Cover Story: Fringe Benefits

After a year of pandemic-fueled gains, cable operators are rolling out the broadband carpet by extending their networks deeper into less-populated areas

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

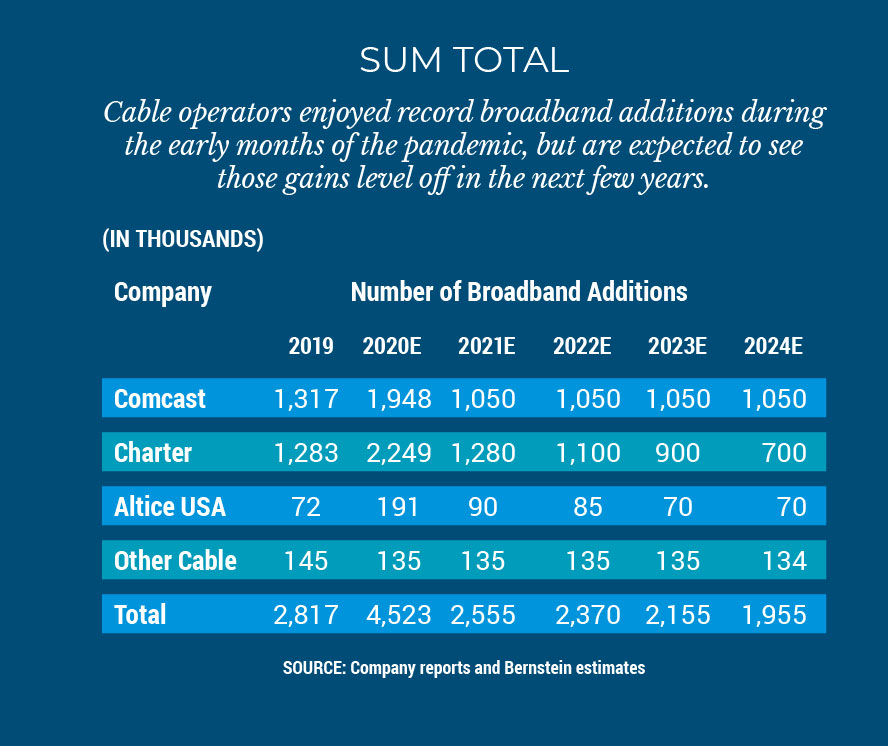

Cable operators smashed records in 2020, adding more than 4 million customers in the first nine months of that year, fueled in part by the pandemic. But as hopes rise that COVID-19 will loosen its grip on the country, sending more people back to offices and schools and potentially softening broadband gains, many providers are looking toward the fringes of their footprints and extending their networks deeper into less-populated areas for growth.

Extending the footprint, or making “edge-outs,” is nothing new for the industry. Many operators have occasionally extended their reach within certain territories as populations shifted or new businesses have emerged in less dense areas. But only recently have large and small operators focused on the fringe as a potential growth area, encouraged by improvements in technology and the availability of federal and state funds to extend their networks.

