Testing Tech Waters and Hoping for a Big Catch

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

The International Consumer Electronics Show, the annual megaconfab in Las Vegas, unfolded Jan. 6-10 with the typical loud fanfare, but without definitively answering the ultimate question: What’s the Next Big Thing in the tech industry?

Even as new product launches proved more evolutionary than revolutionary, and some consumer tech giants such as Apple sat it out, the show lived up to its reputation as a must-attend event for those in the TV business. A sizable contingent of broadcasters, cable operators and programmers flocked to Vegas for a wide-ranging discussion of not only gadgets but also the larger trends in consumer habits and content delivery.

Many of these conversations have been under way for a while—the consumer fixation on all things mobile and the growth of Internet-connected devices that are transforming the TV viewing experience. But they continue to pick up speed.

The proliferation of Internet-connected TVs and devices, for example, “has changed the business dramatically” by opening up the market for new subscription video-ondemand services, Michael Lynton, chairman and CEO Sony Pictures Entertainment, said during CES. “All of a sudden you have five or six SVOD services and competitive bidding for TV series in a way that never existed before. It has changed the market and the economics of the business for the positive.”

If much of this was good news for the TV industry, the same can’t be said for the consumer electronics (CE) industry. The Consumer Electronics Association is predicting that CE spending in the North American market will see a slight 1% decline to about $254 billion in 2014 as the buying of mobile devices, which fueled record spending in recent years, begins to slow. Samsung, for example, has dazzled investors and kept rivals on their toes of late, becoming the world’s top smartphone maker. Yet its stock price has shed 20% since January 2013 as impatience grows and consumers remain willing to play the field.

“We are waiting for the next cycle of innovation to lift us again,” explained Steve Koenig, director of industry analysis for the CEA.

That cycle will come, and when it does, it may well be on the heels of these five key trends that the industry will need to watch in 2014 and beyond, along with a few enticing hints about some of the developments that will lay the foundation for the Next Big Thing:

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Trend to Watch: The Maturation of Mobile

What happened at CES: Mobile devices remain incredibly popular, but growth is slowing as more low-cost tablets and smartphones hit the market.

Why the TV industry needs to stay tuned in: With Horowitz Associates estimating that 91% of all Americans with a broadband connection can watch video on handheld devices, the importance of mobile distribution becomes even more central.

Mobile devices have been hugely important for the CE industry in recent years. The CEA estimates they now comprise 43% of all spending. Those sales drove much of the growth the industry saw between 2010 and 2013.

In the last year, however, sales have increasingly shifted to less-expensive devices. Smaller, 9-inch tablets accounted for about 66% of all U.S. tablet spending in 2013, and the average global price for smartphones dropped from about $444 in 2010 to $297 in 2010.

To attract new buyers, CE manufacturers at CES debuted a number of lower-cost devices as well as new screen sizes. Samsung demonstrated its Galaxy TabPRO tablets in a new 12.2-inch screen size to go along with the company’s more traditional 10.1- and 8.4-inch screens.

“If you look back to 2009, there was a void in screen sizes,” said Shawn DuBravac, chief economist and senior director of research at CES. “There was really nothing between 5 inches and 15 inches…. Now that is being filled out and screen sizes are expanding on both ends,” with even smaller displays on wearable watches and much larger ones, including new 105-inch Ultra HD sets. Some booths at the show even showed off tabletops that double as tablet devices.

The evolving swing in spending for smaller, lessexpensive tablets is attracting many new users, with the CEA predicting that tablet penetration should pass the 50% mark in the next few months.

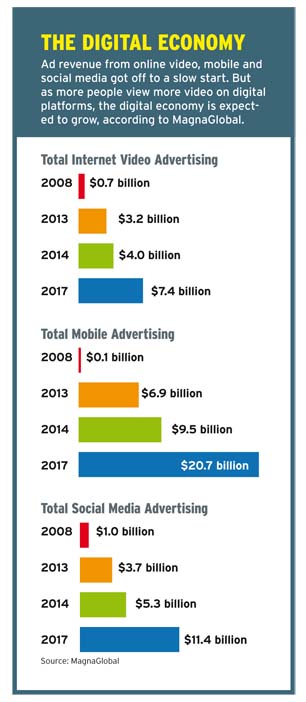

“We are in the middle of a massive platform shift to mobile,” said Marissa Mayer, CEO of Yahoo, who predicted that there will be some 3.8 billion mobile devices worldwide connected to the Internet in 2017. Informed by this expectation, Mayer’s CES keynote emphasized simplicity and the rollout of several apps, as well as the razzle-dazzle of new contributors including Katie Couric and former New York Times tech columnist David Pogue.

