What Will ViacomCBS Look Like on TV and Online Video?

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

This week, Viacom and CBS officially announced their long-awaited merger deal -- actually a reunion, following their 2006 split -- creating ViacomCBS. To put the news in context, we examined viewership and advertising trends for CBS, plus Viacom’s biggest networks.

Social Video Giant

Using data from video measurement company Tubular Labs, we can see just how much of a behemoth the new ViacomCBS company will be on social video platforms. According to Tubular’s most recent (July 2019) cross-platform media property leaderboards, that combined company would be ranked third overall, only behind the Walt Disney Company and WarnerMedia. ViacomCBS owns 26 different creators with over 1 billion monthly cross-platform views, including Inside Edition, The Late Late Show with James Corden, GameSpot, The Late Show with Stephen Colbert and Nick Jr.

Among the most popular ViacomCBS videos of 2019 to-date, those have been published by a mix of creators from both parent companies. On Facebook, CBS News has eight different videos that have generated 25 million views or more, meanwhile 14 Viacom videos fit that bill from creators like Comedy Central, Fear Factor, MTV and Paramount Pictures.

Utilizing Tubular’s DealMaker data, CBS and Viacom properties have also published more than 1,500 sponsored videos on Facebook, YouTube and Instagram from Jan. 1 through Aug. 13. Those have accumulated over 190 million views in total, with CBS Sports, GameSpot and BET publishing the most sponsored video content.

Related: ViacomCBS: Look for Retrans, Affiliate Fees to Rise

Viewership Insights

The smarter way to stay on top of broadcasting and cable industry. Sign up below

With Inscape, the TV data company with glass-level insights from a panel of more than 11 million smart TVs, we looked at viewer trends from January through May across some of the major shows from CBS. Note: we did not include The Big Bang Theory in the viewership crossover analysis since that series won’t be returning this fall.

