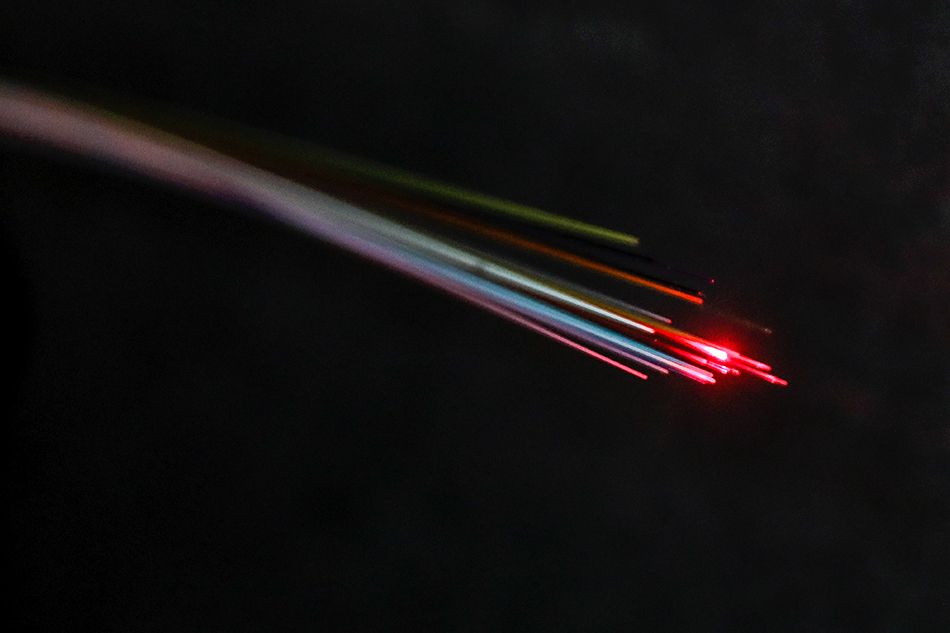

Could Fiber Save Netflix?

Rural broadband initiative could give the suddenly saturated streaming business an inroad to a much needed new customer base

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

After Netflix’s disappointing first quarter — and another one due on the horizon — a general sense of panic that streaming video may not be what unseats traditional pay TV from its throne has enveloped the entire industry over the past few months. Wouldn’t it be an actual hoot if what saves Netflix and its broadband-delivered brethren ends up being something as mundane and dumb-pipe-like as fiber deployment?

Netflix said back in April that it lost about 200,000 global subscribers, its first quarterly loss ever, adding that it could lose another 2.5 million in Q2. At the same time cable and telcos are furiously building out fiber networks, fixed wireless access and 5G offerings across the country to close the broadband gap, mainly in rural markets. With that fiber deployment, fueled in part by billions of dollars of federal money, could come millions of new broadband customers itching to try out streaming for the first, or maybe the second or third time.

Netflix obviously has other problems — it has shed nearly $200 billion in market cap since December 31 as its stock price has fallen 71% and investor sentiment has literally done a 180-degree turn on the company. Investors who were unconcerned about the ever-escalating content spend (about $17 billion in 2021) as long as the subscriber growth trajectory was maintained, are now urging Netflix to close its wallet.

And while Netflix stock has seen its ups and downs in the past, this time it was serious enough to force the company to embrace two things it has vehemently resisted in the past: offering a lower-priced ad-supported version and going after paying subscribers that share their passwords. According to reports, an ad-supported version of Netflix could come as soon as the fourth quarter of this year.

Fiber Blowout

Fiber deployment and construction are the new buzzwords in the cable and telco business, with AT&T claiming they will pass an additional 30 million customer locations with the technology by 2025. Cable operators are regularly extending their existing footprints with fiber — Comcast and Charter Communications are adding roughly 1 million homes per year through fiber edge-out programs — and smaller operators are constantly announcing new fiber builds. So far in May alone, nine small operators and telcos have announced plans to build fiber networks, with TDS Telecom pledging to pass an additional 160,000 homes with fiber this year and Wide Open West pledging $400 million to extend fiber to an additional 400,000 homes by 2027.

Forget that there are still some questions as to whether there are enough skilled techs to actually build networks. Forget that these networks won’t be fully built for another five years at least. Chances are if there wasn’t a worker shortage, the number of projects would be even greater — because nothing creates a growth surge more than money, and the federal government has earmarked $65 billion for network buildouts in areas they deem have insufficient broadband speeds. And even though a lot of those projects will be done in areas that have incumbent providers, more choice and higher speeds can only be good news for streaming service providers, right?

