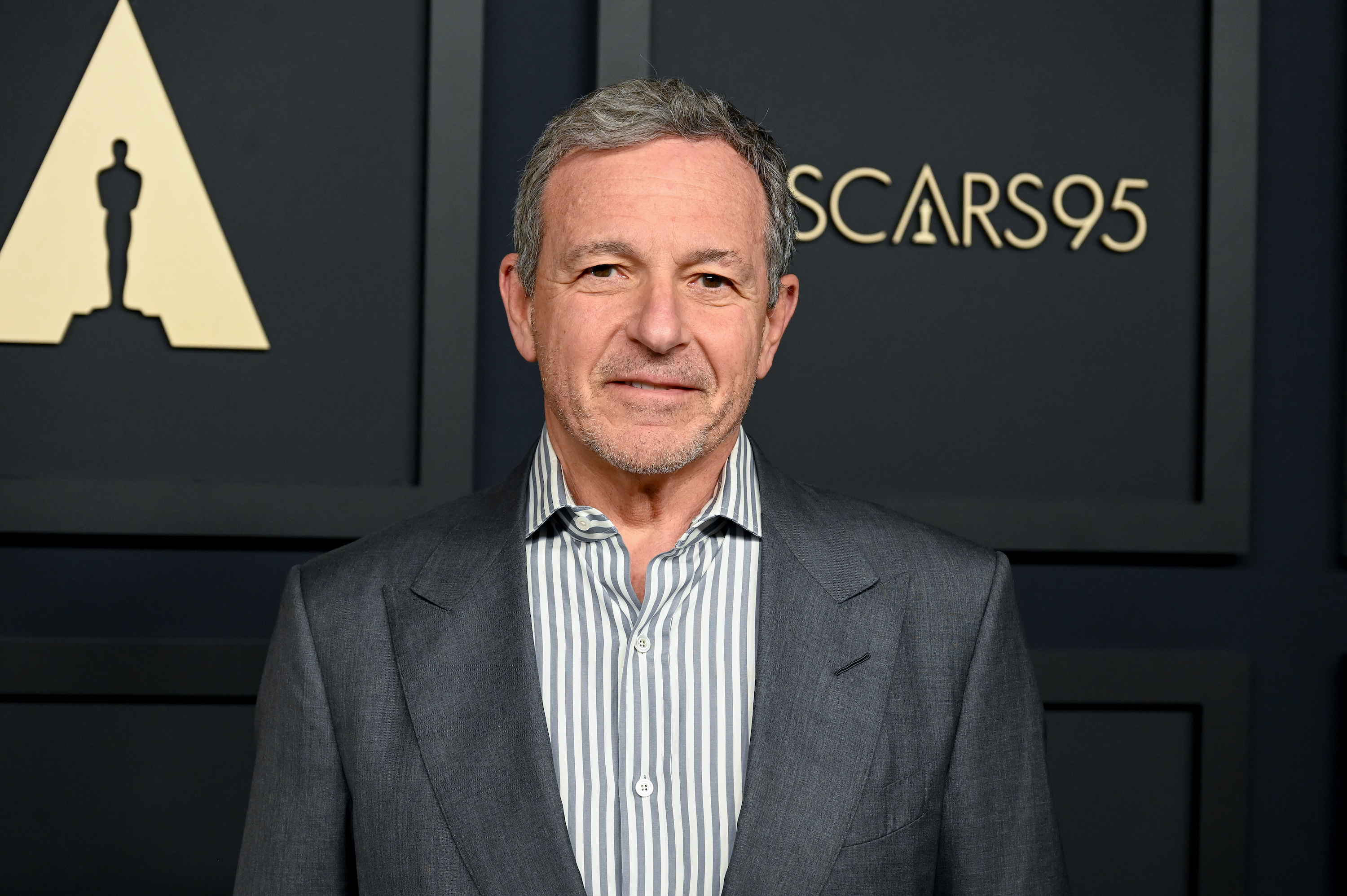

Even Bob Iger Thinks It’s Getting Tricky Out There (Bloom)

Just how treacherous is the the video business right now? Even the original smooth operator thinks the seas are pretty rough

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

It’s a mark of just how treacherous the shoals are in the streaming-video business these days that even the original smooth operator, The Walt Disney Co.’s once and current CEO Bob Iger, told investors last week that it’s anything but smooth sailing right now even for the biggest media company in the world.

“The environment is very, very tricky right now,” Iger said at the Morgan Stanley Technology, Media and Telecom Conference. “And before we make any big decisions about our level of investment, our commitment to that business, we want to know where it could go. The whole streaming business, other than Netflix, which is relatively mature, is a nascent business for most of us.”

Nascent, and increasingly nasty in terms of expectations from those investors, who now want everyone to start making money by — gulp! — next year. Iger has said Disney will get there, and maybe they will because … you know, Bob Iger, the name that soothes and smooths every media investor’s fevered brow.

But for everyone else, I keep thinking of Gollum hissing about the “tricksy” hobbits in The Lord of the Rings (the films, not the hugely expensive Amazon spinoff series).

First, those fur-footed investor hobbits wanted growth at all costs, spending be damned! Get lots of shows on the air, despite a globe-girdling pandemic, and drive millions of subscription signups and market share!

Then Netflix, almost exactly 11 months ago, had a hiccup, and everyone else in the industry contracted long COVID. Tricky! Or tricksy, because the investor hobbits suddenly wanted assurances that all those investments at sky-high valuations would lead to a reliable return on investment.