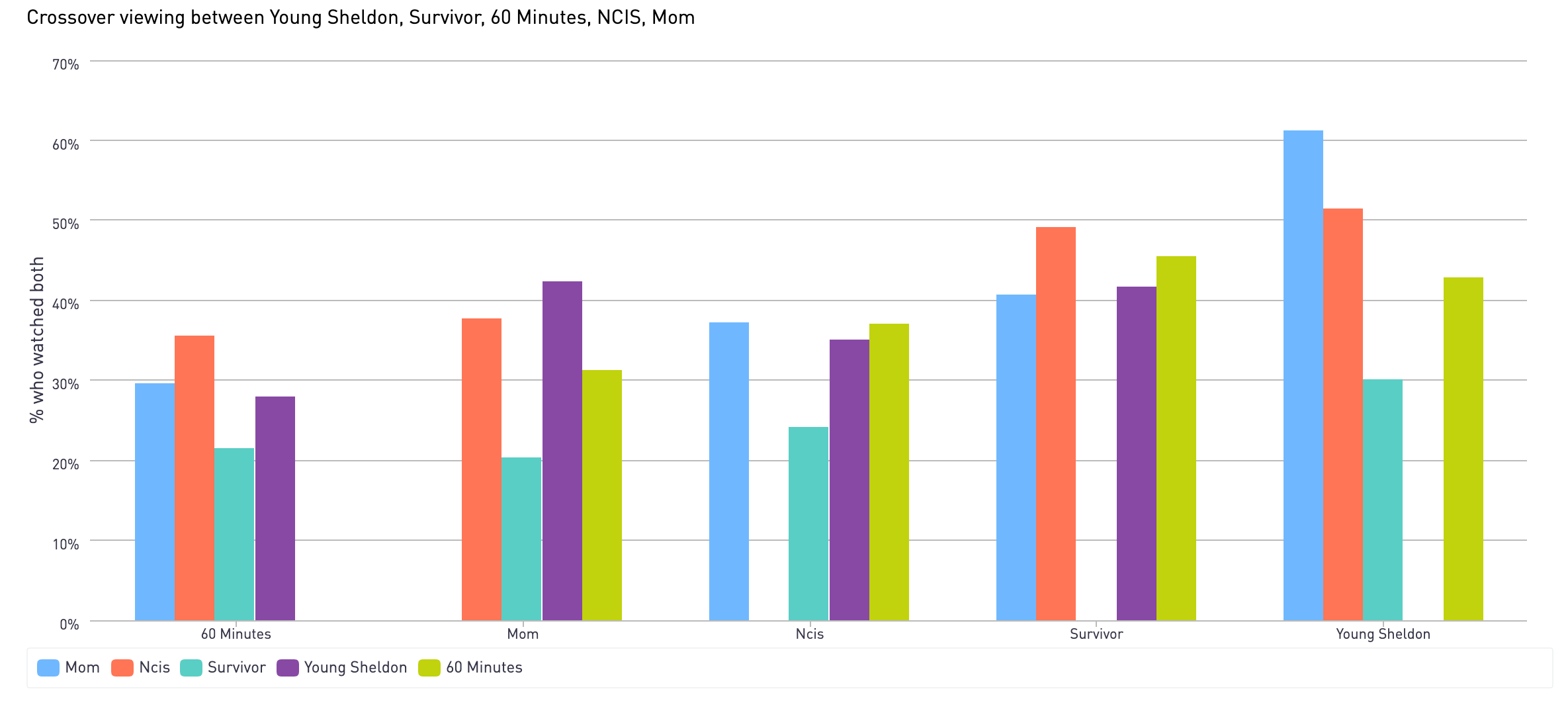

First, a look at the percent of crossover among five of its returning hit series: Young Sheldon, Survivor, 60 Minutes, NCIS and Mom. A note about methodology: You have to do more than just flip past a station with your remote to count as a “crossover viewer” in Inscape’s system. For the data below, the minimum viewing threshold is 10 minutes.

Some highlights:

- At the high end of crossover: 61% of Young Sheldon viewers tuned into Mom; 51% of them watched NCIS.

- At the low end: Survivor lagged in general, with only 20% of Mom viewers tuning into it and it only captured 22% of 60 Minutes watchers.

