The Struggle for Independents

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Life as an independent programmer has never been easy. As the industry has consolidated—drastically reducing the number of distributors able to carry smaller, niche networks, and with over-the-top players and skinny bundles coming to prominence—it isn’t getting any easier. Adding to the hardship is a distributor base eager to keep costs low that has singled out smaller programmers for elimination from their lineups.

“Sometimes it’s hard to get the attention you need,” Reelz Channel CEO Stan Hubbard said. “And it’s impossible to demand anything. The name of the game in getting viewership is obviously getting distribution, and you’ve got to get it wherever viewers are.”

But despite the difficulties, Hubbard and other independents remain fiercely, well… independent. They strongly believe in what they are doing—providing new voices and programming that wouldn’t be possible with larger, more-moneyed operations.

“This is the path we chose and the path we’re committed to, and that is independence,” Hubbard said.

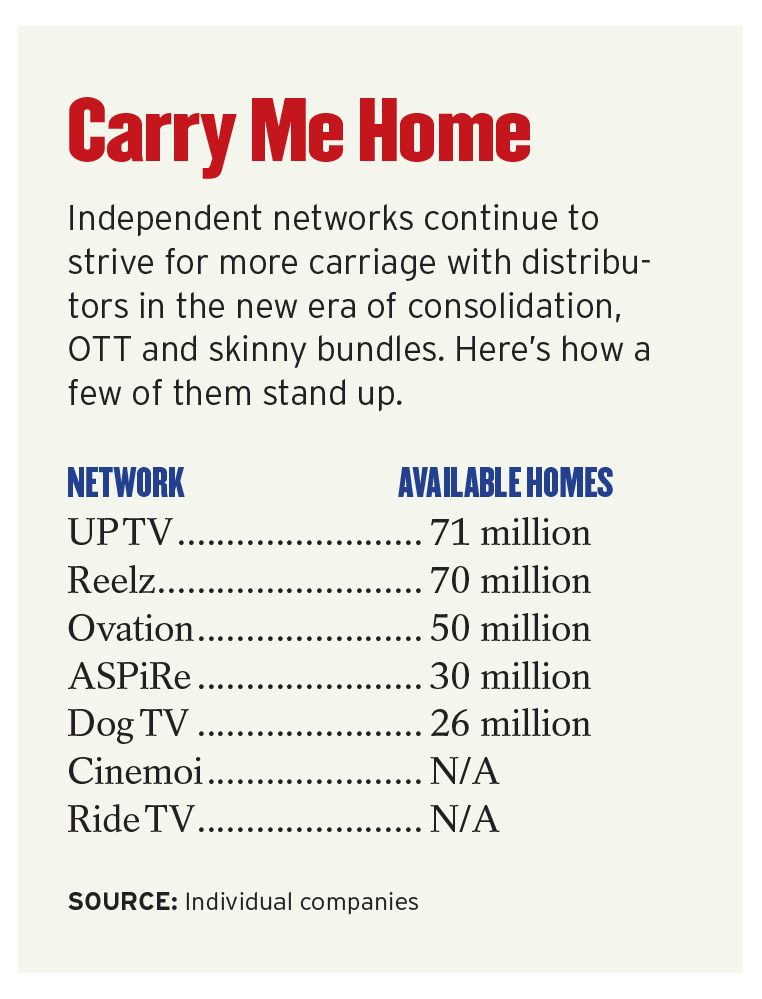

Reelz, which is available in about 70 million homes, is one of the bigger independents. And like its peers in the niche programming community, it has managed to survive through a combination of low overhead, innovation and a little luck.

But securing proper distribution is still a struggle and becomes even more critical for independents because they rely almost totally on ad revenue to survive. Any that charge affiliate fees are typically charging very small amounts—less than 10 cents per subscriber per month.

Hubbard said some brands set rules that dictate which networks they will buy ads on. Some won’t buy any networks in less than 40 million homes, some set the minimum at 50 million and others won’t buy any programmer that’s in fewer than 80 million homes.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

“As you get smaller, you start to fall off and they’re just not allowed to buy you,” Hubbard said.