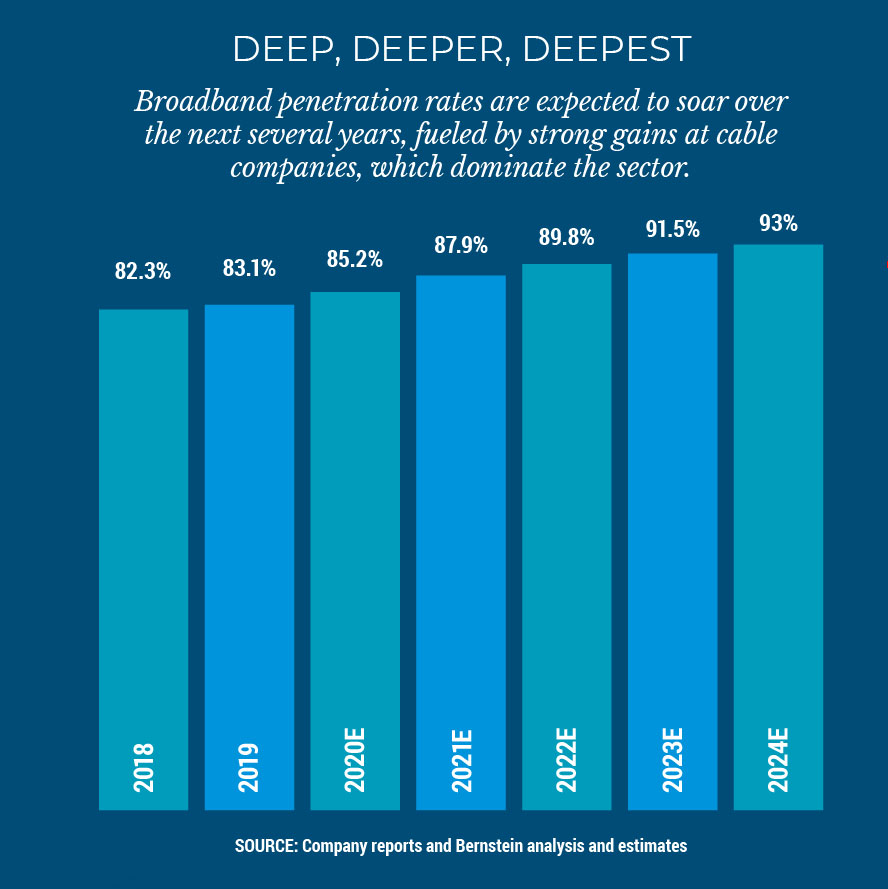

It appears that 2020 was a breakout year for broadband. Residential broadband subscriptions from all providers, already rising at a healthy pace in 2019, grew by about 4.7% in Q3 2020, or 2 percentage points above the prior year, according to MoffettNathanson principal and senior analyst Craig Moffett. Overall broadband penetration grew another 2 points during the year to 85%, per Sanford Bernstein media analyst Peter Supino.

For cable operators, the growth trajectory was even more dramatic. According to Moffett, cable broadband subscriber additions rose 50% to 1.4 million in Q3 2020. Overall, broadband subscriptions increased at a 7.4% pace, nearly 3 points higher than a year before, in Q3 2019, and the fastest growth rate since 2009, according to Moffett.

Telco broadband providers lost nearly 1% of their customers, that sector’s best showing since 2016.

Practically every cable operator broke broadband subscriber records in 2020. Charter Communications led the pack with an astonishing 850,000 customer additions in Q2, a nearly fourfold increase over the prior year. Lockdowns and work-from-home orders, coupled with school closings across the country, increased the need for ubiquitous broadband availability. Comcast, the largest cable operator in the country, added 633,000 broadband customers in Q3, its best showing ever. Smaller operators like WideOpenWest, Atlantic Broadband and Mediacom Communications also reached milestones.

Atlantic Broadband, which has about 492,000 subscribers in 11 states from Maine to Florida, added 23,475 broadband customers in the first nine months of fiscal 2020, a 25% increase over the prior fiscal year. The company has supplemented its edge-out efforts with federal and state grants, and has also partnered with municipalities to share the cost of extending the network. And the efforts go beyond just pushing service boundaries.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

ALSO READ: Operators Put Their (Foot)print Down

“We are not only pursuing edge-outs and working to connect new subdivisions,” Atlantic Broadband spokesman Andrew Walton said in a statement. “We also are finding creative ways to connect established, previously unserved subdivisions that due to distance from existing plant would not meet traditional build criteria. By working closely with homeowners’ associations, we have found creative ways to minimize risk, share costs and improve the rate of return on costly projects, including sharing construction costs with HOAs and obtaining service commitments from residents.”

Increasing speeds also helps boost service take rates, Walton continued, adding that more than 90% of ABB’s footprint has access to 1 Gigabit per second service. The rollout of its new managed WiFi offering also is expected to attract customer interest.

WOW added 27,400 broadband customers in the first nine months of 2020, more than it has in all of the past two years. Mediacom added 97,000 high-speed internet customers, the largest three-quarter increase in its history.

