For Programmatic Ad Tech, Efficiency Is Key Driver

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Related: Top Buyers and Sellers See Benefits In Programmatic Approach

Related: TV Gets With the Programmatic Program

Related: TV Ad Tech’s New Players

Business pressures to find more efficient ways of selling inventory have prompted a number of improvements in programmatic advertising technologies and platforms, which in turn has fueled greater interest in applying those systems.

“This is moving much more rapidly than any of us would have anticipated,” says Walt Horstman, president, AudienceXpress. “We’ve run thousands of campaigns over the last year with over 100 advertisers, involving most of the major advertising holding companies.”

But Horstman and others caution that much more work remains to be done. “On the surface there seems like a lot of action,” says James Rooke, GM of business solutions at FreeWheel, which has launched the FourFronts Programmatic Pilot. “A number of companies are going after what is an exceptionally large business and there has been an exceptional amount of learning on the part of the TV community in terms of understanding [programmatic]. But while companies are willing to test and learn, they are not jumping in with two feet and I don’t see them doing that anytime soon.”

That is prompting tech vendors to step up their efforts to improve the way programmatic ad platforms and technologies are adapted to the needs of TV players.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

One notable area has been the development of programmatic technologies for local advertising. Last fall, Magna Global started working with Tribune Media Co. and WideOrbit to launch WO Central, which offers programmatic targeting and automated buying in local media for local and national marketers. Other station groups, including Hearst, Meredith, Raycom, Scripps and Sinclair, have also agreed to participate in tests, and TubeMogul Inc.’s widely used programmatic platform is accessing local inventory from the system.

Brian Burdick, executive VP of digital and programmatic at WideOrbit, stresses that the system has been designed to avoid hurting the station’s direct sales, a philosophy that is central to a number of the efforts to improve programmatic technologies. “The result is that we are bringing in demand from digital to create higher yields,” he says.

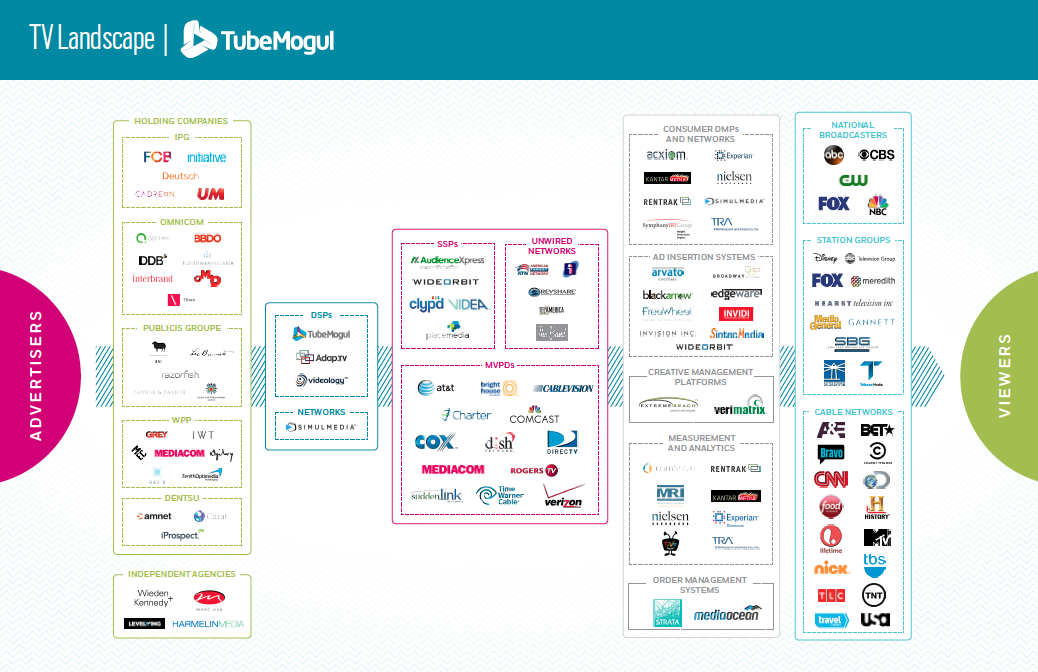

“The object was to bring all the benefits of software and automation to TV so users can more easily apply data, streamline workflows and have transparent reporting,” adds Brett Wilson, CEO and cofounder, TubeMogul Inc., which has launched its PTV programmatic platform. This self-serve software system enables automated buying of TV advertising with inventory aggregated from 80 major cable networks and hundreds of local broadcasters via its partnership with WideOrbit.