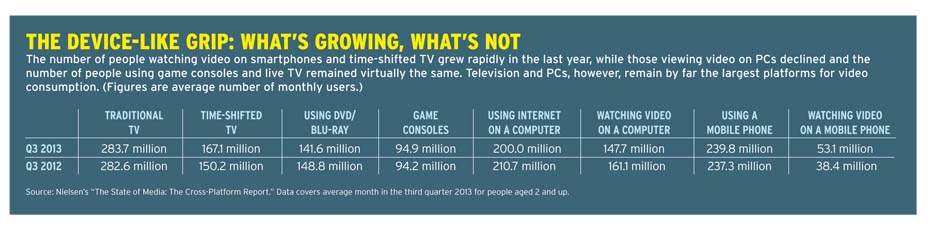

Nielsen data shows that the number of people watching video on a mobile phone jumped from 38.4 million in the third quarter of 2012 to 53.1 million a year later. That stands in stark contrast to the number of people using a DVD/Blu-ray player, which fell by 4.8% to 148.1 million, and those viewing video on a computer, which slipped by 8.3% to 147.7 million.

Trend to Watch: The UltraHD Bandwagon

What happened at CES: In a bid to boost stagnant TV set sales, CE giants heavily promoted new Ultra HD (UHD) sets.

Why the TV industry needs to stay tuned in: UHD set sales remain small, but the push by Netflix and others to add more 4K content will create new competition for traditional TV players that will likely push operators to offer expanded UHD choices. Having just gone through the costly transition to HD and the overhyped launch of 3D, many broadcasters are rightly skeptical of the prospects for ultra high-definition, given the lack of 4K broadcast standards, infrastructure and content. But rumblings at this year’s CES indicate that the format is moving faster than expected. In part, this reflects a big push by CE giants to market more UHD products, with the CEA predicting that somewhere between 75 and 150 new UHD sets would be launched at CES 2014. LG alone was demoing 12 new sets, and Sony showcased nine.

While the CEA predicts that this will tabulate to around 8.7 million UHD sets being sold worldwide in 2014, many of those will find a home in China. Only 57,000 4K sets were sold in the U.S. in 2013, a number that should grow to 485,000 in 2014 and 1.25 million in 2015, predicts Koenig at the CEA.

But prices are dropping dramatically. Sony is already showing some UHD sets in the $5,000 range, while other manufacturers such as Polaroid were demoing sets priced at less than $1,000 at CES.

Chinese manufacturers, which have been ramping up production for their home market, are also looking to bring their lower-cost sets to the U.S., explained Tom Cosgrove, president of 3net. That competition could force big CE giants to drop prices on some sets into the $1,000 to $2,000 range by year’s end. “Things are moving a lot faster than most people would have predicted six months ago,” Cosgrove said.

Consequently, production is also on the rise: 3net, for example, has already finished or is in the process of producing around 20 titles in 4K, and Cosgrove said he expects that number to grow to about 80 before next January’s CES.

Over-the-top SVOD players are also embracing the format. Netflix CEO Reed Hastings appeared at both the LG and Sony CES press events to tout his company’s 4K content, which will include the new season of House of Cards and the rest of Netflix’s upcoming originals.

During the Sony event, Hastings noted that improvements in compression using High Efficiency Video Coding (HEVC) are making 4K streaming a viable consumer option for users with at least a 15 Mbps connection.

This CES also marked the first year that major manufacturers including Sony had put HEVC in all their new UHD sets, noted Keith Wymbs, VP of marketing at Elemental Technologies. With Amazon and Hulu also increasing their 4K production, online streaming services look to position themselves as the major outlet for UHD content.

“There will be a lot of [4K] content online,” Hastings said. “It is a chance for the Internet to shine.”

The bold move is pushing more traditional players to respond. During CES, LG announced that both Comcast and DirecTV will provide 4K content to their Internet-connected UHD sets.

Trend to Watch: Reinventing the TV set

What happened at CES: Companies showed a host of new ways to connect sets to the Internet and make it easier for consumers to access and find content on those devices.

Why the TV industry needs to stay tuned in: Multichannel providers have long controlled what appears on the TV set, but the proliferation of new smart TVs, streaming media devices and game consoles raises questions about the future and nature of TV viewing.

TV sets and TV viewing are showing no signs of losing their hold on consumers, with total TV viewing of live and on-demand content increasing by more than 15 hours between 2008 and 2013 to a record monthly average of 164 hours and 39 minutes in the third quarter of last year, according to Nielsen. The number of people watching TV each month (283.7 million) also stands at a record level.

Yet the TV set manufacturing industry is at a crossroads, struggling with rampant loses and widespread questions about the future. Final 2013 sales are not in yet, but the CE industry is predicting a 1% increase in global sales, with much of the growth coming from emerging markets, while global market research company DisplaySearch expects a drop in U.S. sales.

Part of this reflects the simple fact that many consumers have just shelled out big bucks for a new flatscreen HD set, with Nielsen reporting that the number of U.S. homes with HD sets more than doubled from 41% in 2009 to 83% in 2013.

But the industry also faces some serious questions about the future of the TV set. Will consumers be willing to pay more for smart TVs with built-in Internet connections and a host of features that require improved computing power? Or will those features be provided by outside devices such as game consoles or inexpensive streaming media devices, like the $35 Google Chromecast or a $49 Roku box?

The jury remains out as both approaches appear to be making a great deal of headway.

