Broadcasters Take Long View With eSports

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Related: Twitch’s Swanson: eSports an Opportunity for Broadcasters

On May 13, the Electronic Sports League (ESL)—a Germany- based, competitive video gaming coalition with more than 7 million members—formed the World eSports Association (WESA), a first-of-its kind organization geared toward standardizing competitive video gaming. The founding gaming teams of WESA include Mousesports, Ninjas in Pyjamas and EnVyUs.

If this all sounds bizarre, then perhaps you haven’t been watching closely—eSports has mostly shed its “teen in his mom’s basement” image, growing to a booming and popular international industry, bringing in a half-billion dollars in revenue in 2016, according to data from PricewaterhouseCoopers (PwC).

And Andy Swanson, VP and eSports evangelist for Twitch—the Amazon-owned company credited with fostering the business of competitive gaming, streaming 241 billion minutes of eSports video worldwide in 2015—said the importance of the WESA announcement can’t be understated. It’s a move to bring further relevancy to the sport.

“It’s going to become more important for the players, the teams and the sponsors to see what a season works like,” he said. “If you look at the way traditional sports do it—a 16-week season for professional football, 17 with the bye week, baseball, 162 games—everyone knows, including consumers, when it starts and ends. That hasn’t materialized [with eSports] yet, because everyone is trying to figure out the best way to do this.

“The industry is going to need to step up and agree on things like player salaries, team ownership, rules of conduct, prize pools and dealing with age regulations.”

By 2018, Twitch expects to have 165 million people watching eSports (up from 90 million in 2014), and it estimates eSports revenue will hit nearly $800 million by 2018 (up from $194 million).

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Others are looking for a piece of the action. During its May NewFronts presentation, programmer Machinima announced it would launch an in-house gaming agency, begin offering proprietary eSports data and also work to help brands target eSports fans. Yahoo has launched its own eSports portal with live video, stats and editorial coverage.

ANELEAGUE OF THEIR OWN

In January, ESPN launched a dedicated vertical for eSports, with video, news, analysis and tournament coverage. On May 24, Turner will launch “ELeague,” with livestreamed competitions and regular airings on TBS. Tom Sahara, VP of operations and technology for Turner Sports, said during a recent event in Los Angeles that the broadcaster is in tune with the potential of eSports and is especially mindful of how digitally connected the young eSports audience is.

“More big-name broadcasters will likely engage with and/or invest in eSports to preserve the linear broadcast format and build out new digital solutions,” said Adam Jones, sports advisory services director for PwC. “eSports delivers live and then archiveable content that is in demand among elusive market segments on a global scale that is otherwise difficult for brands and advertisers to reach. Its prime content is already drawing comparable audiences to traditional sports.”

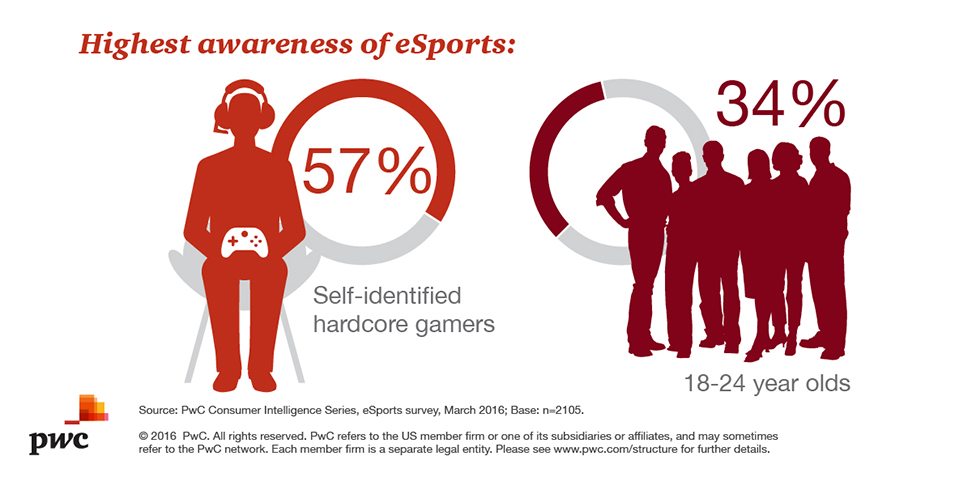

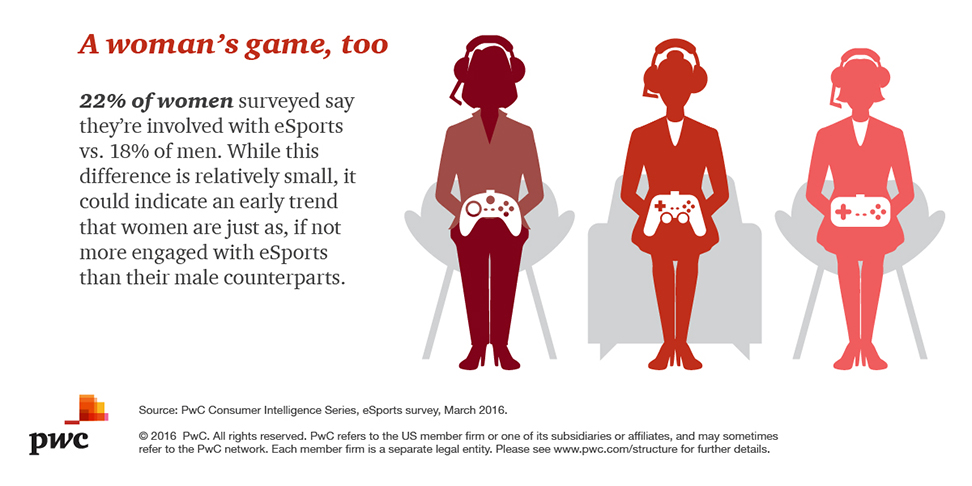

PwC recently published a report that should give broadcasters a clear idea of who they need to target going forward: more than one-third of eSports fans are 18-24 year olds; the eSports consumer leans male but it’s a gender-neutral opportunity, and it’s about as racially diverse a sport that exists.

Among eSports viewers, one in five watch at least once a week, averaging 19 days of viewing a year, and PwC found that Asian and Hispanic viewers tend to watch more frequently than other groups.

During a three-month social media listening campaign, PwC tabulated approximately 278,000 mentions of eSports, up from a mere 5,000 in November 2015.

“There’s still much work to be done to define and size the market for competitive gaming. Scale or sustainable growth will require the industry to adopt leading practices or further innovate across all points in the consumer value chain—from core content to packaging to branding to distribution,” Jones said. “Industry leaders have been successful branding competitive gaming as eSports, thereby establishing parallels to the business of traditional sports, and enhancing the acceptance of its similar product positioning and business models by consumers, rights holders and corporate partners.”