Digital Video Isn’t One Size Fits All

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Instead of viewing the online video audience through a single advertising lens, networks and pay TV providers would be better off tailoring and fragmenting offerings to serve specific segments, suggests a new report from FreeWheel, the ad-tech company acquired in 2014 by Comcast.

In its Q2 Video Monetization Report, FreeWheel suggests that one size does not fit all. It advises programmers and distributors to consider breaking out their strategies and focusing on the specific needs of “Samplers” (a group who, on average, watches less than 50% of a given episode), “Catch-Up Viewers” (those who watch digital video a couple times per month to catch up on shows they missed on linear TV) and “Digital Enthusiasts” (a more committed, binge-focused group that completes multiple episodes per month).

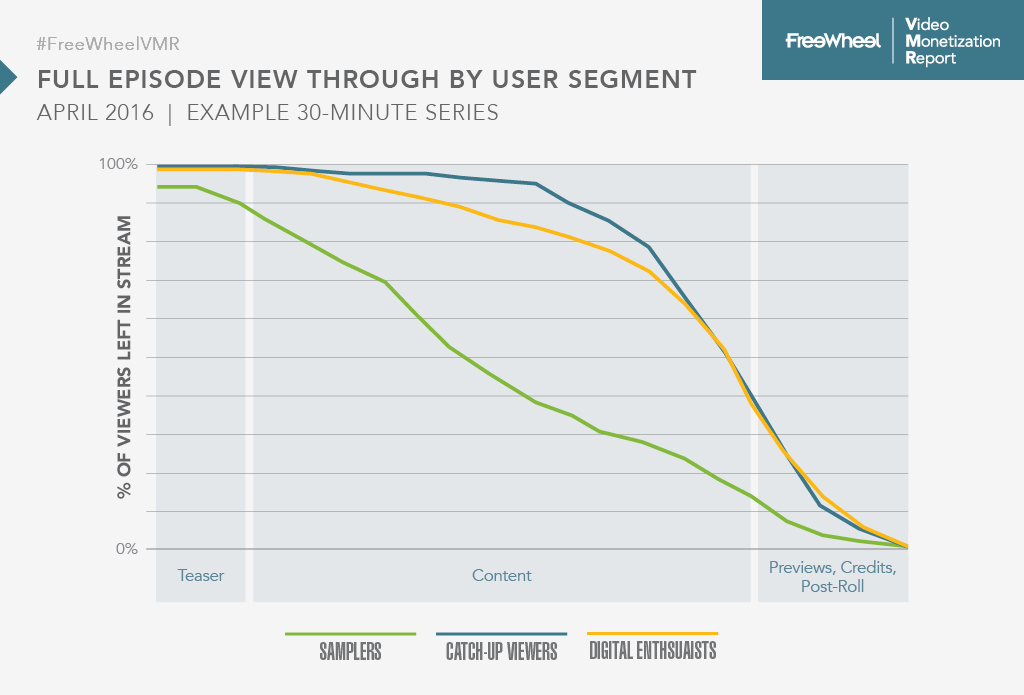

FreeWheel found that the ad dropoff rate for Samplers is about 24%, versus 12% for Catch-Up Viewers and 18% for Digital Enthusiasts. And the average episode view-through among Samplers is less than 50%, versus 50%-plus among the two other groups.

AD PLACEMENT STRATEGIES

Given that Catch-Up Viewers and Digital Enthusiasts are inherently more interested in completing an episode, FreeWheel noted that the data shows an opportunity to apply a more targeted user experience to snacky Samplers that could include smaller ad loads early into an episode “to solidify their commitment to the content” or insert in-house marketing messages to drive them to content that’s more suited to their tastes.

“Said another way, a programmer can tailor ad experiences and messaging to convert Samplers into Catch-Up Viewers or Digital Enthusiasts,” FreeWheel added. “With Samplers, whose lower pre-roll completion results in fewer people making it to the content, tweaking the length or placement of the first ad may help drive viewers further into the experience.”

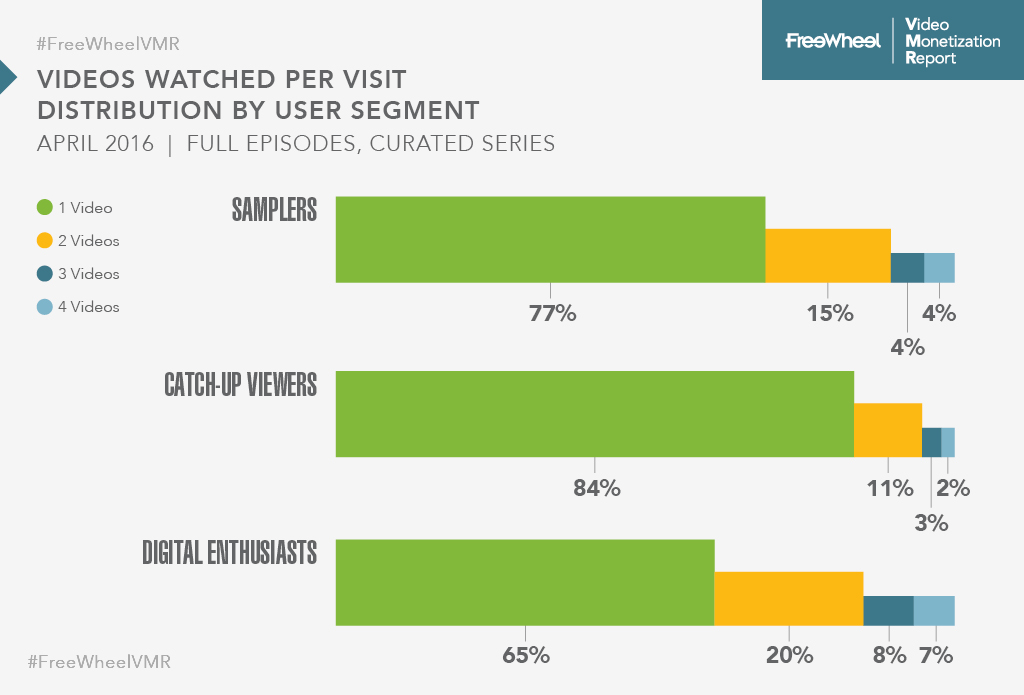

There’s also significant incremental value to be gained from converting a Sampler into a more engaged viewer, the company noted, because a Catch-Up viewer generates 1.7 times the impressions of a Sampler, while a Digital Enthusiast generates 7.3 times the ad impression of a Sampler. Boiled down further, the Sampler group averaged 15.2 ad impressions per user per month, compared to 25.4 among Catch-Up Viewers and 110.3 among Digital Enthusiasts.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

FreeWheel, which based its findings on about 47 billion video views in Q2 alone, said total video views rose 24%, while ad views climbed 28% on a year-over-year basis.

Digital viewing habits have also shifted: Only 34% of viewing was by desktop computer users, while 66% was by nondesktops, specifically OTT devices (23%), set-top box-delivered VOD (17%), smartphones (18%) or tablets (8%).

TVE GROWTH FLATTENS

FreeWheel also reported that authenticated TV everywhere viewing is flattening out. In Q2, 68% of all TV-style viewing occurred after a viewer authenticated with their pay TV credentials. Those rates have been at 60% or better since Q2 2015, but the latest figures did not factor in any usage spikes from streaming coverage tied to the Summer Olympics in Rio de Janiero.

Overall viewing was on the rise across all content durations — up by 37% for long-form video (20 minutes or more), 25% for shortform video (less than five minutes) and 23% for live content.