Reelin’ in the Years

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

More and more baby boomers are turning 55 by the day, exiting the vaunted 25-54 demo, currently the oldest group coveted by advertisers. The aging of the upper end of the 25-54 audience, which is clearly impacting TV audience measurement, could soon force a major shift in the way TV advertising dollars are spent.

At present, most advertisers and their media agencies are minimizing the effect: The 55-plus demo is one advertisers reach essentially for free when they buy shows with audience guarantees for younger demos such as viewers 18-49 or 25-54. A high percentage of baby boomers have now reached the 55-64 age category, but there is no media-buying currency demo for this relatively affluent group.

For decades, advertisers have for the most part not targeted viewers 55-and-older, choosing to believe dusty perceptions that they had less disposable income; firmly established buying habits that could not be influenced by TV commercials; were not tech-savvy or fashion-conscious; spent no money on home improvement; watched totally different programming than viewers under 55; and in general, did not have similar interests as viewers 20 or more years younger. While those perceptions may have been supportable 10 or more years ago, they no longer are, according to consumer research that reminds advertisers that age, like a rating, is just a number.

Last July, Nielsen issued a report titled “Why Marketers Can’t Afford to Ignore Baby Boomers,” which pointed out that eight of the top 10 Websites most visited by boomers are the same as those visited by adults 18-34, including Facebook.

And in a major presentation last October by Alan Wurtzel, NBC Universal president of research and media development, research from assorted sources showed that families headed by people 55 and older have a median income of almost $70,000 a year and overindex those in the 18-49 demo in the purchases of home furnishings, home improvement items, large appliances, beauty and cosmetics, luxury autos and casual dining.

Among the 55-64 demo group, which Wurtzel calls “Alpha Boomers,” 74 percent say they are indeed willing to switch products. They are also equal, in terms of percentage, to the 18-34 demo among those who have cable TV, high-definition TVs, DVRs and Internet access at home. They also spend 30 percent more on consumer electronics than a typical 18-34 consumer, and 49 percent more than that demo for their online purchases. Also, a surprising 70 percent buy at least one product online each month.

“Nielsen is not an advocate group for any business strategy, but we do think the baby boomers are an important demographic that shouldn’t be overlooked,” says Gary Holmes, a Nielsen spokesman. “A number of our clients are interested in raising the visibility of the 55- 64 demo, and we are working with them to advance the discussion.”

Adds Pat McDonough, Nielsen senior VP of insights, analysis and policy: “As the U.S. continues to age, reaching this group will continue to be critical for advertisers.”

So why aren’t advertisers jumping on board, spending dollars to target this group? Because the networks essentially have been giving away 55-64 viewers for free when they sell commerical time targeting the younger demos for which they offer guarantees to advertisers.

“The 55-64 demo has basically been ignored by clients, [but] it’s a powerful demo and has huge value,” says Dave Campanelli, VP and director of national television at Horizon Media. “But the fact remains that if clients buy the 18-49 or 25-54 demos, they will basically get the 55-plus viewers for free. Right now, the incentive to specifically buy 55-plus is not there. I can see some advertisers diverting a slice of their ad budgets, but I don’t think they will change their marketing plans to skew 55-plus.”

Todd Gordon, senior VP and director of national broadcast at Initiative Media, says marketers are aware of the value of the 55-64 demo.

“The idea that we only target 18-49 or 25-54 is misunderstood,” Gordon says. “Our clients, depending on their brands, target all audiences. And most clients do recognize that the lifestyles of today’s 60-year-olds are different than in the past. But because younger viewers are harder to fi nd, the networks will always be able to charge more to reach them.”

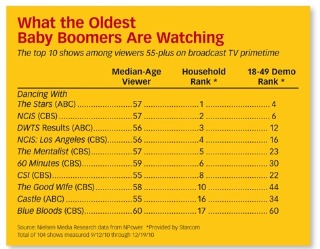

Sam Armando, senior VP of audience analysis at Starcom MediaVest Group, sees the value of the 55- plus demo from the audience-measurement side of the equation. “A lot of shows with a median-age audience over 50 are the most popular on television, and that’s true not just on broadcast,” Armando says. “Look at The Closer on TNT, which has a median age of 57.”

Armando notes that in many instances, “older viewers are dictating what succeeds or fails” on television right now, and the numbers bear that out.

“CBS is the one broadcast network that is having great success, and they attract the 55-plus demo,” Armando says. “If there are any viewer gains on television right now, it’s coming from older viewers.”

Wurtzel plans to keep showing his presentation to as many advertisers and agencies as he can. And he’s talking with assorted advertiser trade groups, trying to fi nd a media agency or advertisers that might want to partner in targeting the 55-plus demo.

“I know it’s a tough sell,” Wurtzel says. “It’s a major paradigm shift for the TV industry. It’s not going to be easy. But I hope that advertisers and their agencies will give it a fair hearing.”

The smarter way to stay on top of broadcasting and cable industry. Sign up below