The AdMore automated TV buying platform now aggregates inventory from some 950 local broadcasters, reaching more than 110 million households across 200 DMAs, reports Brendan Condon, CEO of Media Properties Holdings. “If you have undervalued inventory, it provides a tool set for bringing in national advertisers,” he says. “That creates a way to value those audiences that didn’t exist two years ago.”

Standing on the Shoulders

A number of companies are also working to develop programmatic ad technologies that build on their existing TV ad or tech businesses. For example, ad tech company Visible World set up AudienceXpress, a programmatic TV platform that licenses a great deal of its technology from Visible World. “The lion’s share of inventory we were initially working with was from the [multichannel video programming distributors] but in the next phase we will be looking at cable networks and local broadcasters,” says Horstman.

ITN Networks is entering programmatic via their long-standing work as a wireless network aggregating local inventory and selling it to national advertisers. “The systems we’ve built up over the last 25 years provide an automated, very successful system for buying and selling,” says Tim J. Connors Jr., ITN Networks CEO.

Currently, they are integrating the Ad-Vantage programmatic trading platform into outside agencies and expect to have it running in some agencies for this year’s upfronts. The cable ad rep firm Viamedia has also moved into the game with the placemedia programmatic subsidiary, and is now working to further improve its offering.

“The big focus for 2015 is what we call the 3As—audience measurement, automation and aggregation,” in a way that improves the value of inventory, says Mark Lieberman, CEO of Viamedia, who adds that those improvements will improve the value of inventories. “We need to protect rates so that programmatic TV doesn’t turn into real-time bidding and a race to the bottom in terms of pricing.”

Other advanced ad players are also bringing new technologies to the sector. Denise Mac-Donell, vice president of product management for This Technology notes that their developments for dynamic ad insertion provide them with technical systems and data to help cable operators embrace programmatic advertising. “It is still early days on the distributor side and the operators have not been sure how to participate,” MacDonell says. “But they have very rich first-party data and we are working with them to use that data to make their inventory more valuable.”

Ben Tatta, Cablevision president of media sales, also stresses the importance of better data, which he describes as “the gamechanger” and the foundation of the new programmatic system the operator is in the process of deploying. “We found there wasn’t a system available so we had to build a system that pulls together all the necessary data to implement programmatic buys within a centralized tool,” he says.

Better data is also central to other improvements vendors are bringing to market. Civolution used the data it collects on what 2000-plus channels are airing to launch Teletrax, a TV analytics and second-screen ad solution, reports Civolution CMO Andy Nobbs. During this year’s Super Bowl, that system was hooked up to programmatic market places so that ads could be served to popular websites and social media platforms during key events in the game. “We are creating the bridge between TV and real-time ad decisioning,” he says.

Automating Accountability

In addition to focusing on better analytics and data, Dan Ackerman, head of programmatic TV at AOL Platforms, stresses that they will be focusing “the automation of workflows” and much better integration with existing systems, such as the ad stewardship and traffic and billing systems used by many TV players in 2015.

“We are having much more active conservations with traffic and billing providers on how we can further automate processes,” Ackerman notes.

Simulmedia CEO Dave Morgan adds that automating the sales process will be particularly attractive to multichannel video providers who have a great deal of data, so that the ads can be more targeted to particular groups of likely consumers.

“Audience-based advertising and outcome-based reporting will become much more important,” Morgan says. “We have data on more than 50 million people that can be matched with more than 90 million credit cards, so we can deliver campaigns using purchaser-based segments and then close the loop and measure the impact of impressions on sales.”

Jeff Green, CEO and founder, theTradeDesk, which works with over 300 ad agencies and all the major holding companies, also stresses the importance of making sales more accountable. “For the first time, you can measure impact of media,” he says.

