Nielsen Finds Streaming Gains as High as 95% in Some Local Markets

Research company says Portland and Chicago have the biggest increases

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

With people home-bound to slow the spread of the Coronavirus, streaming has shown some pretty big increases in local markets, according to Nielsen.

Comparing the week of March 2 to the week of March 23, connected device usage by 25 to 54 years old rose 95% in Portland, or 86% in Chicago; 78% in Denver, 74% in New York and 72% in St. Louis.

In terms of connected device streaming ratings, the top markets include Orlando, Buffalo, Milwaukee and Norfolk.

“By understanding where, when and who is watching content across streaming platforms, the media industry as a whole will be positioned to connect with viewers. With some states having recently extended their stay-at-home orders for another month and others announcing plans to lift restrictions soon, we’ll continue to monitor the impact of COVID-19 on viewing habits,” Nielsen said.

Among the different age groups, streaming showed the biggest gains among younger viewers 2 to 17. They were up 60%. The smallest gains were registered by those 55 and up, Nielsen said.

“While we have seen organic streaming growth over the past few months as new services such as Disney+ hit the marketplace, lifestyle changes resulting from the COVID-19 outbreak have accelerated growth as consumers find themselves with more time in front of the TV glass. In addition to searching for new video entertainment content, other categories such as fitness and wellness, gaming live streams, and cooking are all likely to be contributing to connected device streaming gains,” Nielsen said

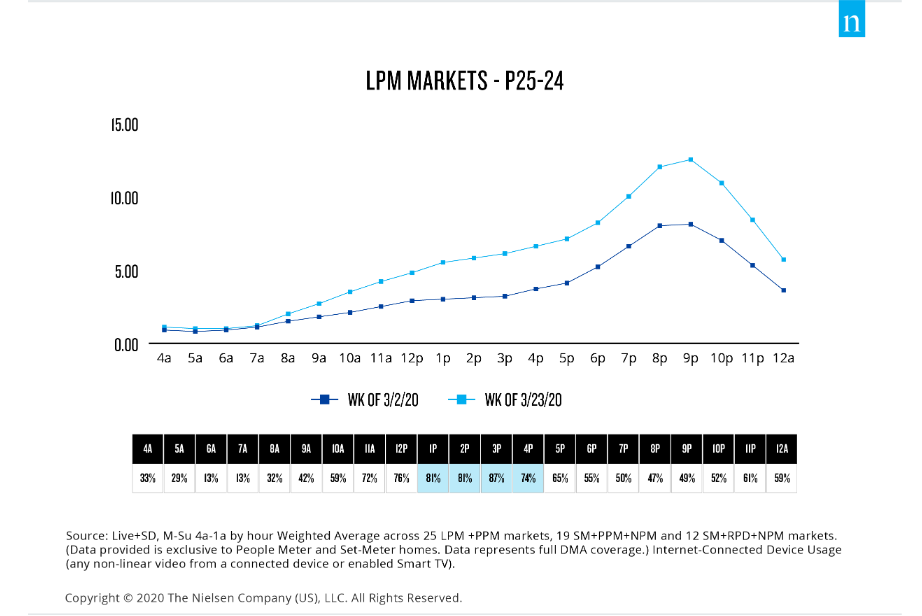

Primetime is also primetime for streaming, which viewing is highest. But the most significant gains are in the early afternoon, where it rose 60%. “Historically few adults would have been home during these hours, but given the current climate, we see over 50% increases in streaming from 1 p.m.-4 p.m. across markets, Nielsen said.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.