New Software Opens Path For Better TV Sales

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

With the online and mobile video ad spend growing rapidly, media sales providers have been investing heavily in expanding their digital ad sales capabilities.

On April 30, for example, WideOrbit announced that it had acquired Fivia, a digital ad management software provider headquartered in Paris as part of a larger effort to provide its clients with better tools for handling digital and non-linear advertising.

“It is the first of three or four acquisitions we plan to make in digital by the end of the year so our clients can expand their digital efforts,” says Eric Mathewson, founder and CEO at WideOrbit, which has seen the number of stations using its WO Media Sales system double to about 1,000 in the last year.

“Companies want increased flexibility and capability in their software because they need to handle big upfront ad deals with multiple brands and platforms,” adds James Ackerman, executive chairman of Broadway Systems. The company has been making a major push to improve its cross-platform capabilities, improve the analytical features it can offer clients and streamline the process of putting together and managing deals.

Silver Lining in Sales

Some providers have also been developing cloud-based systems. “There are many advantages in using the cloud as an alternative to having the hardware onsite,” says John Patrick, product engineering director at Imagine Communications, which launched a cloud-based version of its Landmark OSI enterprise software at the NAB Show and has been improving its ability to handle digital platforms.

These systems can help cut costs, are more flexible and can be accessed on mobile devices as well as PCs. “You can put up a temporary channel for, say, the Boston Marathon and manage those sales,” Patrick says.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

RSG Media Systems has introduced a new cloud-based tool called Cross Platform Reporting that ties together data from digital platforms with Rentrak, Nielsen and internal information to provide clients with a unified view of the performance of their media assets. “Clients want to be able to track an entire deal from the back of the napkin until the cash is received,” says Thomas Siegman, executive VP of strategy, innovation and client relations at RSG, which is deploying the reporting tool with Sesame Workshop.

All of the major vendors are also working to expand the data and the analytical capabilities of their software. For example, Invision, which handles about $13 billion in ad revenue for a number of broadcasters and cable networks, recently partnered with Rentrak to integrate advanced demographics into its DealMaker suite.

Meanwhile, MSA Media has been improving analytical tools for its Gabriel software that is used by a number of cable networks. “It allows them to better estimate audiences and pricing and to maximize the value of the remaining inventory,” says Michael J. McGuire, VP of MSA Media, which offers the Gabriel software used at a number of cable networks.

Information Overload

But, with all new data and features, there can be a danger of overwhelming users. Crist Myers, CEO and president of Myers Information Systems notes that in the run-up to the last release of their ProTrack software, they went back and systematically streamlined the user interface. “You can’t just add features for years and years,” he says. “You need to figure out how to consolidate some of the information and provide a more intuitive layout.”

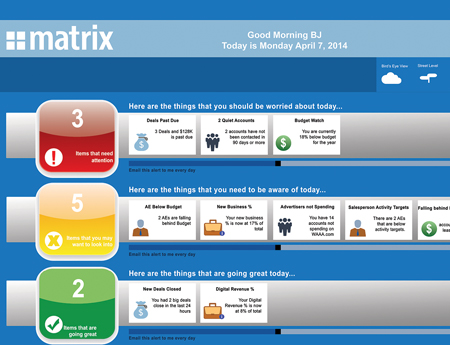

Such efforts can have an important impact on the sales process. In the run-up to its last major release, Matrix Solutions spent a lot of time with clients talking about how it improved information and interfaces. “Within three or four weeks after the release, we saw the adoption use of the product up 18%,” says DJ Cavanaugh, CEO of Matrix Solutions. “When you put the information they need directly in front them, it encourages them to take action on it.”

Simplifying the process of tracking deals has also been a major focus at Broadway Systems, which introduced a Deal Cockpit at NAB as part of a major new version of its software. “It allows you to look at any deal for any advertiser in real time so that all of the information can be reviewed together and they can know immediately about how it is performing,” Ackerman says.

Such systems are increasingly important for maximizing the value of inventory. “Yield optimization tools are getting a lot of traction,” says RSG’s Siegman. “Algorithms can do better than experts in putting together plans that can add tens of millions of dollars in sales.”

Larger programmers are also looking to improve yields by harmonizing sales systems across all their channels so they can improve yields. NBCUniversal, for example, has been setting up a unified ad sales platform across its networks using SintecMedia. This allows its sales teams to put together packages across networks, which in the past used different sales systems, and to better track all of the deals so that it can rearrange the placements of spots if they are over or underperforming.

“It all comes down to everyone in the organization having the same view of the inventory so that sales knows what is available,” says Geoff Nagel, VP of go to market strategy for North America at SintecMedia.

STREAMLINED SALES

As deals become more complex, vendors have worked to streamline their user interfaces and to automate as many tasks as possible. “We try to automate as much of the noncreative process and focus on simplifying things so that it is easy for them to access the insight and information they need to make tough decisions,” says Crist Myers, CEO and president of Myers Information Systems.

One notable advance in automating processes is MSA Media’s recently released Commercial Instructions Importer application, which allows commercial instructions to be sent as an XML file from an advertising agency to a cable network. In the past the instructions were sent by emails or faxes and then manually entered into traffic systems.

“This represents a major step forward in automating operations between advertising agencies and cable networks,” says Michael J. McGuire, VP of MSA Media, which provides the Gabriel software used by a number of cable networks. “It automates a manual process and reduces the chance for human error.”