But he also stresses the importance of adapting those technologies to the TV industry. “We can buy inventory in an automated way but we can also help content owners set floor prices,” he adds. “So they are getting access to demand they wouldn’t have and at the same time protecting the value of their inventory.”

That could help assuage worries among programmers and operators that the real-time-bidding markets often used in programmatic display markets would devalue their inventory.

“Programmatic is a national evolution toward more efficiency and less sales overhead that is being driven by Web-based tools and technologies, but a lot of publishers still worry about the price of CPMs from programmatic as opposed to direct sales,” says Synacor CEO, Himesh Bhise.

To help overcome those concerns, Synacor is looking to expand the number of partners it has for supplying data and to improve its existing tools to better analyze that data. “Data and publisher adoption of programmatic go hand in hand,” he says. “Our big focus is to work with them to use data to better optimize the value of the inventory.”

Dan Ackerman, head of programmatic TV at AOL Platforms, says concerns about the impact of digital programmatic technologies prompted them to focus on private markets and creating systems so that broadcasters can set up rules on pricing and other factors. “There has already been a shift in digital video way from ad exchanges,” he says. “There is greater volume moving to private markets in digital and that model for keeping more control translates well to TV.”

Over time, most players believe there will need to be considerable consolidation so buyers and sellers will have to deal with fewer vendors. “Today, there are a lot of hands in the cookie jar,” says Jay Sears, senior VP of marketplace development, at the Rubicon Project, which operates an advertising platform that can reach about 660 million unique users. “There is a lot of interest in greater transparency and media cost among advertisers. They want to know how much money is flowing to the media owner and if pieces of those dollars are coming off to other players, they want to know what value they add.”

“Today it is incredibly fragmented with no one player able to manage the entire ecosystem,” says Travis Howe, senior VP of client services and operations at Invision. “We’ve already seen consolidation on the digital side. Ultimately there will be fewer players [for TV as well] but that will have to be predicated on increased demand.”

A number of companies are also pushing to have those platforms handle a great range of deals—digital, linear TV, video-on-demand, etc.—from one programmatic system. “Being able to aggregate different types of inventory side by side is a crucial part of our strategy,” Howe says.

Existing providers of traffic and billing software such as Imagine Communication, Broadway Systems and SintecMedia are also working to better integrate their systems into programmatic platforms.

Burdick at WideOrbit notes that their traffic systems current serve about 75% of the TV stations in the U.S. and popularity of those systems strengthens their recently launched options. “Because we are the traffic system of record, we know what the direct sales are so we will only take higher prices,” he says. Tight integration with the traffic systems will also help avoid errors such as placing competing auto spots so they don’t appear in the same ad break.

PROGRAMMATIC TECH: WHAT TO WATCH

Interviews with more than 15 ad tech executives highlight these big trends in upcoming improvements to programmatic TV (PTV) technologies and platforms:

AUTOMATION AND INTEGRATION. Automated buying and selling is already the cornerstone of programmatic technologies but tech companies are focusing on automating more processes and better integrating their systems into existing traffic and sales software.

BIGGER DATA. To further improve the data used to make programmatic buys, platforms are not only looking to provide more data sources; they are also working to provide better analytical tools and build better cross-platform measurement into their systems.

CONVERGING MEDIA. While a number of pilots are focusing on specific types of media, such as local TV station inventory, platforms are looking to add a wider range of inventory, and vendors are working to develop tools to handle crossplatform buys in one user interface.

CONSOLIDATION. While the market is currently fragmented among many different vendors, most expect that to change over the next two years, with a few dominant players emerging, much as the programmatic market for online and mobile has consolidated in recent years.

PRIVATE MARKETS. Worried that the real-time bidding (RTB) systems used in digital could reduce the value of TV inventory, vendors are placing increased emphasis on setting up “private markets” with a limited number of players where there would be rules set on pricing and other aspects of the transaction so TV players retain greater control over their inventory.

STANDARDIZATION. TV and digital continue to be sold in different ways. The industry will have to agree on which types of measurement and approaches will be used for programmatic TV and then develop and fund measurement systems that can track targeted audiences across all platforms.