Comcast Sees New Path Ahead for ‘Watchable’

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

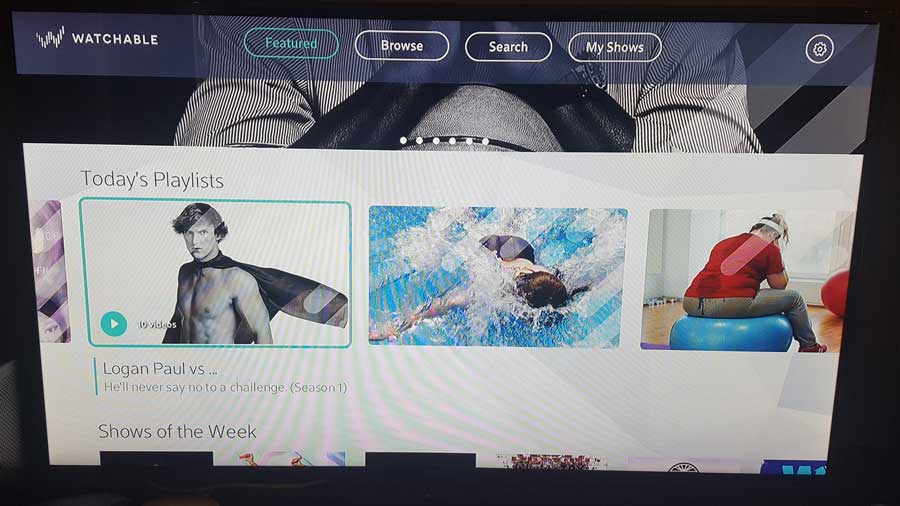

Two years after launching watchable, Comcast is altering the game plan for the short-form, ad-based video service that’s available to the cable operator’s customers on set-top boxes and to all consumers with mobile devices connected to the internet.

After reassessing the landscape for digital short-form content, Comcast confirmed that it is reallocating resources and making some significant strategic changes for Watchable, a “digital-first” service that’s currently offered on X1 set-tops, web browsers and mobile apps for Android and iOS smartphones and tablets.

Heading toward 2018, part of that new plan is to “double down” on Watchable’s technology platform and its distribution on X1 and other Comcast properties, according to Jamie Gillingham, Comcast’s vice president of strategic development.

He said the plan is to also “de-emphasize” Watchable’s over-the-top distribution, and to halt future work centered on Watchable originals, which paved the way for exclusive series from an array of content partners that included Ballin’ on a Budget (Refinery29), Cholos Try (mitú), How to Human and Would You Rather (Cut.com), I Want My Phone Back (CollegeHumor), and Logan Paul VS (Studio71), among others.

“We’ve hit the pause button on that,” Gillingham said, regarding Watchable originals. “We’ll focus more on the licensed content, the nonexclusive content.”

Gillingham said these changes are coming about as Comcast assessed its view of the market and where it should prioritize and focus its energies for 2018 and beyond.

Comcast isn’t the only major service provider to tweak its digital video strategy of late. Verizon recently went through a similar exercise with go90, its free, ad-supported service, before introducing a retooled version earlier this year that was developed by a group formed after Verizon’s acquisition of Vessel.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Gillingham said Watchable is committed to offering its current batch of originals and the slate of other original fare that’s already on tap for 2017.

Regarding Watchable’s OTT distribution, Gillingham stressed that Comcast hasn’t made a firm decision about whether the company will maintain or sunset those apps.

“In the near term, we’ll redeploy resources that we’ve been using to develop our audience over-the-top, and that comes mostly in the form of our exclusive original programming and a lot of our over-the-top marketing activity,” he said.

Reports of Struggles

The changes at Watchable are also coming about amid reports that the service has struggled to pull in big numbers.

Watchable didn’t serve up any specific viewing figures, but Gillingham stressed that Comcast has been happy with Watchable’s ability to develop audience across its different platforms.

“We’re especially happy on the mobile side, mobile web primarily, but also our mobile apps to a certain degree,” he said. Gillingham added that Watchable has also seen “very good traction on X1,” which offers more of a lean-back experience with features such as auto-play, playlisting and, generally, a pattern of longer session times.

Comcast has X1 rolled out to about 55% of its residential video subscriber base, and has been using that platform to integrate OTT services such as Netflix and YouTube.

“We’ve been really underleveraging the X1 platform in a lot of ways,” Gillingham said.

Even with the shift in some of Watchable’s strategy, he said the company remains bullish on the category and being a player in the digital content ecosystem.

“We believe in the digital native content, we believe in the new crop of studios and creators that we’ve seen popping up over the past several years,” Gillingham said. “It’s clearly resonating with very important segments of the audience … Our focus is still on developing and delivering a value proposition for that audience on the Comcast platforms.”

He also confirmed that Watchable is experimenting with the new Facebook Watch platform.

“We’re looking at it very selectively,” Gillingham said, noting that Watchable is offering a couple of series through Facebook Watch. “It’s a potentially great platform for certain types of talent-driven series for us that will allow us and our partners to reach an even broader audience much more quickly.”

Colin Dixon, founder and chief analyst of nScreenMedia, believes that services such as Watchable and go90, despite a historic focus on exclusives, will remain challenged because the niche they are trying to fill is already being addressed well by other sources and services that are adept at aggregating short-form digital content.

“They’re trying to do something that people don’t want or feel that they don’t need,” Dixon said.

Dixon also questioned whether Watchable will find success by putting more focus on X1, and now sees go90 as a fundamentally different animal due to its more mobile-focused approach.

“They [go90] have more runway to get something like this going and allow it to find an audience,” he said, but stressed that, despite recent changes, there’s no guarantee that go90 will be successful either.