Tablets and Smart TVs:What You Need to Know

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

The Consumer Electronics Show is famous for a certain kind of mind-boggling excess, as manufacturers frequently outdo themselves in an attempt to bring eyeballs to what’s hot, new and exciting. Every January, something emerges from all the bright lights and noise as the winner of the tech buzz battle. In 2010, 3D was all the rage—but then sets didn’t fly off the shelves during the year as manufacturers had hoped.

At this year’s CES show in Las Vegas, the talk was dominated by smart TVs and tablets. And now—in the same way 3D was dissected last year—everyone from developers and manufacturers to broadcasters and consumers will be watching to see how far and how fast smart TV moves on that path from promise to delivery. And, more importantly, to ascertain what it means to their business today.

Everyone is understandably expecting smart devices— TVs connected to the Internet, tablets like the iPad with a wireless connection, smartphones, game consoles or computers networked into a TV set—to have a profound impact on virtually every aspect of the television business.

But when? Questions concerning affordability, required bandwidth and content development will continue to be addressed, and are bound to in! uence the pace at which these highly touted devices will be embraced. Much cau tion is still in order about the potential impact of tablets and smart TVs on the industry, at least in the short run. While much has already been done, much more needs to happen before smart TV becomes as much a part of the everyday lexicon as the cathode ray once was.

“Sometimes seeing what is announced at CES isn’t terribly helpful, because the press goes so heavily into overdrive that it takes some time to " lter out what is real and viable and durable from what is just exciting,” notes Brian Wieser, executive VP, director of global forecasting at Magna Global.

Smart Devices Everywhere

The promise is certainly there, and was very much on display at the show. Samsung went as far as to bring the heads of both Comcast and Time Warner Cable to Vegas to demonstrate how their subscribers will be able to access the full features of Samsung’s smart TVs, allowing them to watch both the regular cable lineup and a wide array of over-the-top content from the Internet sometime later this year.

These subscribers will also be able to use Samsung’s tablets to both view programming and to search for new programming—a development that overcomes many of the problems users have in finding the right show among hundreds of channels and tens of thousands of VOD titles with what will one day be obsolete remotes.

“Our goal is to make any content available anytime, anywhere on any Samsung screen,” Boo-Keun Yoon, president of Samsung’s visual display business, proclaimed at CES.

As Brian Roberts, chairman and CEO of Comcast, said at the show, “Today we are showing [an] application that will totally re-imagine how our customers watch TV. Tablets and smart TVs are really an important part of Comcast Xfinity’s plan to [provide] a fantastic next-generation experience…For the first time, we are radically changing how our subscribers interact with TV, and making it easy to access the entertainment they want anytime, anywhere.”

Parts of Roberts’ vision are already falling into place. Comcast is now offering more than 150,000 titles online to its subscribers, and most of the other major operators— DirecTV, Dish, Time Warner Cable, Cox, Verizon FiOS, AT&T U-verse and Cablevision—have launched some kind of multiplatform play, making at least some content available online or on mobile devices. By the middle of 2011, these so-called TV Everywhere programs are expected to be in about 70 million homes.

The new connected TVs will allow users to easily do many things that were difficult on ye olde television— watch online video, play games, download movies, buy goods, share photos with friends and family, and even interact with programs and ads. And when coupled with tablets, smartphones and other devices, they also promise to open up a new era of TV viewing with ubiquitous on-demand content.

But among the issues slowing the progress is finding a way to connect all these devices. PricewaterhouseCoopers estimates that about 85.5 million homes had a broadband connection in 2010; that total is projected to grow to about 113.8 million, about 92% of all homes, in 2014.

Even with those high penetration rates, not all devices can be easily connected. Wired broadband connections are often not available in the living room or bedrooms of many homes, and wireless home networks often offer slow or limited connectivity throughout the whole house.

The new LTE 4G networks, which offer speeds fast enough to carry high-definition video and the expansion of 3G coverage, could help solve the problem, but will be expensive to implement. AT&T will be spending $700 million just to get its network ready for 4G launches, which it hopes will reach 70 to 75 million Americans by the end of 2011. Verizon spent $9.3 billion just for the spectrum needed for its 4G network, which reaches more than 110 million customers today.

The launch of the new LTE 4G networks was a hot topic at the show. A number of 4G devices were demonstrated at CES, including both phones and tablets, and some deals were cut for the delivery of content over these new networks.

During CES, Verizon and Sling Media cut a deal that will allow users who pay a subscription fee to use their Sling devices to access TV content on Verizon’s new 4G networks. “Verizon’s new LTE network shows how far networks have come, and how they now have the ability to really show off an application like ours,” which currently allows users to watch content from Dish Network away from home on their computers or mobile devices, notes Jay Tannenbaum, VP of marketing at Sling Media.

