Plundering Dave Gandler’s (Winnable) Case vs. Spulu, Denis Villeneuve’s Chris Nolan Moment, Chris Nolan’s Disc Dreams, Bob Iger’s Bollywood Hustle … and the Wild Hallucinations of Townes Van Zandt

In this week’s ‘Next Text,’ we further isolate ourselves and make our sense of loneliness and alienation even worse

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

The information provided in this column does not, and is not intended to, constitute good advice. All information, content and materials available in this work are for general amusement purposes only. Information in this column may not constitute the most up-to-date legal or other information. This column contains links to other third-party websites. Such links are only for the convenience of the reader, user or browser. Next TV and its parent company, Future plc, do not recommend or endorse the contents of the third-party sites. And we don't particularly care for Frankel or Bloom, either.

DANIEL FRANKEL: Happy Friday, D. Just got off a conference call replay from earlier this morning with Fubo and its CEO, David Gandler. He seemed to come off a bit hyperbolic to start, calling the Spulu JV members a “cartel” who are executing “borderline racketeering.” Then Gandler rattled off the basis for the vMVPD’s antitrust suit. It does sound infuriating to have the whole pay TV bundle shoved down your throat, only to have the same guys doing the shoving turn around and break all the rules for a new competing service. Got to admit, sounds like Fubo has a case here.

DAVID BLOOM: Maybe Gandler has a case. Maybe he’ll eventually get a case when Spulu finally launches, or just releases more details. But it likely will take a long time after that for the case to play out. The FTC has lost a lot of lawsuits based on an aggressive reinterpretation of antitrust law, but it’s also delayed and scuttled a few proposed mergers. This isn’t a merger, but a programming bundle. Is the bundled content going to be exclusive? Whenever it launches, will Spulu directly impair Fubo finances? Could Fubo build a Spulu equivalent? Will the studios prevent Fubo from getting their services at a reasonable price? As with nearly everything around Spulu, who knows? So, the suit might be an expensive Hail Mary that falls short or maybe just a short-term marketing boost for Fubo. I’m mostly struck by how little is public about Spulu, and how much disagreement there is on its impacts. Some doubt it’ll actually ever launch, functioning mostly as part of Bob Iger’s extremely successful campaign to torpedo proxy battles for Disney board seats. I’m far more intrigued by Disney’s just-announced move in India, where it will merge its Star operations with Reliance Industries, India’s biggest industrial combine headed by Asia’s richest man, Mukesh Ambani.

The guest list for this weekend’s wedding of an Ambani son features a glittering guest list that includes a whole bunch of people that Iger and Disney want to be friends with. Rihanna, the self-made billionaire and Super Bowl performer, will be singing. Iger will be there too. ’Nuff said. Much bigger picture, India’s vast audience and burgeoning middle class beckon to Western media companies, but the country already has a string of thriving media centers led by the massive Bollywood scene. Sony found the hard way with its failed $10 billion merger with Zee Industries that doing business in the Subcontinent can be challenging. But if the Disney-Reliance deal works, it creates a potent new growth opportunity for the Mouse House.

FRANKEL: I’ll tell you who’s zeroed-in on potent new growth opportunities — Jay Penske. After co-opting something his showbiz trade (near?) monopoly has been covering for years, Hollywood award shows, Penske Media Group and Variety are going to take on Nielsen, publishing weekly U.S. audience rankers for subscription streaming. Turns out PMC inherited the research unit behind the Billboard music charts in the 2021 MRC deal, and it has been developing the wherewithal to rank SVOD shows for several years. Gotta say, having forced my way into a peaky blinders look at its sausage factory a few years ago, Nielsen is terrible at this. Folks really want an audience measurement alternative. This is probably a solid move.

BLOOM: Feels like a natural extension, given the Billboard DNA, though no one outside each streamer can reliably access more than the barest viewership detail, despite the ocean of data that streaming generates. Remember the hubbub when Netflix started sharing U.S. and international top 10s, and then that half-year info-dump in late 2023?

Also read: Deep Diving Into Netflix’s Big, Non-Contextualized Data Dump — a Huge Flex or Giant Head Fake?

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

Even that was light on details (demographics, anyone?) but still far outstrips everyone else. Now nearly all the streaming services have an ad tier, and advertisers want to know what they’re getting. Expect someone to crack this nut. Would Penske’s powerful position in the industry be useful and reassuring, or scary and off-putting for studios in adopting anything his empire produces here? Speaking of Netflix, I heard Co-CEO Ted Sarandos speak Friday night at a UCLA conference. The tightly scripted but expansive conversation with SPAC king and former MGM owner Harry Sloan was actually pretty engaging. Sarandos joined Netflix in 2000, with a background in DVD distribution.

