked for Variety, Deadline, Red Herring, and the Los Angeles Daily News, among other publications; was VP of corporate communications at MGM; and was associate dean and chief communications officer at the USC Marshall School of Business. Bloom graduated with honors from the University of Missouri School of Journalism.