Lately, even small networks that have the backing of mega-conglomerates such as NBCUniversal—which shuttered its crime-focused Cloo network in January, switched its Esquire Network to digital-only delivery and has weathered carriage drops from large multichannel video programming distributors for horror-themed channel Chiller—are feeling the pain.

Size Matters

That has been part and parcel of the shift toward smaller video packages and skinny bundles, characterized by Viacom’s decision earlier this year to focus on six core networks. While its 19 other channels aren’t going away—at least not in the near term—those networks will receive less emphasis and fewer resources. Even NBCU, which has about 14 channels, has said that it may have to focus on five or six core brands in the future.

Ovation executive VP, network strategy Liz Janneman said that kind of mega-network pruning could have a positive effect on smaller, independent networks.

“We’re not trying to force you to take five channels in order to get one or two. There’s only one that we have, and only one that we’re having discussions with,” Janneman said. “That makes the conversation a little easier to have, whether it be with distributors or advertisers, because we’re not bundling, we’re not leveraging. The cost benefit is affordable. [It’s] the value proposition.”

Ovation executive VP of content distribution John Malkin said that an independent’s dedication to a specific niche should also be attractive to distributors.

“If you look at Ovation, we’re a one-of-a-kind network in a very saturated ecosystem,” Malkin said. “If you look at the other categories, like sports and entertainment and lifestyle and information, those categories are filled with many different options. If you look at arts, we are literally the only network dedicated to the arts. Affiliates recognize that.”

Not always, though. Ovation, which according to SNL Kagan charges about 8 cents per month per subscriber, was cast into controversy in 2013 when Time Warner Cable (since purchased by Charter Communications) dropped the network for a year, singling it out as an example of a lightly watched channel that wasn’t worth the price.

Ovation eventually got back on TWC systems on Jan. 1, 2014, basically by agreeing to add more original content. And while Ovation remained available in the Charter transition, it is a prime example of the hard sell for independent programmers.

More Bang for the Bucks

For independent networks, the need has never been greater to not only be fleet of foot when it comes to changes in the market and in viewing habits, but to be able to give operators opportunities through online and on-demand content to make more money.

Pivotal Research Group senior research analyst-advertising Brian Wieser said smaller networks will appeal to distributors if the price is right and they can show a contribution to reducing churn.

“They’ll have appeal to advertisers—more sponsorships than conventional ad units—if there’s a strong brand affinity,” Wieser said. “And if they develop their own programming, there’s always an international market to sell rights to [those]which can help fund it.”

Offering incremental revenue opportunities, such as subscription video-on-demand, also is a plus, he added.

UP TV CEO Charles Humbard said providing incremental revenue opportunities is a big part of his channel’s operation. The family-friendly programmer—which also has a black culture and urban lifestyle channel, ASPiRE, co-owned by basketball legend Magic Johnson—has an extensive SVOD offering with Streampix available in about 12 million homes.

UP got its start in 2004 as Gospel Music Channel, and struggled along with its peers to gain carriage. In 2013, the network changed its name to UP, expanded its focus to include faith-based and family programming, and watched its carriage soar.

Looking Up at UP

UP is available in about 71 million homes and last year increased carriage by 3.2 million. Ratings for the channel have also soared—total-day ratings were up by 50% last year and by 47% in the 18-49 demographic.

Humbard attributes that shift to two things: the switch by ABC Family to Freeform in 2016 and UP’s own format change.

ABC Family’s departure from the space—Freeform is more of a younger-skewing network—began on Jan. 12, 2016, when the name change became official. But the channel had been evolving gradually for years before that, with the intent of focusing on “Becomers,” or young adults aged 14-34, with original shows such as Shadowhunters and Pretty Little Liars. Humbard said the shift to Freeform left a vacuum in the Family space, one that UP was more than willing to fill.

The network’s biggest ratings gainer, though, was a mix of savvy program acquisition, serendipity and the forethought to capitalize quickly on an outside event—a Gilmore Girls marathon that coincided with Netflix’s reboot of the series.

UP executive VP and general manager Amy Winter said the network wasn’t aware of the plans for the Netflix reboot when she and her team decided to acquire the past seasons of Gilmore in July 2015. To her, it just fit with the overall theme of the channel.