Back then, founder Reed Hastings “talked about Netflix almost like it is now. To me, that level of vision is almost like a madman. His vision on that was crystal clear.” Hastings said Netflix’s mission was to break the DVD business, then fabulously lucrative for Hollywood but to Hastings a doomed format that wouldn’t matter once bandwidth caught up. I interviewed Hastings a couple of times back then where he said similar things. I thought his vision was fascinating, but a long ways away from reality. By 2008, it happened. The difference between postage and bandwidth costs had evened out, and off they went. At the start, studios would only license “deep library,” long-tail shows no one in Hollywood cared about. Sarandos did voice some regrets, chiefly that the company took too long to launch an advertising tier. That happened in part because “no ads” was one of its crucial differentiators from linear TV, just like its lack of late fees on mailed DVDs differentiated it from Blockbuster in the early days.

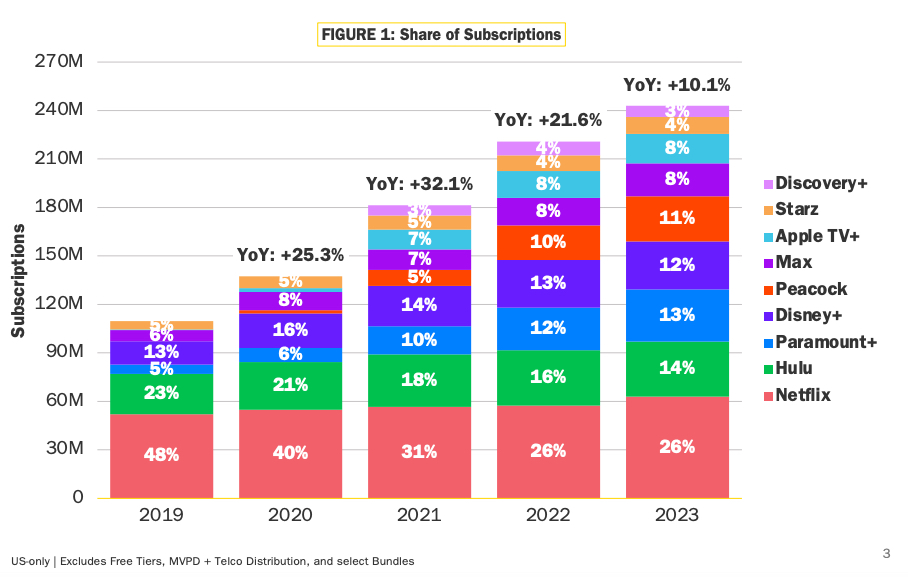

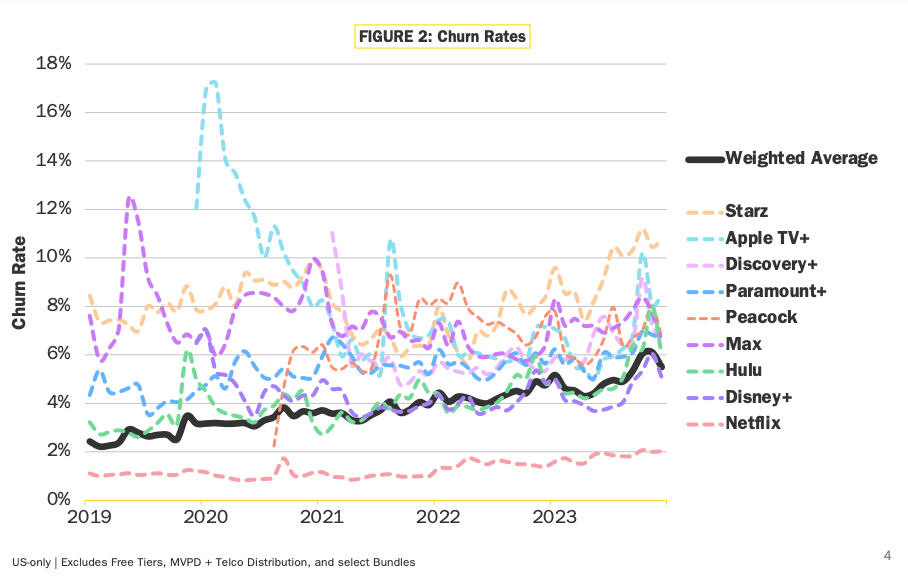

FRANKEL: Research companies bombard us with abstracts and full published reports, a lot of it useless, some of it OK, a precious few reports truly compelling. I see plenty of useless charts showing what “genres” folks are streaming. This week, the very strong Antenna published a fine report showing how subscriber growth for U.S. SVODs is decelerating … and how churn for these platforms is increasing. But when it comes to program viewership, I hardly ever see demographic data get shared. Certainly, this data must exist in abundance.

