Roku Broadens Its Ad Horizons

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Sales of streaming media boxes and sticks presently represent the bulk of Roku’s revenue, but the path to future growth will be paved in large part with advertising dollars generated by its popular streaming platform.

That much was clear in an S-1 document filed earlier this month by Roku as the streaming specialist looks to raise up to $100 million in an initial public offering.

Though the majority of hours streamed on Roku’s platform (6.7 billion hours during the first six months of this year) consist of subscription video-on-demand content, “in order to materially increase the monetization of our platform through the sale of advertising-supported video, we will need our users to stream significantly more ad-supported content,” Roku noted.

As part of a plan to fulfill this mission, Roku last week broadened its streaming scope with the launch of a new free, ad-based streaming channel that features “hundreds” of movie titles coming courtesy of content partners that include Fandor, FilmRise and Popcornflix, among others.

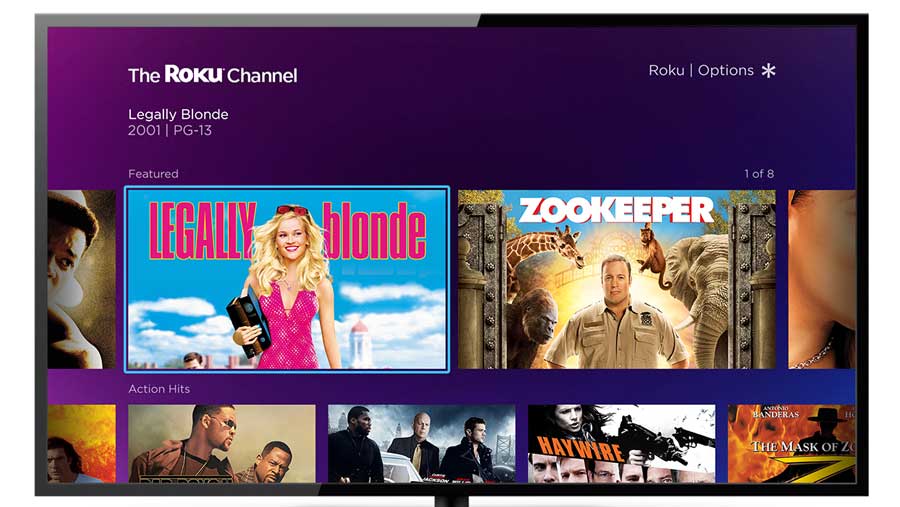

The new curated offering, called The Roku Channel, will be offered across Roku’s lineup of streaming players and integrated Roku TVs in the coming weeks, and won’t require users to log in for access.

That new channel complements an array of other individual free, advertising-based VOD apps and services offered on Roku’s platform, such as Tubi TV, Crackle and Popcornflix.

It’s not the first curated channel from Roku, as the new offering follows the debut of a 4Kfocused content showcase (called 4K Ultra HD Spotlight) that debuted in fall 2015, timed with the launch of Roku’s first 4K-capable model, the Roku 4.

Roku’s new channel is launching as the company accelerates its activity around free content.

“Our users really have a strong desire for it,” Rob Holmes, Roku’s vice president of programming, said regarding free, ad-supported content. “There’s a lot of talk about SVOD … but we see free as a critical driver for the next wave of growth.”

Holmes said The Roku Channel is also aiming to “set a benchmark for the ad experience on the platform,” noting that this will include a special focus on reduced ad frequency and an ad-load that, on average, will be about half of what’s seen on traditional TV.

Holmes, a former Comcast advanced ad executive who joined Roku earlier this year, said the company also believes the new channel will give users an easy entrée into free content on the platform and help them to expand to other free apps it offers.

“It’s a great opportunity for existing partners to make their most popular content front and center for Roku users,” Holmes said, adding that Roku will take on ad sales for the new channel.

Prime Position Makes It Easy To Find

The Roku Channel is also getting a premium position on Roku’s streaming platform, making it easy for users to find. Holmes likened that positioning to a digitized version of an “end cap” display that one might see at the end of a shopping aisle in a retail store.

Other announced publishing partners for The Roku Channel include American Classics, Nosey, OVGuide, Vidmark and YuYu, with still more to come. Out of the chute, the offering will feature titles from studios such as Lionsgate, Metro-Goldwyn-Mayer, Sony Pictures Entertainment and Warner Bros., and films that include Ali, The Karate Kid and Legally Blonde. The channel will also expand into other types of content, including TV series, Holmes said.

Roku supports a lineup of more than 5,000 streaming channels. Per its channel store, top free channels on Roku’s platform include YouTube, Pandora, CBS News, NBC News, PBS Kids, AOL On News, ABC News, Tubi TV, Pluto TV, Crackle, PBS, Newsy, WeatherNation and Fox News.

Roku will be looking for the new channel to expand its advertising business.

According to the aforementioned S-1 filing, Roku player revenues reached $117.32 million during the first six months of 2017, compared to $82.39 million for its Platforms business, which includes advertising, subscription revenue sharing and licensing fees from TV manufacturing partners such as RCA, TCL and Insignia/Best Buy.

Though Platforms currently represents the smaller piece of Roku’s business, it’s the biggest growth engine. While player revenues dropped 2% in that six-month period versus the year-ago period, Platform revenues grew 91%.

The smarter way to stay on top of broadcasting and cable industry. Sign up below