“We felt like it was the perfect show for our audiences,” Winter said, adding that when word of the Netflix reboot came out, UP’s team went into high gear.

UP ran a 153-hour Gilmore Girls marathon to coincide with the Nov. 25, 2016 release of the Netflix reboot, Gilmore Girls: A Year in the Life. Hosted by Sean Gunn, who played Kirk Gleason on the original show, the marathon kicked off on Nov. 18 and ran through Nov. 25, attracting about 6.1 million viewers to the network.

Winter said the success of the Gilmore Girls marathon has the network looking closely at other opportunities. It is scheduling a “March Gladness” promotion tied to its weekend run of syndicated show America’s Funniest Home Videos, coinciding with the NCAA Men’s Basketball Tournament (March Madness). A partnership with The Walt Disney Co. (which produces the show), the grand prize is a trip for the winner and a guest to Los Angeles for a taping of the show.

While syndicated fare has played a big role in UP’s resurgence — the network has the rights to Parenthood, Everybody Hates Chris, 7th Heaven, The Parkers and more — original series are also a big driver. UP originals include family-friendly reality fare such as Bringing Up Bates, a show focused on a family with 19 children, and Growing Up McGhee, a show about a growing African-American family that originally debuted on OWN.

Originals are a key differentiator for many independent networks. Almost every channel has at least one originally produced show, and despite their size and tiny budgets compared to the mega-content providers, have managed to attract attention.

Reelz will release The Kennedys: After Camelot in April, a four-hour miniseries follow-up to 2011’s The Kennedys. Hubbard said the series is testament of a commitment to original programming by both his family and the industry itself.

“We’re making big investments in original programming, big investments to be different than the conglomerates,” Hubbard said.

Attracting attention to these shows is just as important as going out to get them in the first place. Marketing is playing a more vital role than ever in making audiences aware that the programming—and in many cases, the channel itself—even exists.

The Treating of ‘Versailles’

A prime example is Ovation’s Versailles, a costume drama series produced by Banjay Group and centered on the reign of French King Louis XIV. Versailles did very well for Ovation, gaining both viewers and attention when it aired in October.

Like its indie network counterparts, Ovation firmly grasped the marketing reins to drive interest in the series.

Versailles was a big departure for Ovation—it was the first time the network had access to programming of this scope and nature—and the network was determined to take full advantage.

“This was the first time we had programming of this nature over 10 episodes,” Janneman said. “Everything else that we had done from an original series perspective was sort of limited runs and limited exposure. We had availability from major members of the cast as well as the creators of the show. That helped us not only to tell the story from a different creative perspective, but it also helped us to tell the story from an experiential perspective.”

Ovation pulled out all of the marketing stops for Versailles, added senior VP marketing and on-air promotions David Widerøe. That included themed dinners and screenings kicking off with a screening of episode one in Washington, D.C. The marketing train next pulled into New York for a three-day series of themed dinners with menus inspired by Louis XIV and including a masquerade ball.

Ovation also provided clips of interviews with the cast, weaved the premise of the show into existing series such as The Art Of, tapped social media and even created Spotify playlists with music tied to the show.

“We don’t want all of our social activity to be day, date and time to tune in,” Widerøe said. “We want to make sure it’s an extended common experience so there is a reason to go to the different platforms.”

Janneman said the buzz around Versailles also helped drive interest in other Ovation originals such as The Art Of and The Artful Detective and added that in addition to a second season for Versailles, the network plans to announce a new “tentpole” program relatively soon.

Marketing isn’t just a tool to attract viewers to programming, though. It can also drive awareness of the network itself to the general public, and provide critical data to the channel’s potential value to distributors.

Horses and Carriage

Case in point: Ride TV, an equestrian lifestyle network launched in 2014 with the backing of some heavy financial hitters, including Walmart heir Alice Walton, Patron tequila and Paul Mitchell hair products guru John Paul Jones DeJoria and others.

So far, Ride TV has managed to eke out carriage deals with Dish Network, Verizon’s Fios TV and CenturyLink’s Prism TV, Google Fiber, Armstrong Cable and others. But president Craig Morris said it took some innovative marketing to get some carriage partners on board.