BLOOM: There’s buckets of data! Mega-google-bazillions of buckets of data! But disclosing demographic and other detailed data is different than disclosing how many subs you have in a given country. Knowing viewers’ age, gender and ZIP code for a given program, among other tidbits, is really valuable. But who gets to see it? This data secrecy is another of Netflix’s old habits that have become enshrined as industry practice. That likely will change over the next two or three years as advertising becomes more important. The new SAG-AFTRA and Writers Guild contracts, which call for disclosures to ensure higher payments for hit projects, will provide unions with some data. Advertisers will increasingly insist upon more demographic detail, to measure campaign success. And the Walmart-Vizio deal will matter too.

Also read: Walmart Agrees To Buy Smart-TV Maker Vizio for $2.3 Billion

It will give Walmart direct access to Vizio’s straight-from-the-screen ACR data on 21 million or so households, and pair up beautifully with Walmart’s billions of actual retail and online sales records. The result could rival Amazon’s integration of video and e-commerce data. At some point, enough leaks like these will force streaming companies to disclose far more data to somebody. As for Antenna’s report, how is anyone surprised that five years into the modern era of streaming, the U.S. market is largely saturated? It would be shocking if any notable growth continued after billions of dollars in programming cuts and half a year of strikes that killed or delayed more projects. Cutting back on reasons to watch, in an already saturated market, is not a recipe for growth. Add in higher subscription fees, and people are going to churn out more too. But we also have had five years to figure out that simply adding more subscribers, without increasing average revenue for each of those subs, isn’t better.

FRANKEL: Indeed, D Money, just like Townes Van Zandt's hypnotic 1975 kitchen-table rendition of “Pancho and Lefty,” the data can be interpreted in so many ways. Which leads me to the next thing on my disjointed mind. (Well, it is often kind of “jointed,” if I'm being honest.) A little over a week ago, our fiercely Canadian correspondent, Scott Lehane, wrote about Best Buy ditching what had been, 20 years ago, a massive category, DVDs … while Disney offloaded what’s left of its “home entertainment” work to Sony.

Now, The Verge can try to convince me that Blu-ray is the new vinyl in an uncertain video streaming world, but I’m not buying it. I have about 2,000 titles sitting in boxes in a shed, acquired gratis during the early-to-mid-aughts while I was being paid in canned tuna for covering the “home entertainment” business for a cold-blooded Dutch publishing operation. (You remember the place.) A few weekends ago, the wife called a few of her friends over — the ones who can still stand her — to watch the Baz Lehrman classic Moulin Rouge. We have the standard Moulin Rouge DVD sitting in a crate. But with the title renting digitally for $3.99 on Amazon Prime Video, we opted not to go digging through the shed for the disc … The whole endeavor would have also required finding the old disc player and connecting that to our projector. (“Baby, where’s the f***ing HDMI cable!") But that war is over. Streaming won. I don't need to go all Chris Nolan on some fanciful quest for physical media purity. A 4K smart TV with 500 Mbps internet speed over Wi-Fi 7 was just fine with the ladies of our little Rouge Revival. (Then again, they hang out with my wife, so how discerning could they really be?).