Netflix obviously needs more subscribers. And cable operators, telcos and soon-to-be-Twitter owners are all spending huge amounts of cash to extend broadband services to rural areas. And since some of the customers in those markets don’t have Netflix or other SVOD services -- because you need broadband to stream video — that would appear to represent a pretty big untapped market. Maybe not hundreds of millions of people, but at least a few million. And every little million helps.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Sounds pretty simple?

Some Gray Areas

Not really. Like everything else in the media business, there are some gray areas.

Perhaps the grayest is just how many homes don’t have sufficient broadband. The federal government says there are 30 million people that live in areas that don’t have sufficient high-speed data, but doesn’t say how many homes that works out to be. And though DSL service may be a lot slower than cable broadband, with top residential speed of 100 Megabits per second vs. 1 Gigabit per second for cable, it’s still fast enough to stream video. So technically, truly new broadband customers — those who have never had broadband and therefore, SVOD — are probably pretty few.

That’s what Leichtman Group president Bruce Leichtman thinks. Sure, he said in a recent interview, new fiber builds may attract some new subscribers to Netflix, but it will be a marginal amount. More likely, he added, is that a combination of faster networks, lower prices for ad-supported streaming and the advent of free ad-supported TV (FAST) could present an opportunity to convince customers in those areas to subscribe to other SVOD services.

“I think it's an opportunity, but it’s more of a gradual opportunity,” Leichtman said of the fiber build’s impact on Netflix and other SVOD providers. “Remember, they have to build these markets, and the building takes a while. And we’re talking about the 86th percentile. These are not the early adopters that we’re talking about.”

But Growth is Growth, Isn’t It?

Although there has been a lot of talk about the slowdown in broadband growth, it’s still growing. Leichtman believes that one of the biggest catalysts for Netflix and other streaming services would be a return to new housing growth, which has been stagnant throughout the pandemic. New homes means new subscribers for broadband as well as SVOD services.

“While the breadth [of the SVOD market] is mature, the depth will continue to grow,” Leichtman said. “That means more services per household.”

LightShed Partners expects total broadband subscriber additions to be fairly constant over the next three years: 3.5 million in 2022, 3.3 million in 2023, 3.2 million in 2024 and 3.2 million in 2025.

At the same time, traditional pay TV losses are accelerating. Wells Fargo Securities media analyst Steven Cahall estimated that traditional pay TV lost 2.2 million subscribers in Q1, 400,000 more than in the same period last year.

Our own Next TV estimated that cord cutting accelerated 31% in Q1, due mainly to losses at virtual MVPDs and satellite TV service providers.

MyBundle.TV CEO and founder Jason Cohen said what some observers are missing is that broadband is still growing.

“That’s the piece of the puzzle that the streaming marketplace isn’t very focused on,” Cohen said, adding that his company has nearly tripled its number of broadband partners from 31 in June 2021 to 90 currently, including many small market ISPs that are bringing broadband to people for the first time.

“Some of these people still don’t have Netflix,” Cohen said. “Is there another 100 million households for Netflix to gain in the US? No. But we’re talking about, on the margin, there are millions left. If you're talking about the smaller streaming services, there are still tens of millions [of subscribers] to gain. There's a lot of investment happening to bring more broadband to the table.”

Streaming is Not Dead

Cohen bristles at those who claim streaming is dead, pointing to the roughly 68 million households who spend about $120 per month on traditional linear pay TV subscriptions. (That’s $98 billion annually, for those without a calculator) Those ranks are definitely going to deplete as those homes cut the cord, but that doesn’t mean they are going to start reading books and learning how to play the piano for entertainment. They’re going to stream video, either through a service they already have or via one to which they will soon subscribe.

“This idea that streaming is saturated we think is 100% incorrect. Those dollars are going to be shifting from those cable bills. Whatever it is, more broadband means there is going to be more streaming,” Cohen said, adding that consumers unwilling to pay $15 per month for a streaming service may be attracted to paying $9.99 for an ad-supported one.

Netflix won’t be alone in its ad-supported efforts. Others like HBO Max — which introduced its ad-carrying version in June 2021 -- Paramount Plus, and NBCUniversal’s Peacock all have introduced AVOD tiers to varying degrees of success. Disney Plus said it would launch a lower-priced ad-supported version later this year.

