AT&T Preps Big Programmatic-TV Play

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Convinced the technology is ready for primetime, AT&T is jumping into the programmatic TV game with both feet using a platform developed in partnership with Videology.

That automated, self-service private marketplace, christened as the Video Inventory Platform (VIP), will enter the beta phase in the second quarter of this year, and expand to a broader, commercial launch sometime in the second half of 2016.

AT&T unveiled VIP at Videology’s recent “Full Frontal” event, and AT&T, which acquired DirecTV last summer, wanted to get the word out about its new programmatic TV play ahead of the ad-planning season.

“We’ve been working on this for a number of months with Videology,” Maria Mandel Dunsche, vice president and head of marketing at AT&T AdWorks, said. “We wanted to be sure that advertisers were aware that this is happening this year and that they should keep us in mind as they go into upfront season planning.”

VIP will help advertisers and their agencies build campaigns off of the AT&T AdWorks data-driven national TV ad inventory (TV Blueprint), which includes national networks spanning all dayparts and 26 million homes in all 210 DMAs (designated market areas).

AT&T believes its approach to programmatic TV will be groundbreaking in the sense that it’s offering access to a large pool of transparent, data-driven premium linear-TV ad inventory.

“Programmatic is a hot topic right now in the TV space,” Mandel Dunsche said. “But there really wasn’t a platform that automated the buying of premium, high-quality inventory that was national and scaled, and where there was any meaningful volume associated with it. It’s been primarily remnant inventory, VOD, and digital-type inventory.”

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Still, AT&T’s new initiative joins other programmatic TV efforts that are well underway. Dish Network’s media-sales unit introduced an impression-focused platform last fall that relies on real-time bidding technology and ties in three demand-side partners — DataXu, Rocket Fuel and TubeMogul. Among examples involving major programmers, NBCUniversal is adding linear broadcast and cable ad inventory to its programmatic ad sales offering starting this fall, and will make that part of its upfront sales.

As for AT&T AdWorks, the plan is to soon announce its initial beta clients, which could either involve one client or one agency that will use the new platform across several campaigns. AT&T will use those learnings before rolling VIP out wider later this year.

The expectation is to offer access to AT&T’s full data-driven linear TV inventory, selling from the same pool that’s sold by its direct sales force.

VIP also adds targeting to the mix by tapping into the 250 or so attributes that are supported by AT&T AdWorks’s TV Blueprint product, which extend well beyond age and gender. Though not part of the initial VIP beta, the new platform will also eventually allow advertisers to ingest their own data in addition to AT&T’s first-party and third-party data.

Over time, that will enable those partners to learn and determine which targets are working better for them than others, while also enabling them to refine and tune their overall media plans as they go along, Mandel Dunsche explained.

Also post-beta, there is the potential to the hope is to expand VIP beyond linear TV, and reach into other sources of inventory, including addressable inventory and digital inventory. On the digital end, AT&T is preparing to launch three DirecTV-branded over-the-top video services in the fourth quarter of 2016.

“Our goal is eventually roll in all of the ad inventory that we have access to,” Mandel Dunsche said.

Apple TV’s Ad-Vantage

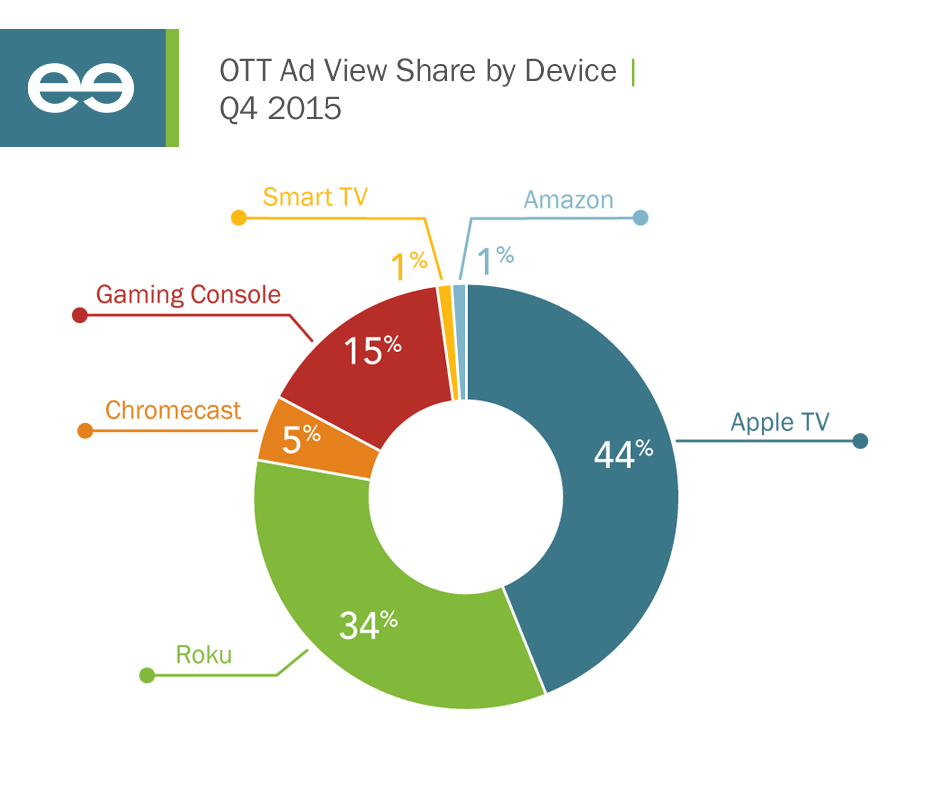

The market for over-the-top video devices remains a tight one, but Apple TV holds a clear lead with respect to ad-supported views of premium digital video.

Apple TV represented 44% share of OTT ad views among the group in Q4 2015, followed by Roku, game consoles, Google’s Chromecast adapter, smart TVs and Amazon’s Fire TV box and streaming sticks, according to the latest Video Monetization Report from FreeWheel, the ad-tech company acquired by Comcast in 2014.

With respect to ad views by device type, desktops/laptops still led all categories with 40% share but grew a mere 0.1% on a year-over-year basis. OTT devices, meanwhile, scored a 22% share (up 76%), followed by smartphones (19%, up 92%), set-top VOD (10%) and tablets (9%, up 40%).

Browsers, FreeWheel predicted, will never again be the “first stop for digital video content.”

On the TV-everywhere front, authenticated viewing for long-form and live content accounted for 65% of monetization in Q4 2015, up from 56% in the year-ago period. Entertainment content was the top category for TVE with respect to video ad views, followed by sports, news and kids’ fare.