Deep Diving Into Netflix’s Big, Non-Contextualized Data Dump — a Huge Flex or Giant Head Fake?

When Ted Sarandos dumped 6 months of audience data for 18,000 shows in our lap, he was trying to tell us something. This week's 'Next Text' wants to know what that is exactly

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Next TV had originally intended to run here our "Ten Diverse Impact Makers Under 10 to Watch" issue, showcasing the youthful hitmakers, dealmakers and earth movers, of all colors, orientations and pronouns — but very, very young — shaping Hollywood into a little ball they could put in a paper cup and crush with their little bare hands. Ad sales were brisk for this little “iconography” package, and we had plenty of high chairs and booster seats lined up at a Beverly Hills luxury hotel at which we were going to stage our associated black-tie event early next year. But our legal department stopped us at the last minute. Seemed wise to let them. Lawyers, right? So we're once again filling this space with yet another one of those long-winded “Next Text” columns, featuring an industry discussion by Next TV writers Daniel Frankel and David Bloom. The way it goes …

DANIEL FRANKEL: Happy pre-holiday Friday, David. Don’t know if you have any travel plans coming up. I’m planning a Netflix-and-chill moment at the ol’ crib this weekend — Sony’s Gran Turismo just dropped, and there's a new holiday-themed Murderville Mystery with Will Arnett and Jason Bateman. I question every streaming subscription I’m paying for these days. But especially with acquisitions returning to Netflix in numbers, that’s one bill I remain just fine with paying. It’s the best business in entertainment right now … for audiences and shareholders alike. But I did get a dose of consternation this week from all the media punditry, like Kubrick’s 2001 apes, standing around Netflix’s big H1 2023 data dump, splitting the lentil in a million different ways. There were some interesting takes, don't get me wrong. But nobody came up with fundamental answers in terms of what it all means and why Netflix just gave it to us.

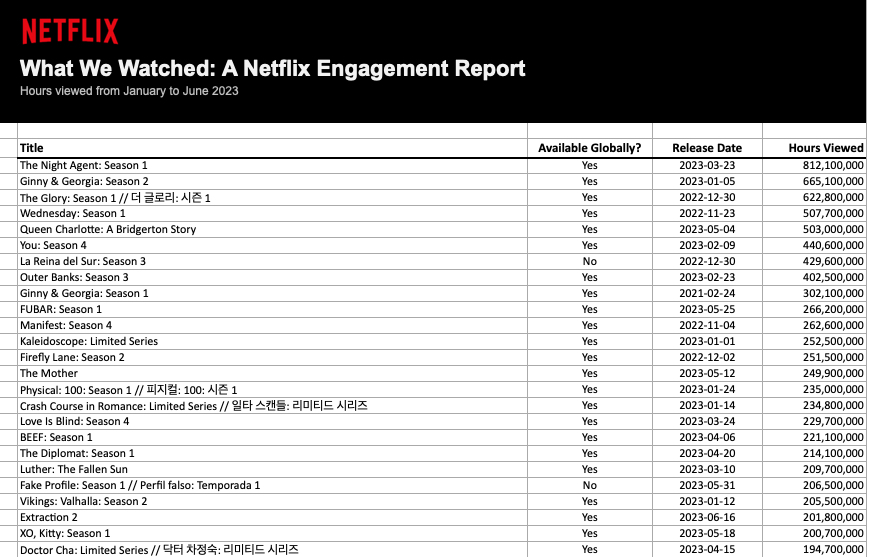

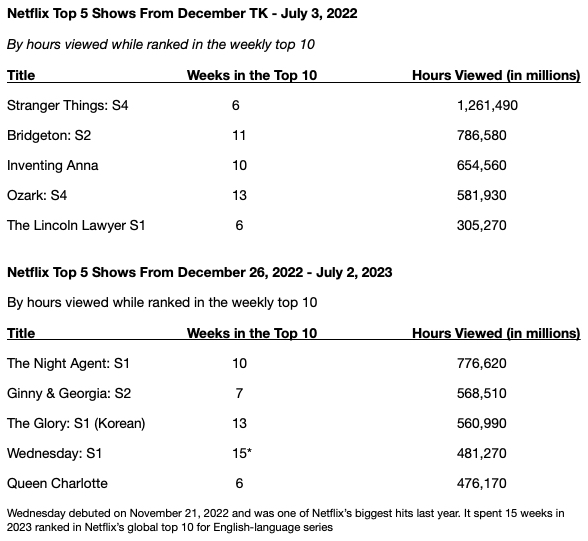

As you probably recall because I remind you of it every two days, Next TV did a deep dive back in June, with what credible TMT analysts agreed was a solid methodology, comparing Netflix’s viewership hours for its top shows in the first half of 2023 vs. the comparable time period in 2022. We determined, based on Netflix's own published data, that viewership was off around 4% at the time. But as we reported on Netflix’s own top 10 rankers every week, the audience discrepancy seemed to grow worse and worse, with popular returning shows regularly underperforming vs. earlier seasons. And that big 2023 H1 dump just sits there, lacking context or comparative benchmarks. Why didn’t they also release a spreadsheet covering the first half of 2022? What are we supposed to do with it? So today, based on Netflix’s weekly top 10 data sampling, I compared Netflix’s top 5 shows from the first six months of this year to the first half of last year and found a 20% YoY deficit.