DisplaySearch estimates that smart-TV penetration will hit 25.9% in 2014, while MagnaGlobal is estimating that about 81 million TVs with built-in Internet connections will be sold between 2014 and 2017. The Digital Entertainment Group, a consortium of distributors, tech players and retailers, released a study of 2013 home entertainment sales showing dramatic growth in electronic sell-through and VOD due to HDTV purchases. About 38 million such sets were bought in 2013, bringing the total in the U.S. to 96 million, DEG estimates.

Meanwhile, the number of TVs connected to outside devices is also rapidly growing. MagnaGlobal is predicting that the number of streaming media boxes such as a Roku or Apple TV will grow from 15.4 million in 2013 to 20 million in 2014, and hit 39 million in 2017.

Overall, consumer market researcher NPD Group is predicting that there will be some 202 million connected TVs in U.S. homes by 2015, up from about 140 million at the start of 2013.

By far the most popular way of connecting TV sets is game consoles, which continue to change the way television programming is viewed.

During CES, Andrew House, president and CEO of Sony Computer Entertainment, reported that Sony had sold 4.2 million of its new PlayStation 4 consoles as of Dec. 28, and that the company had sold more than 70 million connected devices, including 25 million game consoles, in the U.S.

That total would rank Sony among the top 25 cable operators, House said, and provides the company with a large installed assembly of devices for the launch of a new cloud-based video service.

Sony provided no details on pricing or content for the service, to be tested in the U.S. later this year. But House said it would provide live TV, over-the-top and on-demand content, boasting that Sony’s technologies would “revolutionize” the TV-viewing experience.

Microsoft, meanwhile, has even wider ambitions for its Xbox One. It allows users to search for content via voice or motion controls and brings together all content—live TV, over-the-top libraries and a user’s personal collection—into one search screen, explained Brody O’Harran, senior director of Xbox Live advertising sales at Microsoft.

“The launch of Xbox One was really a watershed development for the TV industry,” added KC Estenson, senior VP/general manager of CNN.com, citing the interactivity the unit brings to the TV platform.

But Estenson believes the use of devices to connect TVs to the Internet is an intermediate step toward having all of those capabilities built into the TV. “Having computer-based functionality embedded in the TV will produce a revolution in TV,” he said.

And among other vital industry functions, CES has become an increasingly important venue for discussions between CE manufacturers and programmers that want to get their content on as many devices as possible. “If you are not on a device, they may watch someone else,” argued Rob Sussman, executive VP of business operations, development and strategy at EPIX during one show panel.

That imperative has pushed Univision to get its apps on ever-more devices, said Mehul Nagrani, senior VP of digital operations at Univision Interactive Media. “We are on Samsung TV, Xbox One,” and are in conversations with Roku and other platforms, he said.

Trend to Watch: The Move Toward Simplified Entertainment

What happened at CES: Tech companies showed a number of products that will make it easier for consumers to access and move content from one device to another.

Why the TV industry needs to stay tuned in: Current systems for accessing content from different devices are clunky and complex; simplifying that process will boost viewing and improve customer satisfaction.

Microsoft’s Xbox One, which brings together all content in one searchable interface, was only one of many examples at CES of how tech companies are trying to simplify the at-times convoluted process of finding and accessing different types of content without the consumer needing 16 different remotes to switch between myriad devices.

Virtually all of the major CE manufacturers now have systems for synching up and accessing content between their TVs, tablets and smartphones. But a number of them were also showing systems that would use different devices and brands to interact with content.

In another important step, several vendors demoed technology to improve TV Everywhere offerings from multichannel providers. “We have to make it easier for consumers to sign in and access the content,” Jeremy Legg, Turner Broadcasting System senior VP, business development and multiplatform distribution, said during a CES panel.

Trend to Watch: The Internet-ing of All Things

What happened at CES: From wearable CE gear to dishwashers that talk to TV sets and tablets, tech companies are determined to get everything on the Web.

Why the TV industry needs to stay tuned in: The push to connect more devices is already important for cable operators and telco companies rolling out security and “smart home” products, but it could also help programmers and advertisers better personalize what is being delivered to viewers.

As the cost of putting in sensors and building Internet connectivity into devices drops precipitously, tech companies have embraced the “Internet of Things” (IoT), where a growing array of devices and common household items can communicate and interact with each other.

Last month, research company Gartner predicted that IoT will comprise 26 billion units in 2020, a massive 30-fold jump from 0.9 billion in 2009. And that figure excludes smartphones, tablets and PCs, which Gartner sees hitting 7.3 billion units by 2020.

“Along with 4K, the Internet of Things will be one of the two big tech trends I’ll be watching,” said Matthew Strauss, senior VP/GM of video services at Comcast Cable.

This is important for cable operators that are using their broadband networks to offer a wide array of security and smart-home services.

But it will very likely raise many thorny privacy issues and create an enormous amount of data that can be used to personalize entertainment.

That will also make mobile devices even more important as tablets and smartphones become a kind of hub to communicate with TVs, computers, heating systems and virtually everything else in a person’s life. “The smartphone becomes the remote control of my life,” John Donovan, senior executive VP at AT&T, quipped during one session. It may have produced some chuckles, but as future industry trends go, that one could be a whopper.