While the early months of the pandemic drove big increases, that pace started to slacken for some operators in Q3: Charter had 537,000 broadband additions in the period. The pace is expected to have slowed further in Q4. According to Supino, Comcast should add about 515,000 broadband customers when it reports Q4 results on Jan. 28, ending the year with nearly 2 million additional customers. Charter should end Q4 with 350,000 broadband additions when it releases results on Jan. 29, adding nearly 2.5 million for the year. Altice USA, which hasn’t yet set a date to deliver Q4 earnings, should add 15,000 high-speed data subscribers in the period, pushing full-year gains to nearly 200,000.

Edge-Outs Have Surged

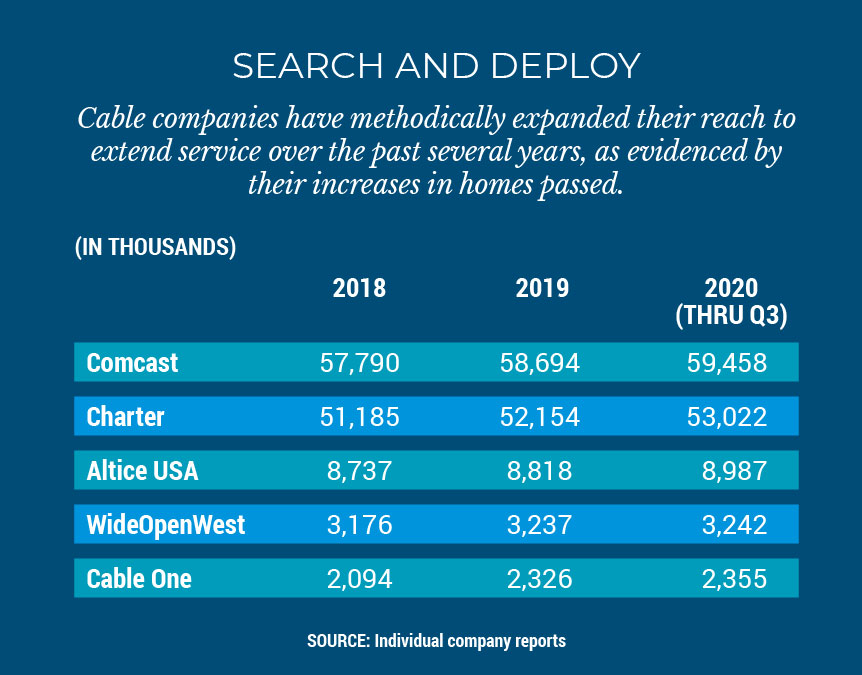

Charter and Comcast both have stepped up initiatives to expand their networks in the past two years. According to Moffett, footprint expansion had been flat or about 1% annually for the top four publicly traded cable operators prior to 2019.

Charter and Comcast began to meaningfully increase that pace in 2019, though, to around 2%, adding nearly 1 million homes to their respective footprints during that year. In the first nine months of 2020, Charter added another 868,000 homes and Comcast added 764,000 homes, suggesting it should meet or surpass its previous pace.

Part of the Charter increase can be attributed to the approval conditions for its purchase of Time Warner Cable in 2016, in which it agreed to build out about 2 million additional underserved homes across the country.

During its Q3 earnings conference call with analysts, Charter chief financial officer Christopher Winfrey said that the overall effect of the edge-out program has been “meaningful, not material,” but he was nevertheless pleased with connection rates in those expanded areas.

Charter has seen a “high level of consistency in terms of our ability to get to very high terminal penetrations when we build into markets,” Winfrey said. “And so, that’s what gives us confidence in our ability to go extend that investment concept.”

At the Morgan Stanley Virtual European Technology, Media and Telecom conference in November, Winfrey said that despite quarterly differences, 2020 was shaping up to be a very strong year for broadband.

“What we’ve said is that our quarterly net adds, our quarterly performance, isn’t what matters,” Winfrey said. “What really matters is the totality of the year and where are we going. And if you look at 2020, no matter what happens over the last two months of Q4, we’re going to end 2020 with a much higher amount of customers than any of us ever expected.”

He said he was optimistic that the company’s edge-out plan will be worth the effort.