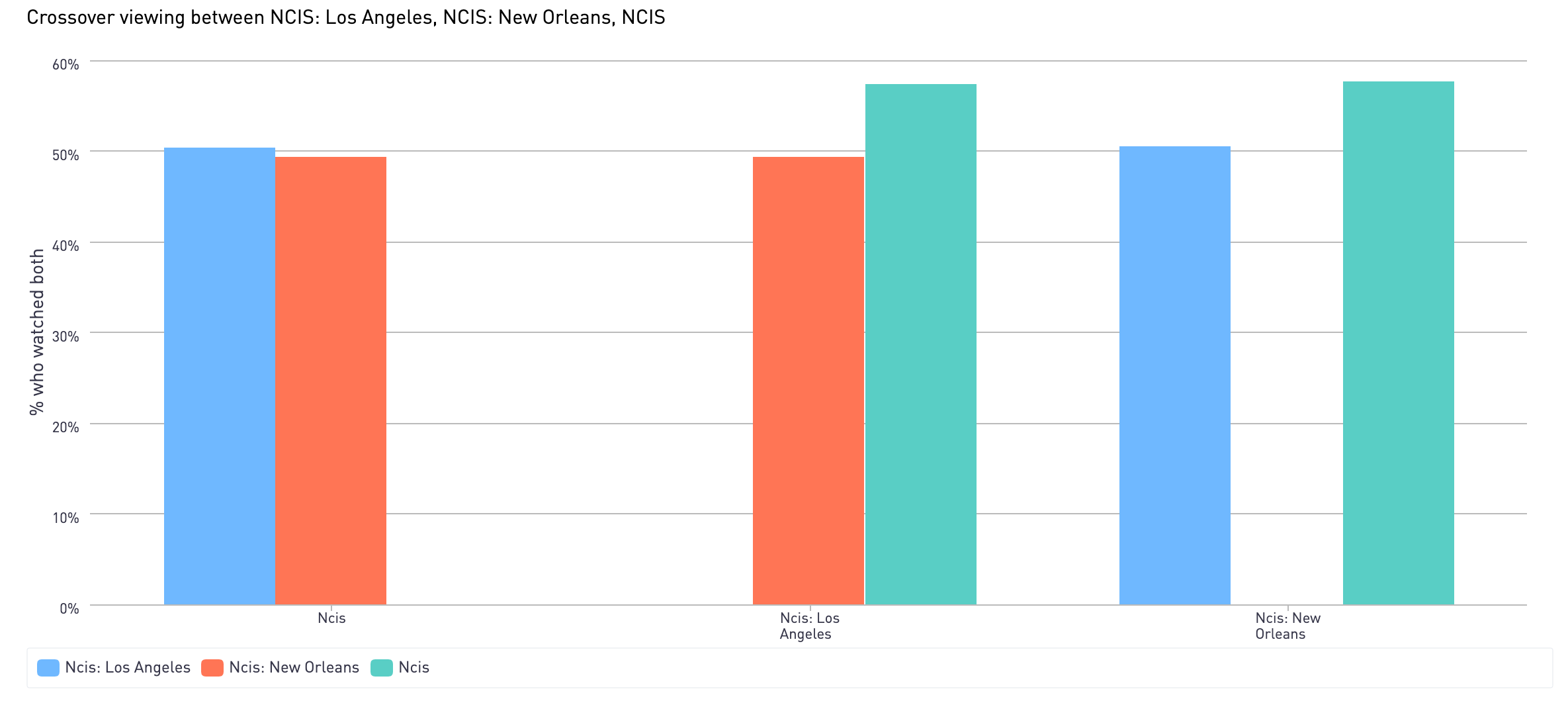

We also looked at the crossover among NCIS and its spinoffs NCIS: Los Angeles and NCIS: New Orleans:

The original NCIS had the highest crossover rates, with 58% of New Orleans fans watching and 57% of Los Angeles fans tuning in. Of NCIS viewers, half also watched Los Angeles and 49% tuned into New Orleans.

Bird’s-Eye View Advertising Stats

CBS

According to iSpot.tv, the always-on TV ad measurement and attribution company, brands spent an estimated $3.55 billion on CBS from Jan. 1 through May 31. Those ads generated a whopping 168.2 billion TV ad impressions, with 11.1 billion occurring during Super Bowl LIII. The top-spending brands on CBS included GEICO, Progressive, AT&T Wireless, Verizon and Bud Light, and the most-seen (non-network promo) spot was GMC’s “Anthem” featuring music by Steam (463.9 million impressions).

iSpot also has attention analytics that measure the propensity for viewers to interrupt ad play during a commercial, called the iSpot Attention Index. Three of the brands with high impressions and a positive Attention Index on CBS:

- GEICO - 1.7 billion impressions, 108 Attention Index (its ads had 8% fewer interruptions than the average)

- AT&T Wireless - 1.5 billion impressions, 117 Attention Index (17% fewer interruptions)

- State Farm - 1.2 billion impressions, 112 Attention Index (12% fewer interruptions)

Viacom

We also looked at the top-spending brands and shows for four of Viacom’s biggest TV networks: Comedy Central, MTV, Nick and BET. It’s worth mentioning that two of CBS’s biggest advertisers (GEICO and AT&T Wireless) also spent big on Viacom networks this spring.

MTV had the biggest spend of the four (an estimated $508 million) and almost 36 billion TV ad impressions. Top spending brands included AT&T Wireless, Gatorade and Taco Bell. Shows with the highest spend included Ridiculousness, Catfish: The TV Show and Teen Mom 2.

Comedy Central was second in terms of spend, with an estimated $487.6 million, and ads on the network generated over 25.9 billion impressions. Top spenders included AT&T Wireless, Taco Bell and GEICO, and top shows by spend were South Park, The Office and Parks and Recreation.

Brands spent about $421.1 million on Nick this spring, racking up 39.1 billion TV ad impressions — the most impressions of the four networks examined here. Top spenders included Goldfish, LEGO and ABCmouse.com, and programming with the highest spend included SpongeBob SquarePants, The Loud House and PAW Patrol.

BET had an estimated spend of $194.7 million and ads on the network generated almost 22 billion impressions. Brands with the biggest outlay included Domino’s, Fresh Empire and GEICO; the top shows by spend were Martin, black-ish and Tyler Perry’s House of Payne.