New Digital Services Reset the Playing Field

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

The recent launch of new direct-to-consumer sports services is quickly changing the game, as professional leagues and other sports entities contemplate playing ball with industry rookies to increase greater awareness and sales opportunities.

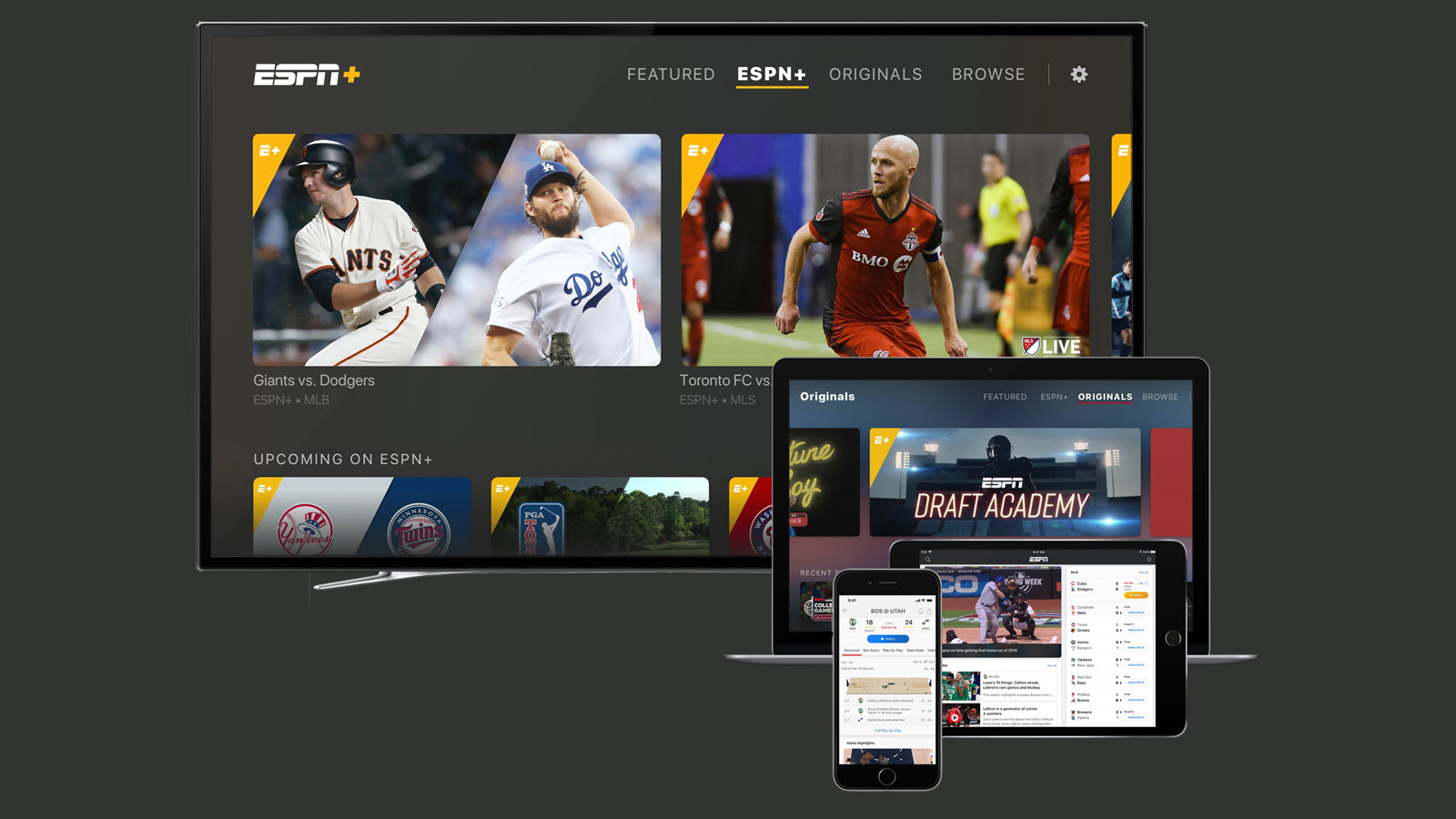

Season-long, out-of-market live game packages from Major League Baseball (MLB.tv) and the National Hockey League (NHL Center Ice) have become part of the upstart ESPN+ direct-to-consumer service lineup, and the National Basketball Association’s NBA League Pass is taking its shots from inside Turner Sports’ Bleacher Report Live (B/R Live) DTC offering this fall. Against this backdrop, industry observers said the now wide-open field of standalone sports league and conference OTT offerings could be winnowed down to a handful of big, conglomerated DTC entities in the near future.

“These very elaborate, multi-sport [DTC] services aspire to be a Netflix of sports, and it certainly seems like they’re making substantial progress in doing so,” sports television consultant Lee Berke said.

Related: Sports Streaming Picks Up the Pace

The current roster of standalone subscription OTT sports services features a number of live out-of-market game packages ranging from the major pro sports leagues to college conferences such as the Atlantic 10 to smaller pro sports leagues such as the National Lacrosse League. Most of the packages operated independently from other digital services until this year, when B/R Live and ESPN+ launched with agreements to add many of the OTT services under their respective banners.

Berke said the emergence of DTC services like ESPN+, Bleacher/Report Live, CBS Sports’s CBS Sports HQ — with huge digital footprints and significant resources — have provided another platform for standalone sports networks to distribute and sell their content while maintaining their core OTT product for the diehards.

“Everybody is looking for as much shelf space as possible, so they will increasingly look to offer standalones or create partnerships with other entities and run the services side by side,” Berke said. “As long as the programming is being sold and watched, they’ll try all these different things out.”