Except Hollywood hasn’t been good about a consistent return on investment for, hmmm, 110 years. Streaming promised to reduce costs, extend reach and create direct relationships with consumers that could be exploited in lots of ways.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

For now, though, Iger had another useful observation to deeply discomfit the hobbit investors in their well-appointed hidey-holes. Every company wants to turn substantial profits, increase subscriber counts by tens of millions of viewers and create new business opportunities.

“It can’t possibly happen,” Iger said. “There are six or seven well-funded, aggressive streaming businesses out there, all seeking the same subscribers, in many cases competing for the same content. Not everyone’s going to win.”

That’s Iger-speak for the great consolidation heading our way. Disney’s next contribution to that consolidation — what to do with friggin’ Hulu — is on hold, Iger said.

“We’re really studying the business very, very carefully,” he said. “We have a good platform in Hulu. We have very strong original programming, highly awarded original programming, some delivered by FX, which is great.”

But whether to spend more than $9 billion to buy out Comcast’s minority share by next year, or sell the whole thing to Comcast or to some other (increasingly unlikely) buyer, remains a tricky question indeed.

Doin’ the Collapse

And talk about tricky. Look at the studio where those Lord of the Rings movies were filmed, now called Warner Bros. Discovery.

Rather than further hike prices when it merges thousands of hours of Discovery Plus reality shows into the estimable (and already expensive) HBO Max, customers will finally get more for nothing more. Tricky!

Presumably, this will lead to the further deaccessioning of some of the high-end cool stuff on HBO Max that only appeals to snobs like me, and even more cheap and disposable “companion” TV like Discovery’s entire oeuvre. It also likely will lead to the eventual death of Discovery Plus, which never had a big reason to exist anyway.

Further adding to the background noise is the shockingly fast shutdown Friday of Silicon Valley Bank by regulators, a shutdown with outsized impacts across the tech heartland for which it is named.

Will the regulator takeover impact entertainment, too? Probably, though indirectly in most cases.

After all, who still had billions of dollars to spend on oodles of streaming shows, regardless of return on invested capital? Tech companies such as Netflix, Apple and Amazon, that’s who. No one’s worried about those companies covering payroll amid a prolonged SVB shakeout.

The same can’t be said for hundreds of smaller tech companies, many of which have been helping entertainment companies figure out the brave new world of streaming video. Their products and services provide better ad targeting, enhanced customer support and retention, and AI tools for everything from script development to video editing to show recommendations.

That’s not even including the whack to Roku. The company had close to half a billion dollars on deposit at Silicon Valley Bank. Now it’s stuck in transition, part of whatever happens to the $209 billion in assets the bank held just a few days ago (For comparison, Disney's market capitalization is just $171 billion). Ouch! Talk about tricky times.

Roku said it has sufficient cash and cash flow to hobble through, but that’s a whack, regardless. Worse, regulators said Friday that they’re not pursuing a bailout of SVB’s many, many large depositors like Roku.

Welcome to the new job, newly announced Roku chief financial officer Dan Jedda! He already was charged with repairing Roku’s frosty Wall Street relations over its non-apparent global expansion plans and OTT ad-sales strategies. That was going to be a challenge even without SVB limbo.

(On Sunday night, federal regulators announced a plan that would cover all the assets on deposit for Roku and other Silicon Valley Bank customers, as well as those of just-closed Signature Bank in New York.)

I’ll tell you what’s not getting tricky, though.

What, Pro Wrestling and Fox News Are Fake?

That would be Fox News Channnel’s apparently immutable audience. That’s despite the festering cancer of repeated revelations detailing the contempt many in the organization have for said audience and their risible adherence to the Big Lie stolen-election meme.

The $1.6 billion defamation lawsuit against Fox and some of its key personalities by Dominion Voting Systems may not, eventually, overcome U.S. libel-law protections. Fox likely will stagger away with most of its wallet still intact.

But in the meantime, the lawsuit’s discovery process has fed a steady, deeply acidic drip line of revelations that would make a journalism school dean weep. Internal text messages, memos and emails detail how even Rupert Murdoch cared far less about, you know, what happened in the 2020 election than keeping the rubes happy by repeatedly perpetuating and amplifying Big Lie narratives.

That elevation of lucre over journalism almost certainly contributed mightily to the Jan. 6 Capitol Hill riots, for which hundreds of aggrieved Trump fans/seditious rioters have now been successfully prosecuted. The prosecutions keep mounting no matter what director’s cut of Capitol Hill tourism videos may have been laughably screened this week by Fox News chief fabulist Tucker Carlson.

It’s possible that the knowing Big Lies offered by Carlson and others also injured Dominion’s ability to sell voting machines, though legal experts doubt the impact is $1.6 billion worth of defamation. We’ll leave that to the courts to sort out.

What’s not being affected by the drip line of deception? The sturdy adulation and repeated tune-in of its 4 million or so regular viewers. Despite the even more unhinged “stories” beckoning from its underfunded competitors populating the wingnut fringe, Fox News keeps powering on with the biggest, most lucrative and most reliable audience in cable TV.

Say what you will (and Fox News stars apparently do say whatever they will), Fox News and its audience are the Rolling Rock of cable TV: Same As It Ever Was. And there’s something weirdly comforting about that in this tricky time. ■

David Bloom of Words & Deeds Media is a Santa Monica, Calif.-based writer, podcaster, and consultant focused on the transformative collision of technology, media and entertainment. Bloom is a senior contributor to numerous publications, and producer/host of the Bloom in Tech podcast. He has taught digital media at USC School of Cinematic Arts, and guest lectures regularly at numerous other universities. Bloom formerly worked for Variety, Deadline, Red Herring, and the Los Angeles Daily News, among other publications; was VP of corporate communications at MGM; and was associate dean and chief communications officer at the USC Marshall School of Business. Bloom graduated with honors from the University of Missouri School of Journalism.