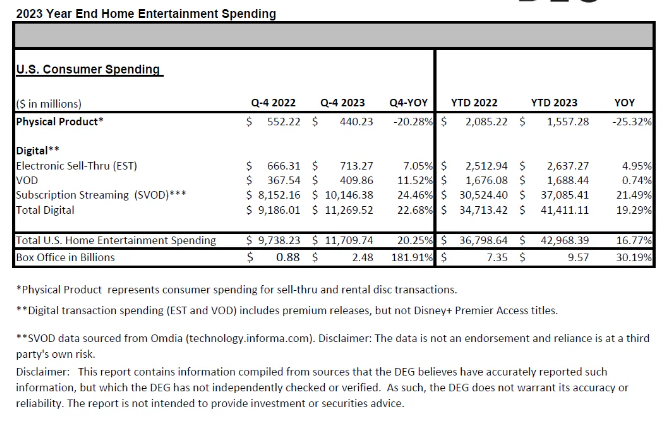

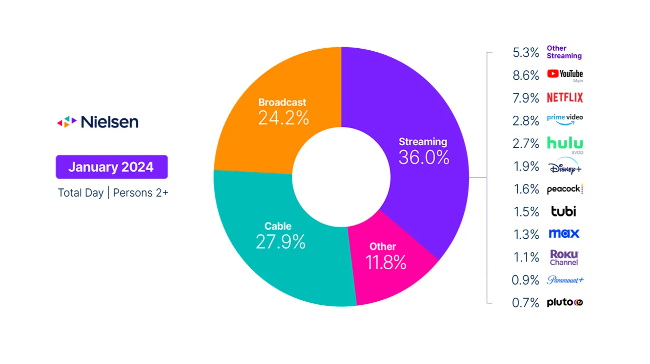

I totally kid the wife, who is actually lovely … on most days ... but since I’m picking needless fights … According to the Digital Entertainment Group, which tracks the ostensibly thriving category known as “home entertainment” based on data culled directly from studio suppliers, “physical media” revenue dropped another 25.32% in 2023 to $1.557 billion. DEG also said the overall “home entertainment” category was up nearly 17% last year to around $43 billion, with SVOD sales accounting for around 86% of that total. So yes, DEG, which integrates SVOD data from research conglomerate Omdia into its quarterly and yearly tallies, counts subscription streaming in the home entertainment bucket. For its part, Nielsen counts subscription streaming alongside broadcast and cable TV usage.

So where does SVOD fit? Now, the era of Pax Home Entertainment was an interesting period in Hollywood. It was a heady time for men (and a few women) who used to sell packaged goods like quadruple-blade Gillette face razors. They could Brylcreem up mid-career, move to Burbank and transform themselves into make-believe movie-studio moguls, their juice stemming from being their ability to deal with Walmart buyers in Bentonville, Arkansas. At one time, the erstwhile “home video” guys controlled the end caps at our shopping centers, along with outsized portions of studio balance sheets, where “media networks” still reigned supreme. The DVD release schedules often dictated our family hours on Friday nights. But their time has … dropped. Us old folks Netflix and chill now. Since I’m already senselessly in the dog house for reasons of Id and self-control, I’m going to double down and suggest “home entertainment” is merely a $6 billion vestige, largely dictated by transactional sales (rentals and sales over platforms like Vudu) that grew a modest 5% last year. Sorry! It's just nomenclature. Send me dead flowers, if you want to.

BLOOM: I am really, really hoping your cherished and deeply beloved spouse doesn’t read what you write, though watching the result if she did might be an amusing definition for “home entertainment.” DEG defines home entertainment the way it does because that’s how its membership, i.e., the studios and the vendors that service them, define it. It’s also probably a really good idea for an organization representing home entertainment companies to keep redefining itself forward to include all the emergent media distribution channels its members are adopting. Nielsen, meanwhile, is trying to create One Rating To Rule Them All, and doesn’t care about studio corporate structures. Nomenclature. I think your story of discs in a box versus a quick TVOD purchase is pretty common these days. Even if a person finds a DVD in a timely way, do they have a working, connected player? Probably not. Chris Nolan does have two points in his favor. One is that while you and much of the rest of the United States have a 4K TV and a fast Internet connection, your screen typically isn’t receiving a 4K signal from most of the sources you use. As The Atlantic put it recently, “4K resolution is a sham.” So having a personal Blu-Ray copy of a movie means it will actually be seen on your TV at peak audio and video quality, for those obsessives who really, really care. Also, Nolan likely has another reason to care beyond his love of the craft: he almost certainly also gets a share of the gross on every one of those discs sold, thanks to provisions in many directors' contracts over the past 20 years. Two, that physical copy will never, ever be taken from you by mean studio executives because they cut a licensing deal, or got bought, or ran out of money, or whatever.

FRANKEL: One last question: You seeing part two of Dune this weekend?

BLOOM: With close friends in town this week, there’ll be no Dune El Dos for me, though I’m looking forward to eventually seeing the latest from Denis Villeneuve. He’s turning into a brand-name, must-watch director in the Christopher Nolan mode: Popcorn films with auteur touches, complicated issues and complicated productions turned into massively popular work. Also, like many Americans, I’ve yet to return to movie theaters in any notable way. I’m paying for so many streaming services, with many great things still to watch, so there's no need to churn out and schlep immediately to a theater for three hours of giant sandworms, messianic Wonka boys and hairless Harkonnen villains. I happily streamed Oppenheimer at home last week, just in time for its imminent Oscar sweep next weekend. I look forward to streaming Dune 2 sometime this summer on my 65-inch Sony TV, without resorting to a Blu-ray Disc for a good experience, no matter what Nolan says.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!