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Bleacher Seats

Turner, which launched its Bleacher Report Live in April, will offer several OTT sports services within its app, including NBA League Pass — which Turner Sports distributes in association with the league — and the National Lacrosse League’s out-of-market service for the 2018-19 season, which last year was offered at a suggested retail price of $49.99.

Related: Turner to Launch Streaming Service Bleacher Report Live

While Bleacher Report Live is offering all of its live events — which include Spring League football games, the World Arm-wrestling League and UEFA Champions League soccer games — for free as part of the service’s introductory offer, eventually consumers will be able to purchase sports content through B/R Live by subscription or on an individual-game basis, according to Turner Sports president Lenny Daniels.

B/R Live will support its league partners with marketing and promotional opportunities across the full spectrum of the services, he added.

“We’re not paying for the rights and saying go away — we’re partners through and through, and we’re going to help them sell their services,” Daniels said. “You just can’t pay someone a rights fee and say we’ll see you in a couple of years — it just doesn’t work like that anymore.”

Along with offering the NHL and MLB out-of-market packages, the ESPN+ service last week secured digital rights to the Atlantic 10 Conference, which gives the $4.99 per month service rights to more than 500 college sports events per year. Those events were previously available through the conference’s website, with consumers paying an average of $9.95 to $14.95 per month to access them.

Related: ESPN Makes Direct-to-Consumer Pitch With ESPN+

The Atlantic 10 deal adds to an already strong price-value proposition for ESPN+, which will offer thousands of live sports events for less than $5 per month.

“There’s just an incredible amount of sports content, and the fan affinity for all the different sports out there just make it a very rich environment for the fan,” said ESPN executive vice president and chief technology officer Aaron LeBerge.

Berke, who consulted on the ESPN+-Atlantic 10 deal, believes more standalone OTT sports services will look to partner with other DTC services for the opportunity to increase sales and marketing opportunities.

“You’re going to want to partner up with [DTC] services that are highly distributed and that have substantial resources behind them,” Berke said. “You’re seeing properties partner up with very well-financed and well-distributed OTT platforms to gain eyeballs and distribution.”

That outreach also extends to the traditional pay-per-view business. ESPN+ will offer for purchase UFC’s monthly pay-per-view fight cards beginning in 2019 as part of its recent five-year, $1.5 billion TV deal with the mixed martial arts outfit reached last month.

While UFC will not offer its globally distributed Fight Pass OTT service within ESPN+, UFC chief operating officer Lawrence Epstein said the MMA outfit’s PPV events will benefit greatly from the additional editorial coverage from ESPN’s linear and digital outlets. The PPV preliminary fights will air on the flagship ESPN channel as part of the deal.

“We see this as a massive enhancer to the growth of our PPV business,” Epstein said. “Everyone was focused on the numbers associated with the ESPN+ and ESPN broadcast deal, but the enhancement to PPV, which is still a big part of our business, is going to be incredible.”

It’s unclear whether ESPN will charge the same suggested retail price for the UFC PPV events as the linear cable distributors. Epstein added that the licensing fee deals with traditional PPV distributors such as In Demand and DirecTV are up at the end of this year, but would not provide details on negotiation points.

“The splits are clearly better for content owners in the digital landscape than they are for traditional cable and satellite distributors, at least for right now,” Epstein said.

Sports executives said they can envision creating new packages exclusively for the DTC services.

The NBA in particular would potentially look to expand NBA League Pass — which already includes full-season, per-game and per-team subscription offerings — to include live game micro-transaction buys in which consumers would be able to purchase live games in progress, potentially beginning at the start of the fourth quarter.

NBA commissioner Adam Silver said during Turner’s March B/R Live press conference that the micro transactions through B/R Live, targeted toward fans with limited free time who want to catch an exciting end to a game or a spectacular performance from a player, will further enhance the league’s already popular league out-of-market package without cutting into traditional package purchases.

“The advantage we have online as opposed to traditional cable systems is that we can test and respond in real time,” Silver said. “We can set price points and experiment with different ones.”

The potential marketing and promotional opportunities aren’t lost on other standalone OTT sports content providers. FITE TV, which offers more than 60 live boxing, wrestling and mixed martial arts matches per month, would be interested in partnering with an ESPN+ or B/R Live for distribution of its PPV events, chief operating officer Michael Weber said, although no negotiations are ongoing. While the company has a strong technological backbone delivering its PPV events as well as a comprehensive website and FITE TV app, Weber said the company’s events would gain more exposure if packaged with a larger DTC sports service.

“Building a relationship with someone who could build off of our technology platforms would be very welcome,” he said. “We also bring a lot to the table that could help them as well.”

While the partnerships benefit both parties, Daniels doesn’t believe the leagues will abandon their standalone OTT offerings anytime soon.

“A lot of people are wondering if consolidation is going to happen,” he said. “Maybe long-term, but I think leagues like the NBA will continue to do their own thing, and I think they need to because there are fans that will want to go all in on a particular league. I think they can co-exist.”

R. Thomas Umstead serves as senior content producer, programming for Multichannel News, Broadcasting + Cable and Next TV. During his more than 30-year career as a print and online journalist, Umstead has written articles on a variety of subjects ranging from TV technology, marketing and sports production to content distribution and development. He has provided expert commentary on television issues and trends for such TV, print, radio and streaming outlets as Fox News, CNBC, the Today show, USA Today, The New York Times and National Public Radio. Umstead has also filmed, produced and edited more than 100 original video interviews, profiles and news reports featuring key cable television executives as well as entertainers and celebrity personalities.