“We’re investing in areas where the economics and the payback are challenging to begin with for the first operator to come in,” Winfrey said at the Morgan Stanley conference. “There really isn't any ROI [return on investment] for the second operator to come in which means you can have a lot of confidence in terms of where your penetration ultimately will land, and we’ve seen that already. To be fair, the cash-on-cash payback for these projects is much longer than what we typically do. But the IRR [internal rate of return], because of your ability to have confidence in the penetration curve, is actually very high. We think it’s an attractive investment to make and we think there’s a bunch of other tangible and intangible benefits that we’re not even baking into our analysis.”

Comcast has kept its plans closer to the vest, but has said that driving connections by extending the network via line extensions is one of four pillars of growth.

Smaller operators are also seeing the benefits of edge-outs, and more of them are stepping up their plans.

At WideOpenWest, edge-outs have been a key part of overall broadband growth, according to CEO Teresa Elder. In WOW’s third-quarter conference call with analysts, Elder said that footprint expansion accounted for about 1,900 of the 10,200 broadband customers the company added in Q3, its best showing in that category since Q3 2018. For the immediate future, the company said it will focus on its existing markets.

“While it continues to be important, we are now more focused on increasing the penetration rates in current markets rather than spending additional capital to push new ones, especially during the pandemic,” Elder said. The numbers back up that strategy. On the call Elder said that broadband penetration rates in communities that were edged-out in 2018 increased to 19.6% in Q3 from 18.5% in the previous period, while rates in communities that were expanded in 2019 grew to 14.8% from 13.6% in Q2.

Economics Have Improved

Increased penetration metrics is one reason cable operators of all sizes are rethinking the decision to expand their reach. In the past, pushing the network out to less densely populated areas was too costly. But a combination of better technology and stronger rural subscriber characteristics makes extending into less populated areas more feasible.

In a research note, Moffett estimated that it can cost between $1,000 and $2,000 per home to extend fiber into an urban market. For rural markets, where the runs are longer and the homes farther apart, that cost could balloon to $4,000.

But rural markets, with fewer competitors, have a much higher opportunity to sign up passed homes for service. While 40% to 50% penetration rates could be assumed for urban builds, Moffett added, in rural markets 80% penetration rates are not unreasonable. That return on investment makes the higher costs more manageable. An urban market with a 50% penetration rate implies a cost of $4,000 per home, while a rural market with 80% penetration implies a cost that is just 25% higher, Moffett wrote.

According to Kagan, the media research unit of S&P Global Market Intelligence, smaller markets are taking broadband at an accelerated pace. Kagan found that although there was a nearly 30 percentage-point gap in wireline broadband take rates between rural and urban markets, homes in less populated areas were increasingly signing on to service when it became available.

According to Kagan, the wireline broadband take rate in areas with 1.1 homes per mile was about 54.3%, compared to 83% in areas with 280 homes per mile.

“Wireline broadband penetration take rates in rural America are likely impeded by limited service access due to uneconomical cable and telco deployment, inhospitable terrain or a combination of both,” Kagan determined.

But as service is deployed over time, the take rates rise. According to Kagan, broadband networks with as few as 6.8 homes passed per mile saw a 2.4 percentage point increase in the take rates between 2016 and 2019, with the largest jump (4.9 points) being in communities with 48.5 homes per mile. In the densest markets, those with 280 homes per mile, the increase was just 3.4 points.

“Of note, the most urban group shows only the fourth-largest gains in penetration during the interval under consideration, reminding industry observers that wireline broadband maturity challenges loom,” Kagan said in

the report.

ALSO READ: Ops Brace for Second Wave of Cord-Cutting

National Cable Television Cooperative VP of broadband solutions Jared Baumann said the Kagan data points to the strong demand for reliable high-speed service in rural areas, and also signals how new products take time to take hold in small communities. He pointed to the early days of the pandemic, when many rural residents used their cellphones as hotspots for home internet connections. But as work-from-home orders dragged on, they flipped that stance.

“Now they’ve realized that when they’re home and need service, a cellular or mobile provider is not adequate for that, you really need a landline connection,” Baumann said. “More than ever you need a landline connection.”

Smaller operators are spending big money on wireless spectrum to extend their reach, which many see as a more economical way than fiber to push broadband out to the hinterlands.

