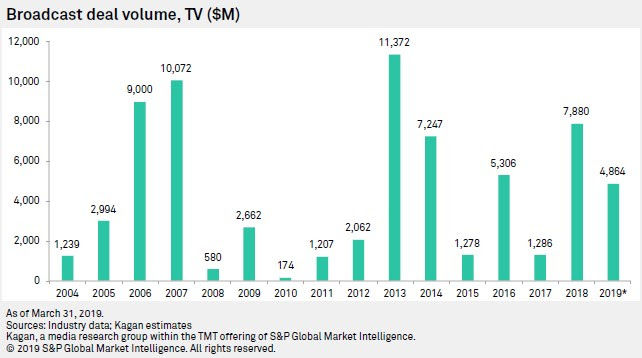

Kagan: Broadcast TV Deal Volume Reaches $4.86B in Q1

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

U.S. television station deals reached $4.86 billion in the first quarter, dominated by station consolidations and spinoffs, according to Kagan, a media research group within S&P Global Market Intelligence.

Top deals during the quarter included New York-based private equity firm Apollo Global Management’s purchase of a majority stake in Cox Media Group -- including 14 TV stations, four radio stations and a newspaper -- for $3.1 billion. Apollo stepped up to the deal plate for a second time in the period, agreeing to buy a majority stake in Northwest Broadcasting for $384 million.

Spin-offs coming from the larger Nexstar Media Group-Tribune Media merger also played a hand in deal volume in the quarter, selling off 19 stations in two separate deals with E.W. Scripps and Tegna valued at a combined $1.32 billion. In February, Gray Television said it would buy two CBS affiliates, WWNY-TV in the New York market and KEYC-TV in the Minnesota market from United Communications for $45 million.

The smarter way to stay on top of broadcasting and cable industry. Sign up below