And these “top 10” windows seem to account for most of Netflix’s overall viewing. Consider this: Netflix says in its big dump that its top show from the first half of this year, Shawn Ryan spy thriller series The Night Agent, which premiered March 23, collected 812,100 million total viewing hours through June. By our calculations, it collected 96% of that viewership in the 10 weeks during which it was ranked and its audience was publicly viewable in Netflix’s weekly top 10 lists. So by comparing five top 10 shows in 2023 to a the same list from the same time period last year, we’re providing a solid comparative analysis of Netflix's total audience picture. My point?

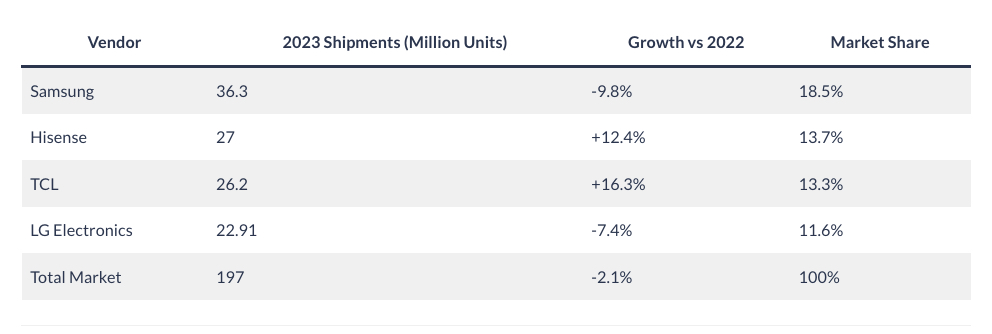

Ours is the only comparative, contextual analysis I’ve seen on these Netflix numbers. Sure, the data dump makes Ted Sarandos and team seem “transparent” amid growing concern that they are not, accentuated by recent Hollywood union strife. But I think it also serves to distract from a narrative Netflix doesn’t want us to delve too much into — that after several years of heavy streaming consumption fueled by the pandemic, the comparables across the video business, not just for Netflix, are pretty terrible. You can see it in things like smart TV shipments, which are down to their lowest ebb in a decade. They were down another 2.1% in 2023, as this chart shows.

None of this means that consumers are over Netflix, or streaming in general, but acknowledging dramatically lower year-over-year platform engagement might get investors wondering about things like the effect of all that Tiktok watching on the younger edge of the audience. My thinking, which can admittedly warrant a tinfoil ball cap at certain moments, has Netflix being a bit knowing and cagey on all of this. For instance, in June, before the first half ended, Netflix fundamentally changed its top 10, ranking shows on number of views vs. hours viewed. It said it was doing this based on outside input, but it had the effect of making it harder for outsiders like us to conduct the kind of comparative analysis we were trying to do at the time. In any event, as they navel-gaze at the monolith none of the TMT punditry has followed us so far into this abyss. And our own readership response to all this coverage has been crickets. Curious to hear what you think.

DAVID BLOOM: I’m tempted to respond to your … ample “question” with a monosyllabic “looks good” and leave it at that, but such restraint would be wildly out of character. More usefully, this week I moderated three panels of streaming video executives and analysts, all organized by industry trade group OTT.X. (The video from last week’s events isn't up yet, but here’s a panel I moderated back in October so you can get a feel.)

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

The NFLX data dump occasioned a lot of conversation on all three panels. A few relevant tidbits: This dump involves a LOT of data, so much so that some analysts (the very definition of “data geeks”) hadn’t yet waded through it. But they also noted it’s also kinda not very much, despite those 18,000 shows. Sarandos confirmed as much, saying the company won’t be revealing really useful granular details such as country-by-country viewership and demographics.

• Ad-supported streaming services therefore don’t expect the dump will become a scouting report on what to license when it cycles off Netflix. Smaller services must laser-focus on their specific niche audience, making even country data crucial in licensing decisions. Many shows here were available in 192 territories, so knowing where a show was popular really matters.

• That said, library owners licensing these shows to their next customer should be very happy: “Netflix audiences watched 153 million hours of New Amsterdam (season 1) in 2023. What’s it worth to you?” One analyst predicted studios will start pulling shows back and renegotiating prices now that they see what’s possible on Netflix.