Mediacom Communications has spent about $30 million for CBRS spectrum in federal auctions, according to senior VP of government and public relations Thomas Larsen. That additional spectrum should lead to more broadband subscribers, as the company plans to target communities that have access to high-speed data speeds of less than 50 Megabits per second, replacing it with a service with speeds of 100 Mbps upstream and 20 Mbps downstream.

“We’re going to try to roll out a 100/20 service so that in those areas we are a significant upgrade to whatever they have today,” Larsen said. “We think we’ll do OK in those areas. That is fertile ground.”

Funds to Add Rural Homes

Although smaller operators have used edge-outs for years, the difference today, beyond the fact that there is more and more competition from overbuilders than in the past, is the availability of government funds, like the Rural Digital Opportunity Fund (RDOF).

“In places that just would never make financial sense to build with private or corporate monies, you can supplement some of that with the funds that are coming from RDOF or other government stimulus programs,” Baumann said. “It’s great for people who live in these areas, because these areas have traditionally been vastly underserved and in some cases, unserved.”

Mediacom has also taken advantage of state grants for broadband expansion. It received grants for about a dozen communities in Alabama, Wisconsin, Iowa, Illinois and Minnesota last year and expects to apply for more this year.

“That’s an area where I think with the $3.2 billion that went into the last round of the [federal COVID-19] stimulus, you’re going to see companies jump on board. And that can come from rural or urban areas,” Larsen said.

The RDOF program, which will hand out $20 billion in Universal Service Fund (USF) subsidies for rural fixed broadband over the next decade, also should help grease the deployment skids. Charter was the biggest winner in the RDOF auctions, snagging $1.2 billion in awards in phase one, winning just over 1 million of the 5.2 million locations available.

At the virtual UBS Global TMT conference in December, Charter CEO Tom Rutledge said he couldn’t talk specifically about plans for the RDOF funding, because of a quiet period, but he did comment on the idea of rural expansion.

“We think it’s good for us financially to extend our broadband network and all of our network capabilities to as many people as possible,” Rutledge said. “And we think working with the federal, local and state authorities to improve access to poles and rights of way, along with the proper subsidies, can get it done, and that we can have a bigger customer base and the communities that we serve can be expanded.

“We think it’s smart for our company to do that,” he continued. “We think it can be done in an economically efficient way and by working with regulatory authorities, state and federal authorities, that we can expand our network and have a bigger footprint. We’ve embraced that and we’re participating in various programs around the country to expand the amount of serviceable footprint that we can reach. And we think if we do that, we’ll end up with more customers, and a happier customer and a better relationship with the total community."

Mediacom, which won about $2.5 million in phase one of the RDOF reverse auction, agreed, adding that extending the footprint not only potentially brings unserved or underserved homes into the fold, it can create new businesses.

“Piece by piece, we’re going to inch our fiber out deeper, pick up more homes and when you combine it with the CBRS spectrum, hopefully we close massive gaps in the coverage area,” Larsen said, adding that the opportunities are huge even in states where Mediacom has a strong presence.

As an example, he pointed to Iowa, where Mediacom has large clusters in larger areas like Cedar Rapids, Des Moines and Iowa City. Outside of those markets are vast swaths of territory that are underserved.

“If you look at an Iowa broadband map, a lot of the geographic areas of the state look like they’re unserved because there is a lot of farmland,” Larsen said. “Every mile, you may have four houses or six houses. Those don’t have a wireline broadband provider today, so if we can get them a 100-Mbps wireless service quickly, that’s a new house passed.

“Ultimately, we would love to figure out a solution, using that same wireless service, to be a provider to the farm itself as a business operation,” Larsen continued. “So, if they have water sensors or they have tractors or combines or whatever that are moving around the farm and we can connect wirelessly to them from the towers, that would be another business opportunity.”

Mike Farrell is senior content producer, finance for Multichannel News/B+C, covering finance, operations and M&A at cable operators and networks across the industry. He joined Multichannel News in September 1998 and has written about major deals and top players in the business ever since. He also writes the On The Money blog, offering deeper dives into a wide variety of topics including, retransmission consent, regional sports networks,and streaming video. In 2015 he won the Jesse H. Neal Award for Best Profile, an in-depth look at the Syfy Network’s Sharknado franchise and its impact on the industry.