Disney Plus added 7.9 million new customers worldwide in fiscal Q2, exceeding analysts’ consensus estimates of 5.9 million additions. Including its Hulu, ESPN Plus, and Disney Plus Hotstar brands, total customer additions were about 9.2 million in the period. But the company warned that because the first half of the year came in so much better than expectations, the second half may not be as strong.

“...[T]he first half came in better than expected, so that delta that we had initially anticipated may not be as large,” Disney chief financial officer Christine McCarthy said on a conference call with analysts Wednesday to discuss quarterly results. “But we still do expect an increase in the second half to exceed the first half.”

The push towards AVOD is a logical next step for streaming, and could ease the pressure to spend heavily on new content just from the nature of the business model. With AVOD, the longer a consumer watches, the more money the service makes, while the absence of advertising means as consumers burn through shows, more content has to be created to keep their attention.

FAST and Furious

At the same time, free, ad-supported TV (FAST) services like Paramount’s Pluto TV, Fox’s Tubi TV, the Roku Channel and others are becoming the fastest growing segment in the streaming universe. Pluto TV has about 68 million monthly active users, Tubi about 51 million and indications are that the segment will continue to soar as new players enter the fray.

Cohen added that the FAST segment is where he believes the ad dollars once earmarked for linear networks will go, adding that MyBundle.TV is building a FAST component into its platform to take advantage of that growth.

“We know people want free TV, they want to pay for no adds, they're willing to pay less to get ads, and then some of them are willing to lean back and say, ‘You know what, I’m willing to take a little bit lower quality content so I can flip through channels,’ ” Cohen said. “Whether it's Pluto or Tubi, you name it, there's a real market for that free TV.”

MyBundle.TV obviously is in the position to take advantage of the shift in how programming is delivered, and Cohen believes that his service, which enables customers to navigate the growing number of streaming services to find the content they want to watch, will become even more valuable as choices increase and traditional linear bundles erode.

That is even more true today as the number of services increases and the sheer amount of available programming balloons. Tubi alone has a content library with more than 40,000 titles. And as more and more content providers are focusing on originals and other exclusive shows, finding programming across the various streaming services can almost become a full-time job.

It’s About Aggregation, Not Consolidation

“It’s not what I’m paying for my apps, it’s what am I getting out of it,” Cohen said. “Right now if I subscribe to an app and I'm not going to it to find the content and I’m not finding new shows or movies, then that might be a problem. There’s a lot of content out there, and a lot of good content, on multiple different streaming services. … By helping consumers discover new shows and movies across their services there's another way to increase that value.”

“To me, it’s not streamer vs streamer, it’s still streaming vs the $160 billion [in revenue] between the subscriptions and the advertising that is still spent by advertisers on traditional linear TV,” Cohen continued. “That money is shifting over through this new delivery mechanism that is streaming.”

And Cohen believes that the industry can support more streamers, just as long as there are simple ways for consumers to access the content they want.

“I think that ultimately our view of the market, there doesn't need to be consolidation, but there needs to be aggregation,” Cohen said. “There needs to be a way for consumers to more simply navigate this process. We think this because the way that consumers build their own bundle that will still include Netflix, that will still include these other big services, as well as the niche services for people’s interests.

The pay TV industry is not blind to the need for aggregation either. Comcast and Charter Communications unveiled a joint venture earlier this month that would serve as a streaming platform for its broadband-only customers, one that could easily become a streaming app aggregator.

Cohen acknowledged that larger pay TV companies will likely go on their own when it comes to app aggregation. But he added there is plenty of room for the smaller guys, adding that there is a growing number of ISPs with 200,000 or 300,000 subscribers that would welcome help.

“We do not think Comcast is going to be using MyBundle.TV,” Cohen said. “But for everybody else, we view ourselves as that aggregator. We consider ourselves the streaming aggregator for the broadband industry.” ■

Mike Farrell is senior content producer, finance for Multichannel News/B+C, covering finance, operations and M&A at cable operators and networks across the industry. He joined Multichannel News in September 1998 and has written about major deals and top players in the business ever since. He also writes the On The Money blog, offering deeper dives into a wide variety of topics including, retransmission consent, regional sports networks,and streaming video. In 2015 he won the Jesse H. Neal Award for Best Profile, an in-depth look at the Syfy Network’s Sharknado franchise and its impact on the industry.