More bandwidth will be needed, however. Even though the delivery of video content to connected TVs and other devices is only in its infancy, Netflix subscribers already account for 20% of the downstream traffic on " xed-line networks during peak hours, notes Ken Morse, chief technical of" cer of the SP video group at Cisco Systems, which announced a software-based architecture dubbed Videoscape at CES that is designed to help operators deliver content to multiple platforms and devices.

“By 2015, we are estimating that video will account for 91% of all IP network traffic,” Morse said.

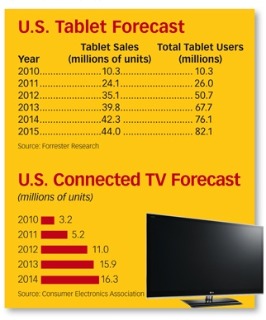

Much of that growth in video traffic will be driven by connected devices. In the U.S., sales of connected TV will grow from about 3.2 million in 2010 (amounting to about 9% of all sets sold) to 5.2 million in 2011 and 16.3 million in 2016 (when they will account for about 52% of all digital TVs shipped), according to the Consumer Electronics Association.

The Wait Is On

Even with that growth, it will take years for smart TVs to reach a significant proportion of U.S. homes. Forrester Research projects that it will take another four years—until 2015—for smart TV to be in about 43 million American homes.

Older TVs can be connected to the Internet via game consoles, Blu-ray players with an Web connection or boxes such as the LG Smart TV Upgrader that launched at CES.

But users would also have to find a way to hook up those devices to a high-speed connection. And dedicated boxes like Apple TV or Roku that supply access to over-the-top content have proven to be a relatively niche product. Since launch in 2002, Roku has sold about 1 million units, while Apple’s second-generation box sold about 1 million units in the last four months of 2010.

Cell phones are being replaced much more rapidly, with Nielsen estimating that U.S. smartphone penetration could top 50% by the end of 2011. The Consumer Electronics Association predicts that some 72 million smartphone units will ship in the U.S. this year.

Tablet Growth and Broadcasters

Impatient consumers should also be cheered by what is impressive growth in the tablet market—though things will still take time. Forrester Research is predicting that U.S. tablet users will more than double to 26 million by the end of 2011 and that total tablet ownership will hit 82.1 million by 2014.

The proliferation of video-friendly devices such as tablets and smartphones is good news for broadcasters who are launching mobile digital TV services later this year. More than two dozen devices capable of receiving mobile broadcast signals were on display at CES, and some of the demonstrations offered broadcasters, which have been struggling with stagnant ad sales, potential new revenue.

But broadcasters face their own challenges in the transition to the new landscape. While more devices are entering the market, the major groups backing mobile DTV have not cut a deal with a carrier such as Verizon that would have the market clout to force manufacturers to include mobile DTV receivers. Not surprisingly, the vast majority of the new tablets and smartphones launched at CES can’t receive mobile DTV signals on their own.

A gulf still exists for broadcasters and programmers looking to deliver content via apps to tablets and smartphones. Currently, creators must develop apps for many different operating systems and devices. That imposes considerable costs on both programmers and advertisers, and has limited the mobile ad market, which Magna Global estimates will produce only $631 million in revenue in 2011.

To take full advantage of the ad potential of tablets and mobile devices, better measurement will also be needed. Nielsen is delivering combined ratings for linear TV, DVR and VOD usage and will be adding online usage to the mix this spring. But it has released no timetable for adding mobile metrics, which Nielsen says poses some problems.

A much more hyped problem is cord-cutting. Some have argued that these new connected devices would encourage consumers to drop or cut back on their multichannel subscriptions; they point to multichannel subscriber losses of 335,000 in the second and third quarters of 2010.

If this trend accelerates, it could threaten the $74 billion multichannel providers expect to take in from subscriptions in 2011, according to PricewaterhouseCoopers. And it could severely hurt cable programmers, which receive a large chunk of their revenue from operators.

Still, the recent losses amount to only 0.3% of the overall multichannel universe, and they may reflect the U.S. unemployment rate of more than 9% for six quarters. A recent study by Frank N. Magid Associates found only 1% of multichannel subs were planning to cut the cord. and a fall 2010 study by CTAM found that 84% of people who were using connected TVs to watch online video watched the same or more regular TV than they did before.

Operators also seem to have embraced these devices as a way to enhance their services. “We’re positioning ourselves to offer content across all platforms, just like what we’re doing with NFL Sunday Ticket,” which allows subscribers to watch games on TVs, PCs and mobile devices, said Derek Chang, executive VP/content strategy and development for DirecTV.

A more immediate issue is content rights. Current deals between operators and programmers don’t necessarily include rights to stream content to a tablet, for instance, and in some cases the channels that have acquired programming from the major studios don’t have those rights either.

“The technology is here, it is just a matter of working out the rights issues,” Chang said.

Thorny negotiations between programmers and distributors, it seems, are one thing that the new age of smart TVs and tablets is unlikely to change.

The smarter way to stay on top of broadcasting and cable industry. Sign up below