Wurl Pivots Into ‘Pay-as-You-Go’ Streaming

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Why This Matters: Wurl is providing content companies with a technical assist as they get into the streaming business.

With Sinclair Broadcast Group launching the latest over-the-top platform, the content companies backing its STIRR ad-supported programming bundle don’t want to have to reinvent the wheel in developing all of the complicated streaming tech needed to run channels on the service.

Enter Palo Alto, Calif.-based Wurl, a one-stop shop for content brands like FailArmy and Stadium. For these channels, STIRR is one distribution hub within a broader OTT universe that also includes Samsung TV Plus, Roku, Xumo and Twitch, just a to name a few.

“Each of these platforms have very complicated specs and requirements for on-boarding and advertising,” Wurl CEO Sean Doherty told B&C at CES earlier this month. “There are lots of things you have to do exactly right, and no two companies have exactly the same specs.

“You use us to host your programming,” he added. “Then you arrange distribution deals with these video services, and we make the connections that deliver the streaming 24/7 and forever. It’s a one to many solution, If you’re ABC News, for example, you don’t want to deal with four different [technology shops] and have to manage linear programming and VOD separately for four different services.”

Handling everything from scheduling to markers to ad integration, Doherty’s startup has adopted a kind of pay-as-you go model. Content creators pay the tech company around 2 or 3 cents per each hour a consumer spends streaming video.

For the first three years after Wurl pivoted into this model, business was slow, Doherty said. But starting in September, right around the time Wurl launched its latest service offering, the server-side ad insertion tool AdSpring — which it officially announced last week — business began to take off.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

With a growing stable of content clients including Fox, NBC, MGM, Sony, ABC News and Crunchyroll using Wurl’s engineering assets to distribute to an ever-expanding group of platforms that also includes Pluto TV, Sling TV, Sony PlayStation Vue and YouTube TV, Wurl’s business has hit a kind of critical mass.

Total monthly viewers are averaging around 3.5 million a month, with total hours of viewing coming in at around 10 million a day. Ad inventory is up around 70%.

“I used to say this company would never go public, because it’s a [business-to-business] company and not a consumer-facing brand,” Doherty said. “Markets tend to want something they can buy at the store. But at the pace we’re growing, I think it’s possible.”

Kicking Cable to the Curb

Doherty, a veteran technology executive who has spent two decades in Silicon Valley, playfully bristled when asked about his cable background. But from 1995-97, he served as president and chief operating officer of @Home Networks, a joint venture between Comcast, Cox Communications and TCI that was among the first to deliver high-speed data over the cable plant.

During that experience, Doherty said he “learned about how fearful at the time cable operators were about video delivery in the broadband plant.”

Jump to 2010, when Doherty joined Wurl, then a two-year-old startup — the cable industry’s attitude toward IP video had evolved from fearful to merely indifferent.

“What we were trying to do at the time was bring internet video to cable, working with Comcast and Arris and WOW and TiVo and all these set-top makers to import video from the unmanaged internet onto cable boxes,” he explained.

Developing an audience of only around 2 million subscribers and finding little traction, Doherty convinced Wurl’s cable partners to let the company deliver its content brands, which included internet companies such as IGN and Awesomeness TV, in the form of linear networks and onto the main program guide.

Viewership spiked, but cable companies still were doing little to support what they perceived as fringe internet content brands.

“So we had to create all this stuff to linearize the programming,” Doherty said. “That included the scheduling, the markers, the ad insertion — all of that stuff. It worked technically, but it still didn’t work commercially on cable because the operators still weren’t embracing it. And we knew it would take forever to get them to embrace it.”

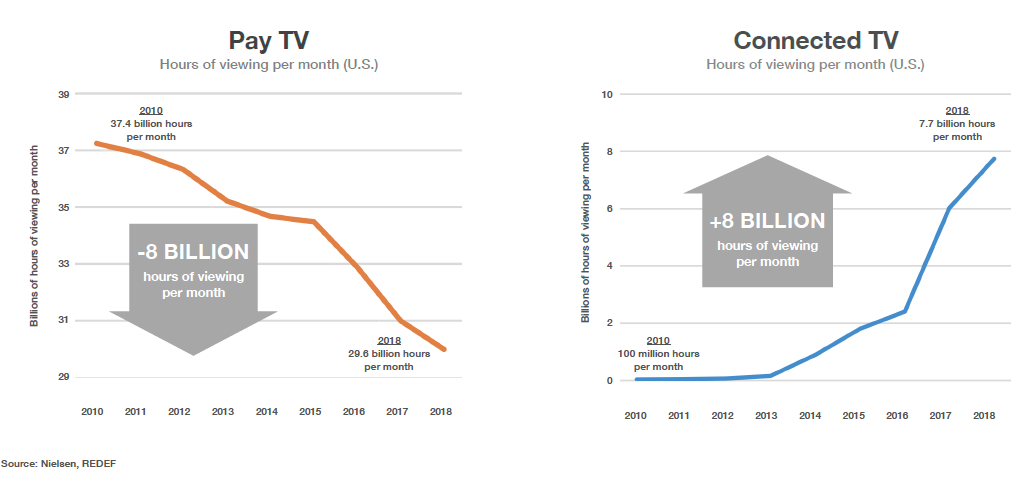

Well, not forever. Comcast, for example, has natively integrated internet platforms ranging from Netflix to YouTube to Cheddar on its X1 platform, and other cable operators are beginning to perform similar integrations. But by not waiting around, and pivoting to exclusively focus on a technical role as a liaison between content makers and OTT platforms, Wurl turned the corner at the right time, scaling its business to match rapid OTT consumer adoption.

Business these days, Doherty explained, is largely driven on the platform side by services such as STIRR, which refers its content partners over to Wurl for engineering fulfillment.

“We don’t do any outbound marketing,” Doherty said. “We just kind of wait for the phone to ring.”

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!