• NFLX is indeed seeing a steady decline in dominance, but subscale SVOD competitors aren’t benefitting. Instead, viewers are heading pretty much everywhere, to free video providers such as Amazon’s Freevee (boosted by originals such as Jury Duty), phalanxes of FAST channels on the OEM-controlled platforms, Tubi/Pluto TV/Xumo/Roku Channel, TikTok, Twitch and, especially, the giant, stomping elephant in the room, YouTube. “Traditional Hollywood executives really don’t understand how YouTube has become the go-to place for watching television,” one analyst said. Audiences are watching traditional TV shows there too, though perhaps not legally.

• For all the many limits of the data dump, which competitor has released anything? Apple is perhaps worst, given that it barely acknowledges it has a streaming service. But no one else does much better. I saw the dump as an NFLX Flex — Let’s see what we can do with shows no one watched on our puny putative competitors! See what we can do with non-English-language shows! See what we can do with our eight-year-old originals! And why don’t you just make it easy on yourself and sell all your shows to us, like in the old days?

• Smart/connected TVs aren’t the only sector seeing sales declines. Most connected electronics segments are down, in part because people have bought so many already, especially this year. Now the economy’s tighter, they’ve already bought all the must-have devices, and it’s time to watch some shows. The average number of connected devices per household is up dramatically, from 11.4 in 2019 to 17 this year, according to Parks Associates. That’s up 50% in just four years. And try to buy a non-connected TV these days. You pretty much can’t. Internet connectivity is turning into a checklist item, like 4K resolution.

Keep that tin foil hat on. It sets off your data-crazed eyes very nicely.

FRANKEL: Looks good! ... Ah, who am I kidding, I can't resist, either. I guess what puzzles me is the indifference the market has to an obvious decline in Netflix viewing. Every week, they've shown us they're in a slump. From The Witcher to The Lincoln Lawyer to Sweet Magnolias, one returning Netflix show has premiered after another this year with viewership scores, reported by Netflix itself, that are markedly lower than the previous season. What is this telling us about Netflix's business? About streaming? Who knows? Everyone continues to navel-gaze at the Big, Non-Contextualized Netflix Flex.

BLOOM: One peek at Netflix’s fast-rising share prices quickly clarifies Wall Street’s view on Netflix versus all the media companies competing (badly) with Netflix, Alphabet, Amazon and Apple. On January 2, when the market opened for 2023, Netflix share prices closed at $315.55. This week, shares ended at $472.06, slightly below the year’s high. That works out to a thumping 49.6% rise in less than 12 months. Not bad for a “slump.” I think what the market is betting on is not market dominance by NFLX, but growing awareness that it’s positioned now as the ONLY service that matters on a global scale, while everyone else flounders along as either sub-scale and looking to merge/consolidate, or are such an insignificant part of their owner’s operations that they barely or never report their streaming service's progress. So, when Wall Street peers at Netflix versus just about everybody else, what do they say? Looks good!

FRANKEL: I’ll leave this dead horse alone … right after I say, if Roku reported a 20% YoY drop in engagement, it would fall back through the floor. Now to start in on this other dead horse: Warner Bros. Discovery announced last week that Max is now being sold in YouTube’s Primetime Channels disaggregation machine. No surprise there — Zaz has indicated he could care less who controls his company’s brands and user experiences, as long as the checks clear. But what I thought was interesting about that announcement was Warner using half the press release to tout HBO’s upcoming slate. Now I've seen other folks grouse about the low water level on HBO these days, but this flex had me kind of hopeful, starting with next month’s new installment of True Detective, along with Robert Downey Jr.'s The Sympathizer. I was hopeful about HBO’s return to some semblance of brand prestige ... until Larry David announced he's leaving. Really does seem like he’s taking the old HBO with him. You see anything in this upcoming slate that excites you?

BLOOM: If you’re an ice-blooded corporate operator wading out of $55 billion in debt toward a potentially vast new payday after next April 8, you shift quickly to a new distribution strategy for your prize possession. In this approach, more carriage is better as long as resulting deals drive more of that heaven-sent manna known as free cash flow. YouTube is just another (very big) aggregator giving WBD more reach and less churn while offloading some marketing and customer-service costs. The march toward arms-dealer status, selling content to the highest bidder, continues. Similarly, you can drive cash flow by cutting programming (except for the occasional anvil blow like Coyote vs. Acme), regardless of how badly it’s received by creative partners.

I predicted months ago that the many, many cuts Zaz and Weeds have inflicted on HBO (and Jason Kilar’s reorganizations before them) would inevitably starve a development pipeline responsible for HBO's remarkable track record and reputation of the past three decades. Who wants to do business with these guys, regardless of Casey Bloys’s charms? January’s delayed Emmy presentation may be a last hurrah for the ancien régime. Whatever HBO was, it’s difficult to see it remaining the same culture-shaping heavyweight in the future, or mean anything as a brand to the next generation of “TV” watchers, wherever they see video. But hey, look at the free cash flow!

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!