Banking on Lure of Free Over-the-Top

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Thanks to a massive number of genre-focused services, there’s no shortage of subscription video-on-demand choices that complement mainstream mainstays such as Netflix, Amazon Prime Video and Hulu. Some might even argue that there’s a glut of subscription VOD options that will result in a shakeout.

Meanwhile, the free advertising side of the over-the-top VOD sector has fewer players, but is rapidly picking up steam with content libraries that are growing in size and quality and services that are underpinned with a business model that appeals to consumer pocketbooks.

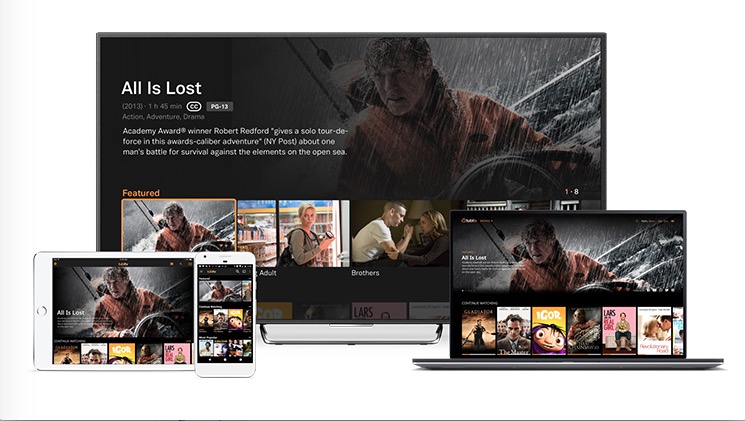

A key player among them is Tubi TV, which is now enjoying a $20 million fount of funding that expands its total to about $30 million, and gives it more fuel to expand its reach and its library.

To say that Tubi TV, which launched its service in 2014, is bullish about VOD advertising is an understatement.

“I do believe that ad-supported [VOD] will have a larger reach than any subscription video-on-demand service in the next five years,” Farhad Massoudi, Tubi TV’s CEO, predicted.

Though a flood of SVOD services have hit the market, “the truth is that most of them have no scale and no path to scale,” he argued.

“Most of TV will be consumed on an on-demand basis,” Massoudi added, noting that advertisers are also gravitating to services such as Tubi TV to help offset audience viewership declines on traditional TV.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Tubi TV is private and doesn’t disclose financial information, but said its audience grew by a rate of 9 times in monthly active users last year.

“We’re seeing a lot of demand,” Massoudi said, noting that Tubi TV has been selling out ad inventory regularly, save for some periods such as early January.

It’s that sort of demand that is also drawing increased competition.

TAKING INVENTORY OF DEMAND

Others in the AVOD sector include Sony-owned Crackle, which leans heavily on high-end originals, and Vudu, which recently complemented its OTT service with a library of free, ad-supported fare. The latest to join the mix is Pluto TV, another well-heeled provider that started with a linear-style ad-based OTT service and just added AVOD to its menu.

Tubi TV is trying to differentiate with a large library (currently at about 50,000 titles), broad support for connected devices and use of its own ad-serving platform, which gives it access to important data about what’s working well and what isn’t, and the ability to tweak ad loads and ad frequency.

“Those that use data in the smartest way will have the biggest market share,” Massoudi said.

But having such a massive library comes with another problem — its sheer size can overwhelm consumers.

Massoudi said Tubi TV would continue to invest in its tech platform in ways that help to curate what’s presented based on the viewer’s tastes and interests.

“It’s a very complex problem,” Massoudi said. “When you have a library this size, you can no longer rely on only humans. I think we are only 20% into where we need to be.”

And Tubi TV will use its new funds to shore up its library, and complement deals it has with partners such as Lionsgate, MGM, Paramount Pictures and Starz.

Tubi TV started off with library content, but is also starting to offer more recently produced content, as well as episodic TV content. The latest example of that work is the addition of the first few seasons of Fear Factor.

As for other near-term priorities, Tubi TV will focus on driving organic growth and improving its experience.

Tubi TV is offered on myriad streaming platforms, including Android and iOS mobile devices, Roku and Fire TV devices, Xbox consoles and certain smart TVs, but it’s not ruling out the idea of being integrated on internet-capable set-tops from cable operators and other pay TV providers.

“We are interested in being on every platform that consumers are using to watch TV shows and movies, and that includes [multichannel video programming distributors],” Massoudi said.