The Monthly Price of a Full Collection of Premium U.S. SVOD Services Went Up $17 in Just One Year (Charts)

The unbundled premium prices of Netflix, Hulu, Disney Plus, Max, Apple TV Plus, Paramount Plus and Peacock will now set you back $105 a month

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Late last week, MoffettNathanson released a report that once again downgraded Roku to "sell" status, claiming the streaming company's recent climb to back over $100 a share was "too much" growth "too soon."

But that wasn't the news -- Roku seems perpetually doomed to ride its Wall Street roller coaster, with ever-bearish equity analysts convinced the company at any moment will run head first into an increasingly competitive OTT ad market and slowing uptake for SVOD services. (Note: MoffettNathanson remains neutral on Netflix, at a price target of $390 a share, despite the fact that its platform engagement has fallen around 20% year-over-year, based on Next TV number crunching of Netflix data.)

Also read: My dabble into cord-cutting: Made a lot of complicated decisions, saved 8 cents

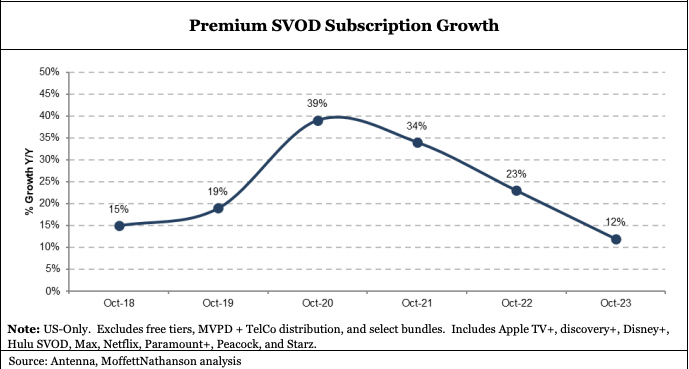

Analyst Michael Nathanson's evidence for the latter assertion about slowing SVOD customer growth was what interested us. Subscriber expansion for premium SVOD services in the U.S. has slowed to its lowest level since 2018, before the beginning of the "streaming wars."

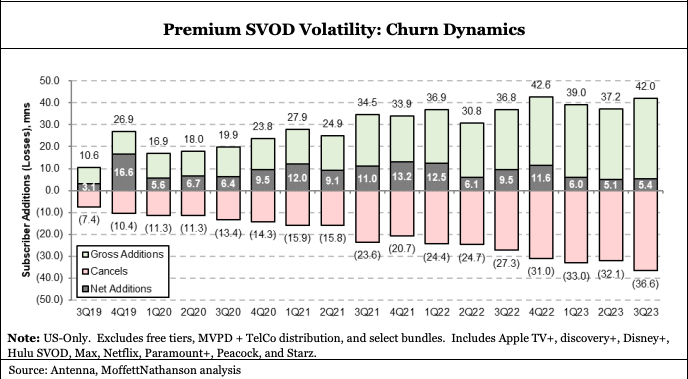

And churn has increased dramatically over the past five years, as well.

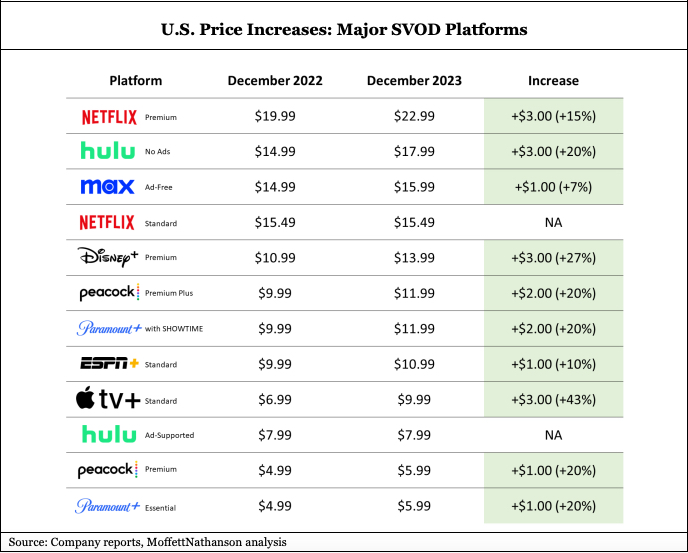

Meanwhile, an examination of just how much premium subscription video-on-demand pricing has increased recently adds context to the aforementioned dynamics.

Consider that a collection of Netflix Premium, Apple TV Plus, ad-free Max, Peacock and Paramount Plus, and the unbundled ad-free Disney Plus and Hulu, will now set a consumer back nearly $105 a month.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

That's $17 a month more than it was just a year ago, and nearly double the nearly $55 all these services were collectively priced at during the height of the streaming wars in 2020-21.

Keep in mind that a lot of folks canceled pay TV and loaded up on cheap SVOD services because their monthly cable bill had exceeded $100 a month.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!