“We understood that we were going to have to go at this with a little different angle,” Morris said. “We had to offer more to the MVPDs than just a channel—we had to offer marketing, we had to go in and show grassroots support for the channel and that there were people out there who would actually watch.”

So, in addition to telling MVPDs about the potential size of the market—more than 30 million Americans ride horses and spend about $160 billion annually on riding and horse-related products—Ride TV went to the consumers themselves. Ride TV forged alliances with horse organizations and surveyed their membership, asking them if they would switch their TV provider if a rival has access to Ride TV.

“We leveraged that with the MVPDs to prove to them that we could mobilize that membership and get people to switch possibly from one provider to another if they put us on. I think being creative with your approach to carriage is definitely key to having success in today’s marketplace.”

He added that the programming also can be a catalyst.

“There’s just an inherent love of horses in humans,” Morris said. “People are drawn to them; it’s a lot like being drawn to the mountains or the ocean. I don’t know too many kids that grew up playing ‘Fishermen and Indians.’ ”

Ride TV wouldn’t give current carriage figures but CEO Michael Fletcher said the goal is to be in front of about 45 million homes by 2020. His next carriage target is AT&T/DirecTV, which he said the company is working hard to secure.

Research that goes deeper than the typical broad universe numbers can help convince distributors not only that a network has an audience, but can silence the chuckles that some channel ideas elicit from executives.

A Dog Net’s Purpose

Dog TV CEO Gilad Neumann has a strong sense of humor and the thick skin that would appear to be essential to lead a network that is literally for the dogs. Dog TV is just what the name says—a 24/7 network programmed exclusively for Man’s Best Friend (except for a brief primetime block for their owners). Dog TV alters its broadcast colors to de-emphasize red and green (colors dogs can’t see) and features shows geared to ease separation anxiety and promote relaxation and stimulation. Crave a three-minute segment for your pooch that simulates riding in a car with its head out the window? Dog TV is the place for you.

Neumann said that Dog TV conducted three years of extensive scientific research into the channel before launching it in 2012, but still faced opposition from distributors.

“It was very, very difficult at first going into a meeting room with serious operators and executives and telling them, ‘We have a great channel with a very big potential audience, and by the way, they’re dogs,’ ” Neumann said. “But what we have rooting for us is a lot of science and research, registered patents about what we do, studies that show the preference of dogs for our content for their special needs. It’s attuned to their vision and hearing and their day cycle.”

Dog TV has carriage with DirecTV and RCN that puts the premium channel (it costs $4.99 per month) in front of about 26 million potential subscribers, half of whom own dogs. The channel also is available internationally and individual programming episodes can be accessed online via Apple TV and Amazon Fire.

While pluck, determination and innovation have helped independents last this long—Ovation is in its 10th year, UP TV technically in its 13th—many believe that breaking into the crowded distribution universe won’t be possible going forward without some help from the government. Last year, Democratic Federal Communications Commission commissioner Mignon Clyburn tried to do just that, putting forth a notice of proposed rulemaking that would eliminate unconditional “most favored nation” clauses in programming contracts, as well as unreasonable alternative distribution method provisions that restrict programmers from offering content online. That effort is in limbo as the Trump administration transitions to new Republican FCC chairman Ajit Pai, but there is still hope that the agency will be able to offer relief.

Ride TV’s Fletcher said that one of the biggest obstacles for independents to clear in going after distribution is forced bundling by other networks. And the proposed FCC rulemaking could go a long way toward ending that.

“[Ninety percent] of the MVPDs when we initially call on them, say they don’t have the available bandwidth, and that it’s tough to add new channels if there is a cost attached,” Fletcher said. “The fact is, the operators themselves, if they truly want to make more content available to customers, have to control their own fate.”

Cinemoi CEO Daphna Ziman, who has been an outspoken opponent of mega-mergers in the media industry, said that bundling is only one factor that stifles competition.

“Independents have to work hard because everything they do has to serve the interests of the public,” Ziman said. “It doesn’t start and end with an idea. It has to have a whole strategy attached to it. The most important effort must be to serve the subscribers in the best possible way we can. No. 2 is promotion: We need to find alternative ways of reaching the public. And then reading every single email or comment that comes back to you. Not just letting it pile up, but really listening to the people. It all begins and ends with the people.”